The US Commodity Futures Trading Commission is consulting on perpetual derivatives contracts as crypto exchange Coinbase and Bitnomial Exchange, the CFTC-regulated venue that offers physically settled digital asset derivatives, both launch new crypto derivatives.

The CFTC said in a statement on 21 April 2025 that it is asking for public comment on the potential uses, benefits and risks of perpetual contracts in the derivatives markets. Perpetual contracts allow traders to buy or sell crypto at a predetermined price with leverage, without an expiration date and with periodic funding rate payments to maintain their position.

Caroline Pham, acting chairman of the CFTC said in a statement: “The CFTC is getting back to basics by requesting public comment on perpetual contracts that have seen significant interest recently from exchanges and market participants.”

There is growing demand for institutional-grade, institutionally-focused venues, markets and technology infrastructure as digital asset trading volumes increase, according to consultancy Crisil Coalition Greenwich. In a report, Digital asset trading 2025: A market in transition, the consultancy said it expects to see more nationally regulated U.S. venues emerge over time, similar to those in other jurisdictions, such as Archax and Zodia Markets in the U.K.

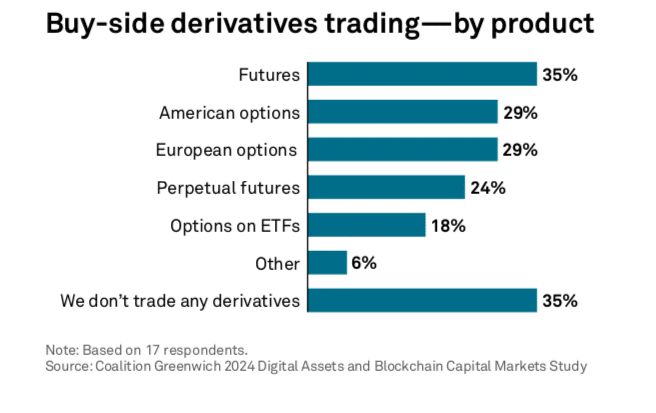

David Easthope, senior analyst who heads up fintech research on the market structure and technology team at Crisil Coalition Greenwich, said in the report: “We expect the product range on derivatives exchanges to continue to expand with a particular focus on options markets, including options on ETFs. Across products, traders will continue to prioritize access to the deepest liquidity available, as well as manageable counterparty risk, institutional-grade custody and faster execution speeds.”

Nearly two thirds, 65, of the crypto buy side trade trade either crypto futures, options or perpetual futures according to the study.

“With the proliferation of ETFs, we expect the options market on listed ETFs to explode, with volumes and open interest accelerating throughout 2025,” said Easthope. “It’s a good time to be a regulated derivatives market for digital assets.”

Sygnum, the Swiss regulated digital asset bank, also said in its Q2 market outlook for 2025 that it expects a much broader set of regulated futures, options and ETFs on crypto assets and indices to be available by year end – and this trend is already underway with CME Solana futures, Solana futures ETFs and XRP swap-based ETFs.

Coinbase

In the US, the crypto derivatives market has expanded with Coinbase, the crypto exchange, and Bitnomial Exchange, the CFTC-regulated exchange that offers physically settled digital asset derivatives, both launching new contracts.

On 21 April 2025 Coinbase Derivatives listed cash-settled futures on XRP, the Ripple network’s native cryptocurrency.

Coinbase Derivatives, LLC now offers CFTC-regulated futures for $XRP. https://t.co/omSNu0aEoC

— Coinbase Institutional 🛡️ (@CoinbaseInsto) April 21, 2025

1/ First, what happened?

XRP was delisted from Coinbase back in 2021 due to the SEC lawsuit.Now, not only is XRP trading spot again, but it's been listed on Coinbase’s futures platform, the one used by institutions and serious traders.

— Mike iT Easy (@Mike_XRP589) April 21, 2025

3/ The listing brings 3 massive tailwinds for XRP:

1️⃣ Exposure

Being back on Coinbase’s derivatives desk means more accessibility for XRP across institutional desks.2️⃣ Volume & liquidity

Futures bring more trading activity and depth to XRP’s price action.3️⃣ Infrastructure…

— Mike iT Easy (@Mike_XRP589) April 21, 2025

5/ What comes next?

This opens the door not just for ETFs, but to structured products, options, and exposure at scale.

When institutions gain access to leverage and deep liquidity… Price discovery accelerates.

— Mike iT Easy (@Mike_XRP589) April 21, 2025

Bitnomial

In March this year Bitnomial Exchange launched XRP US Dollar Myra futures, the first CFTC-regulated XRP futures product in the U.S. Bitnomial’s physically settled futures means contracts are delivered in XRP upon settlement, which the exchange said enhances market integrity and strengthens price discovery by tying derivatives trading directly to XRP’s supply and demand dynamics. The firm also has a CTFC-regulated clearinghouse and brokerage subsidiaries to connect native digital asset hedgers with institutional traders.

On 22 April 2025 Bitnomial Exchange listed options on ether.

Current clients have immediate access to $ETH options. Prospective clients can onboard with one of our FCM partners:

· R.J. O’Brien and Associates | @rjofutures

· Marex Capital Markets, Inc. | @MarexGlobal

· Bitnomial Clearing, LLC. | Bitnomial Exchange Affiliated…— Bitnomial (@Bitnomial) April 22, 2025

Bitnomial said in October last year that it plans to launch Botanical, which aims to be the first regulated perpetual futures trading platform in the U.S.

EDXM Global, which is part of the EDX family of digital asset technology companies, is also planning to launch a regulated perpetual futures trading venue based in Singapore.