CoinShares, the European alternative asset manager specialising in digital assets, is launching a hedge fund division and making its funds accessible to qualified US investors for the first time, after resetting its strategy last year to focus on active management.

On 22 September the firm said in a statement it was launching CoinShares Hedge Fund Solutions and would be expanding in the US. The strategies are managed by Lewis Fellas, who has 23 years of experience, of which the last seven have been focussed on digital assets.

Fellas, head of CoinShares Hedge Fund Solutions, told Markets Media that investing in passive products made a lot of sense when interest rates were near zero. However, the rise in rates has led to increased volatility and opportunities for active management, and was a big catalyst for deciding on the time to get into active management.

Fellas said: “For CoinShares as a franchise, we were thinking about the right way to approach the US market. We are not a start-up and consciously coming to the US market as a premium product.”

He continued that active management is very much within the DNA of the company. CoinShares began in 2013 when hedge fund Global Advisors pivoted from commodities towards bitcoin. Jean-Marie Mognetti, chief executive of CoinShares, founded the firm with Daniel Masters and Russell Newton and established the first listed and regulated bitcoin active fund in 2014, which the firm said delivered over 800% growth in performance, net of fees.

Fellas argued that CoinShares differentiates itself through its strong risk management and the ability to deliver the whole of the firm to investors including a range of products, research and market insight.

“We are trying to partner with investors to share our crypto expertise and I think that’s going to be quite an important differentiator,” he said.

There is also a good opportunity to enter the US following the turmoil of the crypto market in 2022 which caused many hedge funds to close and large US asset managers, such as BlackRock, filing with the US Securities and Exchange Commission for approval to launch bitcoin exchange-traded funds.

“We have never seen more institutional engagement in crypto than we have today,” said Fellas.

One barrier to entry for institutions was the lack regulated custody of digital assets but Fellas said that obstacle is being cracked following the launch of custodians such as Copper and Fireblocks, and traditional custodians entering the space such as Fidelity and Zodia, which is owned by Standard Chartered, Northern Trust and SBI.

“The market has evolved a lot and we will be launching some innovative products in the next 12 to 18 months,” said Fellas.

He continued that each product that will be offered is designed to mitigate counterparty risk whilst providing investors with clearly defined asset class and strategy exposures.

Strategy

Mognetti said in CoinShares’ 2022 annual report that it was a violently turbulent and difficult year for the entire digital asset industry, with steep falls in the value of the main digital assets and the failure of several operators in the sector.

“At the same time, it was the perfect testing ground for CoinShares and our strategy,” wrote Mognetti. “Thanks to our approach to risk, our transparency, and above all the professionalism and skill of our colleagues, we weathered the storm better than almost any other firm in our space.”

Although CoinShares fared better than most of its peers in 2022, Mognetti said the losses incurred in the second and fourth quarter of last year effectively wiped out the positive performance of the underlying business, resulting in total comprehensive income of £2.9m, compared with £113.4m in 2021. As a result of the turmoil CoinShares also closed its consumer business acquired through Napoleon in France.

Mognetti said 2022 will be remembered as a watershed for the industry.

“We believe that companies that are capable of being publicly listed and fully regulated will emerge as the winners in our industry,” he added. “This is a position we have maintained for years and believe that the events of the past 12 months have fully vindicated that position.”

In 2022 CoinShares graduated to Nasdaq Stockholm’s main market.

