Annual average daily volume at CME Group increased 9% year-over-year to an all-time high of 26.9 million contracts in 2024, boosted by the third consecutive record-breaking year for interest rate futures and options.

Terry Duffy, chairman and chief executive of CME Group, said on the results call on 12 February 2024: “This growth was broad-based, with volume increasing year-over-year in all six asset classes, including all-time volume records in interest rate, foreign exchange, metals and agricultural complexes.”

In addition to record annual average daily volume, CME reported record revenue, adjusted operating income, adjusted net income and adjusted earnings per share. Total revenue for full-year 2024 was $6.1bn, up 10% year-on-year and adjusted net income also rose 10% from 2023 to $3.7bn.

Average daily volume has remained strong in January 2025 at 25.7 million contracts, up 2% year-on-year, and the highest on record for that month. This is due to shifting views around the global economy, persistent inflation, potential for changes in tariffs and ongoing geopolitical tensions which contribute to the need for effective risk management, according to Duffy.

Interest rates complex

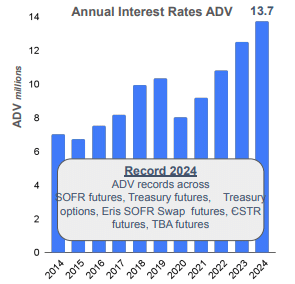

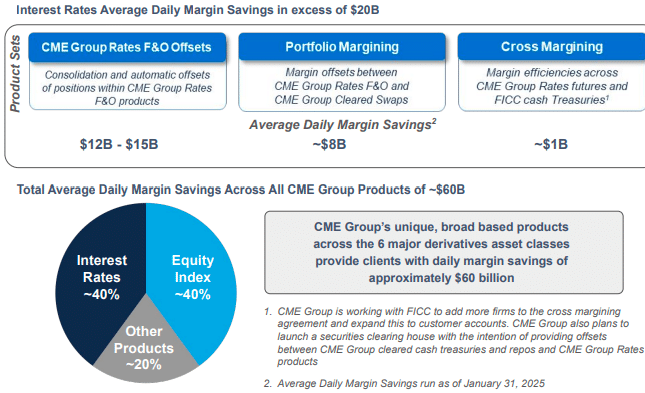

In 2024 interest rate futures and options volume was an average 13.7 million contracts per day, marking the third consecutive record-breaking year for the contracts.Duffy continued that in addition to “impressive” volumes, CME continues to provide unmatched capital efficiencies for its customers of $20bn per day, just within the interest rates complex.

“It is worth noting that this margin savings applies across all the asset classes,” he added. “O ur customers are now saving approximately $60bn per day across all six asset classes.”

CME said Treasury yield volatility as measured by CME Group Volatility Indices (CVOL) peaked on November 4 around the US presidential election, marking the highest level of the year, and softened post-election.

“The strong roll drove the highest fourth quarter treasury futures average daily volume in history, also supported by strength in young products, with credit futures achieving a record high daily volume of over 10,000 contracts traded on December 5.”

The US Securities and Exchange Commission has mandated expanded clearing in the Treasury market and CME has applied to launch a clearinghouse. Suzanne Sprague, chief operating officer and global head of clearing, said on the call that CME’s application was published in the Federal Register in January 2025, which will improve capital efficiency.

Sprague said: “We continue engaging with the SEC towards approval. We are excited about the opportunities that that license could bring in terms of generating additional value for our customers.”

At the beginning of 2024 CME and The Depository Trust & Clearing Corporation, the US post-trade market infrastructure, announced an enhanced cross-margining to enable capital efficiencies for clearing members that trade and clear both U.S. Treasury securities and CME interest rate futures. Eligible clearing members of CME and the government securities division of DTCC’s fixed income clearing corporation (FICC) can now cross-margin an expanded suite of products.

“Capital efficiency is a large focus for us with our own securities clearing offering and continuing to expand that partnership with FICC” added Sprague. “

Retail

Growth has been driven by strong new client acquisition across both institutional and retail sectors, added Duffy. He said: “I’ve said many times in recent years that it is going to become more difficult to distinguish between retail and institutional trading behaviors. Technology is equalizing the access to data and improving the flow of information which is bringing a new type of trader into our markets and will continue to grow the overall financial system.”

Several large retail broker partners joined CME last year to meet customer demand, and the group increased its allocation of expenses to marketing and education of potential new clients.

New clients added in the last five years have generated approximately $1bn of revenue, including approximately 5% of transaction and clearing revenue in 2024, said Duffy. Approximately two thirds of that $1bn of revenue is from retail customers.

CME partners with around 100 retail brokers around the globe and is currently rolling out futures to the 24 million customers of Robinhood, the US retail broker.

Julie Winkler, chief commercial officer at CME, said on the call that new customer acquisition increased 23% year-on-year across all regions. As a result, she said the retail business is a “huge”contributor to international performance.

“Our very diversified product offering is appealing,” added Winkler. “We have the micro equity suite, but we are also seeing a lot of uptake in crypto and commodities.”

Tim McCourt, global head, equities, FX and alternative products said on the call that CME will continue to wait for regulatory clarity before introducing additional contracts on tokens or cryptocurrencies. He highlighted that on 3 February 2025 CME had its largest trading day in crypto of almost 700,000 contracts with records across bitcoin and ether in both standard and micro contracts.

“We are continuing to innovate in the bitcoin and ether lane, where we have certainty and clarity with regulators,” added McCourt.

Commodities

All six futures and options asset classes reached record revenue in 2024. Commodities were the third fastest growing asset class in 2024 and generated a record $1.7bn in revenue in 2024. up 16% versus 2023.

“Growth came from every customer segment, led by the buy side, where we have seen significant increases in activity by global multi-strategy hedge funds as they expand into commodity focused strategies,” said Duffy.

Derek Sammann, global head of commodities markets at CME, said on the call that climate events were one of the primary drivers of record activity in agriculture markets.

“I think we’re seeing significant participation for folks looking to understand the impacts on real economies and they are playing that through our agriculture markets,” added Sammann. “We are also seeing that play through the energy markets, particularly in natural gas, which is increasingly becoming the power source for both heating and cooling.”

In addition, volumes have been increasing in contracts related to the energy transition economy, such as battery metals contracts, and the industrial metals market.

“We certainly see that the weather-driven niche itself has room to grow,” said Sammann.