Terry Duffy, chairman and chief executive of CME Group, said the derivatives exchange will oppose the proposal from crypto venue FTX US to remove futures commission merchants from the clearing process.

Duffy said on CME’s first quarter results call that if there is any change in market structure this will not preclude CME from participating in such changes.

“We will give our views exactly as it relates to the flaws in the FTX application,” he added. “They are glaring to say the least and we will be opposing that application.”

He continued that the industry is very concerned about some of the things in the application and it should not be approved just because it involves a new asset class.

“The CFTC has to look at new products but you cannot have innovation for the sake of innovation,” said Duffy. “Innovation has still got to be under the principles-based regulatory regime that is highly outlined by the CFTC today so it will be fascinating to see how this plays out.”

FTX US has applied to the US Commodity Futures Trading Commission to operate a regulated 24/7 derivatives markets offering a range of traditional products in addition to crypto with a market structure that would allow participants to clear directly, rather than through a futures commission merchant. The crypto exchange acquired LedgerX in 2021 to launch a regulated derivatives business. Once the deal completed in October FTX US Derivatives gained a CFTC regulated designated contract market, swap execution facility, and derivatives clearing organization.

FTX has heard good questions about our application before @CFTC to clear margined digital-asset derivatives, including, does FTX have enough default resources to effectively manage risk on the platform? We explain here why we believe the answer is yes: https://t.co/8905SWWTDF

— Mark Wetjen (@MarkWetjen) April 15, 2022

FTX US Derivatives currently operates a non-intermediated model and clears futures and options on futures contracts on a fully collateralized basis and has also proposed to clear margined products for retail participants while continuing with a non-intermediated model.

The CFTC has announced it is holding a public roundtable on May 25 to discuss intermediation in derivatives trading and clearing.

NEWS: CFTC Announces Staff Roundtable Discussion on Non-intermediation. Get the details: https://t.co/UYxUBfu4q1

— CFTC (@CFTC) April 27, 2022

“With limited exceptions, derivatives trading today is conducted through regulated intermediaries who perform many important functions, including providing customers with access to exchanges and clearinghouses, processing transactions, ensuring compliance with federal regulations, and guaranteeing performance of the derivatives contract to the clearinghouse,” said the CFTC. “Recently, however, a number of registered entities have discussed with CFTC staff proposals to offer ‘non-intermediated’ or direct trading and clearing of margined products to retail customers.”

Acuiti, which provides a management intelligence platform, said in a report: “The CFTC has launched a consultation on the proposals and, while it is not expected to approve the market to trade in traditional futures and options any time soon, it is likely to approve it for crypto derivatives as a test case. This represents one of the most significant potential innovations in derivatives market structure since the advent of electronic trading.”

Check out our latest blog on CCP risk management! Whether it's GameStop in the securities realm, or recent defaults at the LME exchange, the policy issue is the same: how to shorten the period of risk. FTX has a market-tested solution: https://t.co/FD2UjO39Gi

— Mark Wetjen (@MarkWetjen) April 28, 2022

Volumes

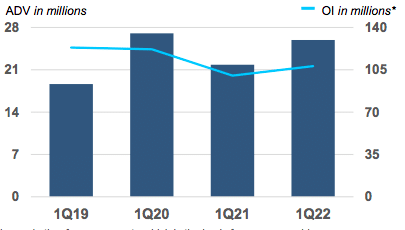

CME Group reported revenue of $1.3bn, a 13% increase year-on-year, and net income of $711m for the first quarter of 2022.

Average daily volume of 25.9 million contracts was up 19% from a year ago, primarily driven by record quarterly equity index ADV and double-digit increases in equity index, interest rate and options products, as well as significant volume outside the U.S.

Duffy said: “Volatility was extreme in the quarter due to the beginning of a war. If volatility becomes normalized that is actually better for the entire franchise.”

He continued that volume in April was just over 20 million contracts a day, down from the 26 million in the first quarter as volatility reduced.

“I have never measured a year on a quarter,” added Duffy. “We have to measure the entire year as we are seeing what can happen when people need to manage risk on a real -time basis. I don’t think anybody has seen a boots on the ground war on European soil since World War Two.”

SOFR futures and options had a record quarterly ADV averaging a combined 1.2 million contracts per day. At the end of the quarter SOFR futures trading had increased for nine consecutive weeks.

Duffy said: “On 19 April SOFR futures daily volume surpassed Eurodollar futures trading volume for the first time which was a major milestone in the industry shift away from Libor.”

In total 1.37 million SOFR futures contracts were traded on 19 April compared to 1.33 Eurodollar futures contracts. At the same time, SOFR futures open interest reached a record 4.7 million contracts.

Google partnership

In November 2021 CME and Google Cloud announced a 10-year strategic partnership to accelerate the exchange’s move to the cloud.

John Pietrowicz, chief financial officer at CME, said on the call that the initial focus will be on moving trading and market data to the cloud and the first phase will also include migrating corporate and clearing systems.

Pietrowicz said good progress is being made as they are analysing each application and determining the right course of action.

“This is not a ‘lift and shift’”, he added. “It’s really a lift, analyse the application, optimizing it and then automating it when we get to the cloud.”

He explained that Google is excellent at managing large amounts of data so CME will then be able to offer analytics and other capabilities.

“Risk management is critical in this uncertain time and we are moving some of our risk models to the cloud,” he said.

Julie Winkler, chief commercial officer at CME, said on the call that futures and options data have migrated to the cloud so there is a full suite of historical and real-time data available to clients.

“The team is actively working on some additional projects based on the unique datasets and the wide range of benchmark products that we have at CME,” she added.

Sunil Cutinho, chief information officer at CME, said on the call that the firm internally hosts a real-time margin calculator.

“Risk management is very important for our clients and we want to give them the ability and the flexibility to launch these calculators as necessary during the day to track their exposures,” he added. “This is something that we are targeting to deliver in the cloud.”

Cryptocurrency products

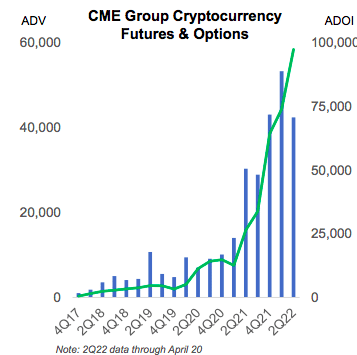

The exchange has launched a suite of cryptocurrency reference rates and real-time indices. CME said they are designed to allow traders, institutions and other users to confidently and more accurately manage cryptocurrency price risk, price portfolios or create structured products like ETFs, and address the increasing demand for reliable, standardized cryptocurrency pricing information based on robust, regulated reference rates.

In the first four weeks of trading, Micro Bitcoin and Micro Ether options gained ground with 40K+ total contracts traded, along with 28K contracts in open interest. Ample block and on-screen liquidity are available across all expiries. https://t.co/7mLb5OKjvw pic.twitter.com/TVScZBOesj

— CME Group (@CMEGroup) April 27, 2022

Sean Tully, senior managing director, global head of rates & OTC products, said on the call: We originally launched bitcoin and ether indexes and a couple of years later we launched futures, where we are gaining substantial revenues, so that is the primary commercialization opportunity.”