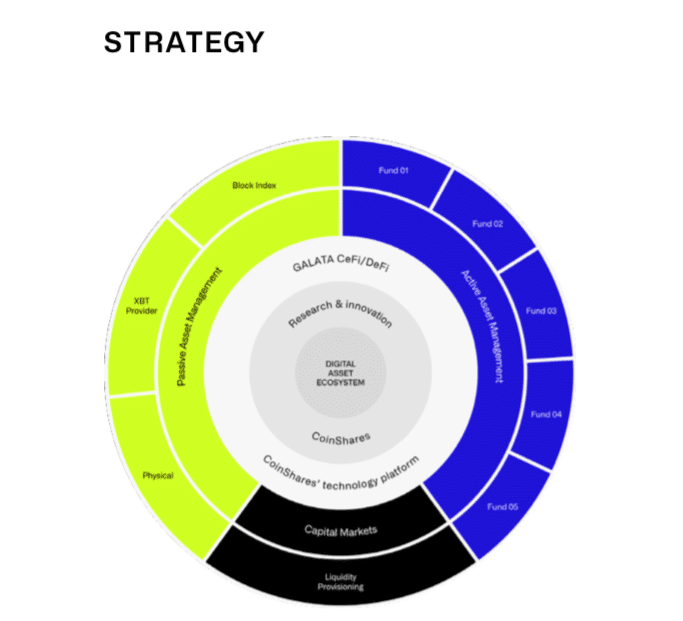

Due to the change in market conditions in 2022 CoinShares reassessed its business model and decided to focus on regulated asset management, financial product engineering and distribution, with a specialisation on digital assets. Therefore, the firm said it planned to to establish an active asset management business, creating several active investment strategies open to external allocators and prioritising risk-adjusted returns.

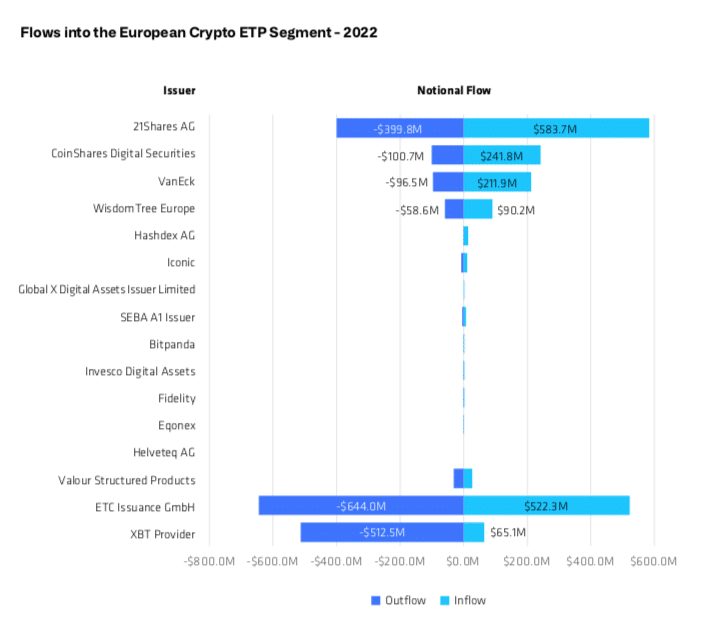

In its passive asset management franchise, the focus would be on increasing European market share of gross inflows.

“Our goal is to capture a market share of more than 30% of gross inflows this year, following our 16% share in 2022 and 8% in 2021,” added Mognetti.

In the annual report CoinShares also anticipated the entrance of financial institutions into the market in 2024, with regulation playing a significant role in shaping the market.

“We are experiencing a flight to quality and continue to harvest the fruits of our efforts towards greater transparency and adherence to regulatory frameworks,” said Mognetti. “We believe that, following the events of 2022, institutional focused, regulated players will potentially be those who will benefit the most moving into 2023.”

CoinShares owns a stake in Komainu, a regulated digital asset custodian. Komainu completed part of a funding round which commenced in the latter stages of 2022 and closed a significant tranche in early 2023.

In CoinShares earnings call on 1 August 2023 Mognetti said the digital industry landscape experienced two significant developments in the second quarter including regulatory actions by the SEC and the CFTC against key industry figures. As a result newer, smaller players may be prevented from entering the space and the crypto industry might lean more toward trusted financial institutions.

In addition, he said the filings from US managers for bitcoin ETFs are a clear sign that the institutionalization of the digital asset industry is a reality.

“These trends validate our pioneering role at CoinShares and support our initial thesis,” he added. “By blending together the best of reg tech and blockchain innovations, CoinShares is a perfect conduit for investors to effortlessly incorporate digital assets into their portfolios.”

Mognetti said CoinShares is not satisfied to be only the European leader, but wants to be the global alternative asset manager specialised in digital assets.