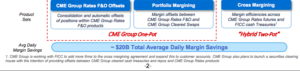

CME Group, the US derivatives exchange, stressed that it provides margin savings of nearly $20bn per day for clients in interest rates alone through the combination of offsets within its franchises, as it is due to face new competition in September.

Terry Duffy, chairman and chief executive of CME Group, said on the second quarter results call on 24 July that the group provides unmatched capital efficiencies for customers.

“Within interest rates alone, these efficiencies result in margin savings of nearly $20bn per day for our clients through the unique combination of offsets within our rates futures and options franchise,” he said. “Our one pot margining with CME cleared swaps and cross margin offsets versus cash treasuries, offers clients the efficiencies which no one else has the regulatory approval to provide.”

Sunil Cutinho, chief information officer of CME Group, said on the call that clients who trade futures and options save roughly $12bn in margin, $7bn for swaps with futures and options, and $1bn for cash.

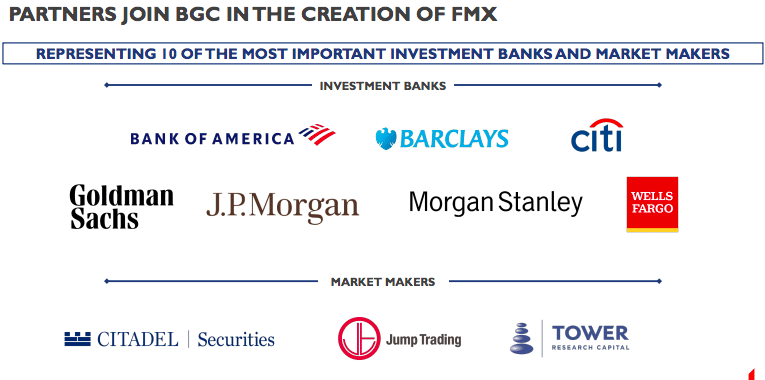

BGC Group, the broker headquartered in New York and London, announced in April this year that 10 financial institutions have become minority equity owners of the new venue it is aiming to launch, FMX Futures.

FMX combines BGC’s U.S. cash treasuries platform with its spot foreign exchange platform and U.S. interest rate futures exchange. The venue received regulatory approval in January this year and is slated to launch in September 2024.

The new venue has partnered with LCH, the clearing business of the London Stock Exchange Group. Lou Scotto, chief executive of FMX, said in April that LCH is the largest clearer of interest rate swaps in the world, so clients will receive significant portfolio-margining capabilities which creates competitive advantages across U.S. interest rate markets.

Duffy said CME has done a number of things over the last eight to 10 years to put itself in the strongest position possible.

“I could not cite the $20bn number if we had not made investments over a long period of time to create unparalleled efficiencies for our client base,” Duffy added. “To walk away from a potential $20bn of margin savings on a daily basis to go to an unproven model seems to be a bit of a fiduciary stretch for people, so we are in a strong position today to compete with anybody, including the announced competitors.”

He also argued that the US government has $27 trillion of outstanding debt, and there is no agreement to clear US sovereign debt in an overseas jurisdiction.

🚨 Watch CME Group Chairman & CEO Terry Duffy sound the alarm on foreign clearing of U.S. treasury derivatives @moneymoverscnbc. pic.twitter.com/DDXYNTVey6

— CME Group (@CMEGroup) July 24, 2024

Duffy continued that relationships with dealers are not fractured in any way, shape or form.

“I think that the guy that’s out there promoting his 10 friends is trying to promote that there’s a fracture because of pricing and other things,” he added. “We bring a lot of value, and that $20bn goes a long way on a daily basis.”

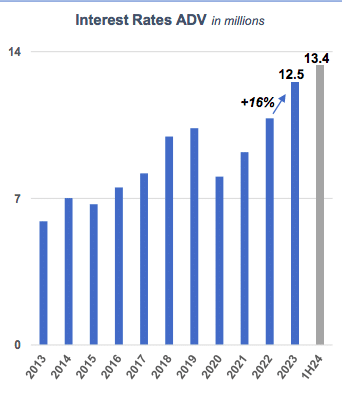

Total average daily volume for CME’s financials complex increased 13% from the second quarter of last year, including record Treasury average daily volume of 8.2 million contracts, up 36%.

“Our U.S. Treasuries set a new daily volume record of 34.4 million contracts during the quarter on May 28,” Duffy added. “The continuing high levels of issuance and deficit financing are tailwinds, even in the absence of Fed rate changes.”

Quarterly average daily volume records were set across 2-year Treasury note futures and options, 10-year Treasury note options, ultra 10-Year futures, ultra Treasury bond futures and options, and micro 10-year yield futures.

CME has also announced plans to clear Treasuries, under the expanded regulatory mandate in 2026. Duffy said the firm is working with the US Securities and Commission and had a call with the SEC chair and staff last week.

“We feel very confident that all the information will be in the SEC by mid-September,” added Duffy.

Google Cloud

Duffy continued that CME took a significant step forward in its partnership with Google Cloud near the end of the second quarter.

CME plans to build a new private Google Cloud region, and a co-location facility in Illinois to support global trading of futures and options markets in the cloud. Duffy said the new platform will have “next-generation cloud technology, ultra-low latency networking and high-performance computing” to provide a broader range of connectivity options and faster product development.

“In addition to our state of the art trading infrastructure, our clients will also be able to utilize Google’s artificial intelligence and data capabilities to help develop, test and implement trading strategies to manage their risk more efficiently,” Duffy added.

Ken Vroman, chief transformation officer of CME Group, said on the call Google will be building a one of a kind, purpose-built facility for CME that will provide scale and resiliency to customers, as well as allowing markets to operate in the cloud.

Vroman highlighted that when CME first introduced Globex, its electronic trading platform, it was put alongside the floor to enable new strategies, business models, products and services.

“We think about this migration to cloud very similarly, and will allow our customers to choose and migrate over time,” he added.

Google is currently constructing the physical building and customers will be able to test the new cloud environment early 2026. Vroman stressed that CME will give a minimum of 18 months notice before it starts migrating any markets.

Duffy added that if Google does not provide a platform that is as good, or faster, than what CME has today, there will not be a migration.

“We still have to see the platform before that ultimate decision can be made,” said Duffy. “We think they will get there, but the exciting part is the functionality associated with that speed.”

Financials

CME reported record quarterly revenue of $1.5bn, up 13% from the second-quarter of 2023. The exchange said this was driven by year-over-year growth in both average daily volume and open interest across every asset class.

Duffy added: “This is the first quarter with this broad based growth since 2010. As escalating uncertainties drove an increased need for risk management across all asset classes, CME Group achieved record Q2 volume and generated record revenue, adjusted net income and adjusted earnings per share.”

Second-quarter average daily volume of 25.9 million contracts increased 14% and represented the highest second quarter average daily volume in CME’s history. Activity was boosted by a quarterly record for non-U.S. average daily volume of 7.8 million contracts, up 23% year-over-year.

Lynne Fitzpatrick, chief financial officer of CME Group, said on the call that more than half, 52%, of the exchange’s trading days were above 25 million contracts in the first half of this year, compared to 34% in the first half of 2023.

“In addition, four of the first six months this year set all time volume records including all three months this quarter,” she added.

CME said double-digit year-on-year growth in foreign exchange volume in the second quarter is indicative of the rapidly evolving interplay of over-the-counter and cleared FX futures liquidity. The group reported two all-time daily volume records on 12 June 12 for FX futures and FX Link.