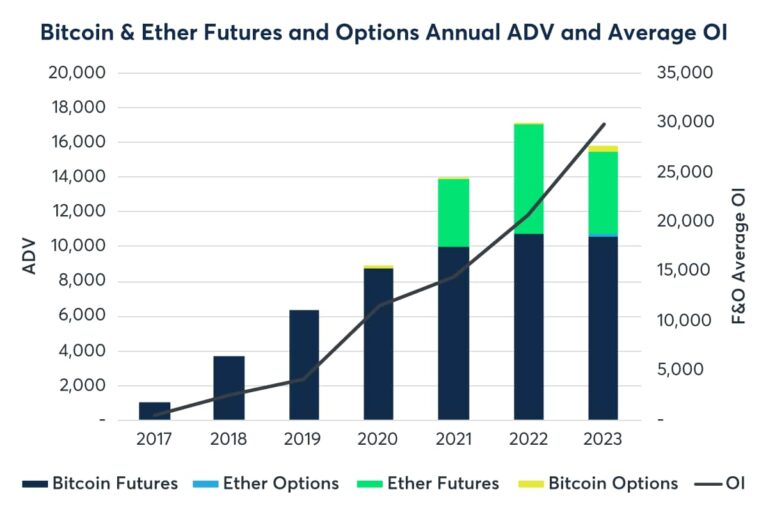

Trading of Bitcoin and Ethereum futures and options contracts skyrocketed at CME Group in Q3 as institutional investor interest in crypto derivatives continued to grow.

The third quarter set a record average of 15,800 contracts for bitcoin futures, an increase of 11% quarter-over-quarter. The total number of outstanding ether futures and options contracts held by market participants at the end of each trading day, also known as open interest (OI), jumped 22% from the second quarter. Ether options contracts shot up significantly in the third quarter, increasing 75%.

Volatility in the spot cryptocurrency market returned briefly halfway through Q3 with the price of bitcoin and ether falling from their previous annual highs. After two consecutive quarters of rising prices, Q3 saw the prices of the two leading cryptocurrencies by market cap, Bitcoin and Ether, drop 12% and 15%, respectively. Even with these declines, Bitcoin’s price has increased 62% YTD while Ether’s price has gained 39%.

“While volatility and prices have remained mostly range bound resulting in muted trading volumes this year, we continue to see increases in open interest across our Cryptocurrency suite as investors establish or hedge their portfolios. Most notably, our Bitcoin futures reached a record open interest of 20,380 contracts on October 25, equivalent to $3.5 billion in notional exposure,” said Gio Vicioso, Global Head of Cryptocurrency Products at CME Group.

“Bitcoin options have seen a sharp increase in both volume and open interest each rising more than 2 times compared to 2022, whereas Ether futures and options open interest continues to develop. As demonstrated by gains in our OI, market participants view CME Group as a trusted source for risk management,” Vicioso added.

Source: CME