David Solomon, chairman and chief executive of Goldman Sachs, said there will be good secular growth in private credit and the bank is well placed to take advantage, especially since the formation of the bank’s capital solutions group.

Solomon spoke with Alison Nathan, senior strategist in global macro research at Goldman Sachs on 27 January 2025 for an episode of the Goldman Sachs Exchanges podcast.

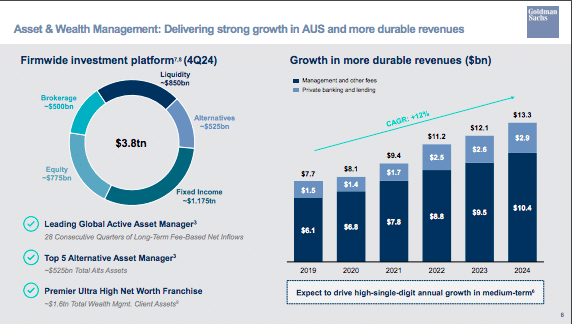

Solomon highlighted that Goldman Sachs started its private credit business 30 years ago and now manages $140bn of private credit for clients.

“What’s interesting about Goldman Sachs is that we sit at the center of the ecosystem between public markets and private markets,” he added.

He argued that the real value to be added in private credit is in finding interesting investment opportunities and that Goldman Sachs has an “enormous” origination engine due to its corporate relationships. The bank has the ability to distribute credit and interesting investment opportunities to clients; has the ability to originate and use its balance sheet and has the ability to originate and direct opportunities to its asset management franchise.

As a result, Goldman Sachs said in a statement in January that it is forming a capital solutions business which Solomon said will take advantage of the firm sitting in the middle of the private credit ecosystem.

“You’re going to see good secular growth in private credit lending we’re certainly in a very interesting position to participate, for both our investing clients and our trading or markets clients,” said Solomon.

The capital solutions group, which combines capabilities in the financing group, financial sponsors coverage from investment banking and coverage of alternative management firms from FICC (fixed income, currency and commodities) and equities. The group will be led by Pete Lyon, previously global head of the financial institutions group and the financial and strategic investors group, and Mahesh Saireddy, previously global head of mortgages and structured products.

Solomon said in the statement: “Our strategy and core franchise strengths position Goldman Sachs to operate at the fulcrum of one of the most important structural trends taking place in finance: the emergence and growth of private credit and other asset classes that can be privately deployed.”

He continued there is significant demand from investing clients for private credit and private equity, from investment grade and leveraged lending to hybrid capital and asset-backed finance as well as equity. There will be an alternatives origination group within the capital solutions group to focus on sourcing across investment grade credit, leveraged loans, real estate, infrastructure, other asset-backed finance and private equity.

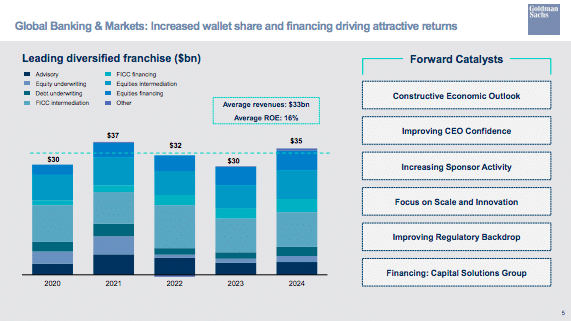

Capital markets

Capital markets activity has run below trend for the last few years, according to Solomon. After an “extraordinary” period between 2020 and 2021 there was a rebalancing in 2022 that resulted in capital markets and M&A activity becoming meaningfully below 10-year averages.

However, the Trump administration has changed the regulatory environment and Solomon believes business confidence has improved, which will open up capital markets. In addition, private equity firms have been on the sidelines and the bank is seeing more indications of them pulling activity forward. Therefore, Solomon argued that capital markets activity will meaningfully improve in 2025.

“Capital markets activity improved in 2024 but it still ran below 10-year averages,” said Solomon. “We’ll get back to 10-year averages, or better, in 2025.”

Solomon continued that one of the most important things to watch are the appointments that affect the regulatory environment for the financial system. Mark Uyeda has been named acting chair of the SEC and Caroline Pham is the equivalent at the CFTC. Other important regulatory appointments, according to Solomon, will be vice chair of supervision at the Federal Reserve, head of the OCC and the head of the Consumer Financial Protection Bureau.

“It’s very important that the administration gets people into these jobs so that the policy discussion around the regulatory environment for the financial system can move forward,” said Solomon.

One of the consequences of regulatory uncertainty is that large banks are holding extra buffers of capital, and this could be freed up for more investment in loans and growth, argued Solomon.

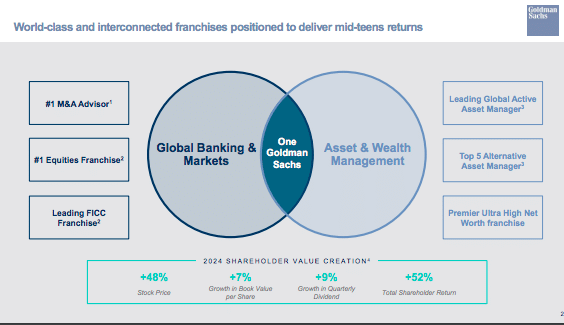

Goldman Sachs held its first investor day five years ago and Solomon said the bank has done a “great” job strengthening its core business of banking and markets and capturing share. He believes the bank will continue to grow the asset and wealth management business in high single digits, and improve margins and returns in that business, which will increase overall returns.