CME Equity Index Sector Futures Volumes Boosted by Tariff Uncertainty

04.07.2025

Uncertainty due to tariffs introduced by the Trump administration have led to increased volatility and helped boost record average daily volume at CME Group, particularly in equity index sector futures.

In the first three months of this year CME reported record quarterly average daily volume of 29.8 million contracts, 13% higher than in the same period of 2024. Volumes included all-time highs for equity index contracts alongside interest rate, agricultural, foreign exchange and cryptocurrency products.

Paul Woolman, global head of equity products at CME Group, told Markets Media: “The key word really is uncertainty. Clients are not sure what they should be doing to their exposures and how best to position themselves.”

On 3 April 2025 CME’s equities futures and options volume was 43% above the year-to date average daily volume, according to the exchange. On the following day, volumes rose further to almost double, or 95% above the year-to date average daily volume.

BREAKING: Brokerage firms are sending out circuit breaker warnings as US stock market futures extend 3-day losses to over -15%. pic.twitter.com/NvdR9B0EcY

— The Kobeissi Letter (@KobeissiLetter) April 6, 2025

Equity volatility is incredibly high compared to credit spreads.

IMO, this is especially unwarranted in a trade war with risk of a significant recession. Date range: 5 years pic.twitter.com/kQm1KwzPhU

— boaz weinstein (@boazweinstein) April 7, 2025

When you see volume like we saw on Friday combined with outsized ETF market share of volume — its usually a sign of capitulation or at least the beginning of capitulation. ETF market share of US exchange volume almost hit 40% on Friday.

Both stats likely gonna be higher today https://t.co/Veof3lbCGi pic.twitter.com/gE5vvMhky3

— James Seyffart (@JSeyff) April 7, 2025

All-time record volume day for $SPY with $123b and counting (for context, the avg is like $25b). Just a total trade-a-thon. Many ETFs are going to end up setting records when all the dust settled. Congratulations all. pic.twitter.com/q9DIhZ1JYL

— Eric Balchunas (@EricBalchunas) April 7, 2025

Nicholas Colas, co-founder of DataTrek Research, said in a report that the bedrock of the “American exceptionalism” trade over the last 15 years has been the virtuous circle connecting stock prices, the allocation of corporate/societal capital, and the US government’s economic policies.

“This ecosystem generally worked well for most people, and a few weeks of turmoil does not necessarily threaten it,” added Colas. “A few months of volatility and ever-lower stock prices, however, risks permanently damaging investors’ confidence in its foundations.”

Colas added that the CBOE Volatility (VIX) Index closed last week at 45.3, +3 standard deviations from the long run, so stocks will remain volatile and under pressure until US trade/tariff policy changes.

“Futures now give 68% odds of at least 100 basis points of rate cuts this year, up from 32% last week,” said Colas. “Equities cannot draw much comfort from this shift, as it might not be enough to avoid recession.”

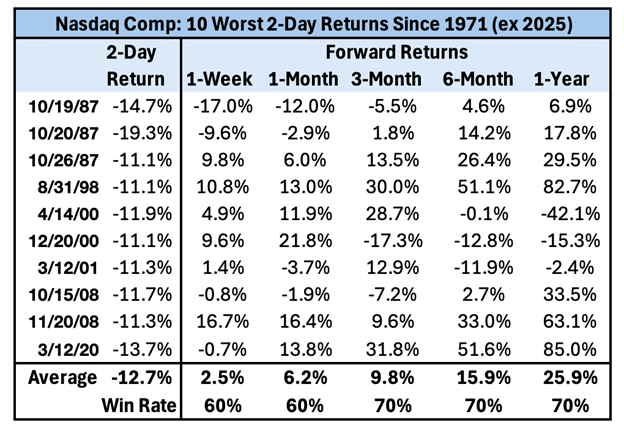

In addition, Colas said the Nasdaq Comp had a +6 standard deviation 2-day move on Friday 4 April 2025.

“That’s only happened 10 other times since the index was created in 1971, signaling a crisis on par with the likes of the 1987 crash, dot com bubble bursting, and 2008 Financial Crisis,” Colas added. “In the week, 1/3/6 months, and 1 year after those 10 prior instances, the Comp produced a positive average return and was mostly higher. The caveat: there needs to be a sufficient change in current government policy and very soon.”

CME volumes

CME’s equity index contracts had record quarterly ADV of eight million contracts in the first three months of this year.

Micro E-mini Nasdaq-100 futures had record ADV of 1.8 million contracts, E-mini Nasdaq-100 options ADV was a record 98,000 contracts and micro E-mini S&P 500 futures ADV increased 57% to 1.3 million contracts.

In March ADV grew 27% year-over-year to reach the second-highest ADV on record of 30.8 million contracts. The month included record monthly equity index ADV of 9.7 million contracts and double-digit ADV growth in interest rate, energy, agricultural, foreign exchange and cryptocurrency products.

Woolman said equity index product volume in the first quarter at CME was driven by a few key areas such as the OTC [over the counter] alternative bucket, which includes equity index sector futures, where ADV grew more than 20% from last year to about 26,000 contracts.

“The environment we see at the moment is very conducive to sector futures, where we see a lot of rotation between sectors that are relative winners and losers amongst the tariff noise,” Woolman added.

As Trump’s trade war led stocks to post their worst Q1 since 2022, diversification proved its worth.

📉 Check out 13 key charts that reveal the dramatic market rotation and what it means for investors. https://t.co/suTOVRebWQ

— Morningstar, Inc. (@MorningstarInc) April 6, 2025

Growth in equity index sector futures has been facilitated by the derived blocks functionality, according to Woolman. A derived block is a block trade in which the price and quantity of the trade depends on hedging transactions in an eligible related market, which can include stock baskets and ETFs. Parties agree to the pre-defined notional or number of contracts and the markets in which the hedging transaction will take place, and the basis price to be added to the index price of the resultant delta hedge in the related market.

“Derived blocks have been very popular and helped level the playing field from a liquidity standpoint with sector swaps or sector ETFs, but with all the benefits of the futures wrapper,” said Woolman.

Similarly, CME launched S&P 500 Equal Weight Index futures in 2024, based on an index which allocates the same weight to all names in the S&P 500 Index. In the last two years, the ‘magnificent seven’ technology stocks have outperformed the rest of the S&P index, and as a result, market cap indices have become more concentrated.

“This year the mag seven have really underperformed, so we see many clients looking to adopt this product,” Woolman added.

Equity index total return futures

A second growth area in the OTC alternative bucket at CME was equity index total return futures, according to Woolman.

ADV of equity index total return futures rose between 90 to 100% in the first quarter of this year, according to Woolman, who more clients are interested in using the product. Clients use equity index total return futures at year-end around equity financing or repos to manage their risk. In addition, Woolman said clients use the contracts instead of total return swaps, because futures are more capital efficient and transparent.

“As liquidity has increased, we see more clients using equity index total return futures in lieu of total return swaps,” added Woolman. “So far in 2025 ADV is roughly 100% up over what we saw in the whole of 2024.”

A third area of growth is equity index dividend futures. CME launched the products In 2024 and Woolman said the contracts have had really strong growth this year, with volumes up about 50%.

In addition, Woolman said more institutional and retail clients are trading overnight, which has accelerated this year due to the unpredictability of news flow from the Trump administration.

He added: “As more clients become aware that the overnight liquidity pool is available, they are able to manage their risk in real time.”

Options

Woolman said: “We continue to see options being a strong growth area for us, particularly option blocks, which were introduced two or three years ago at the end of Covid.”

Option blocks allow clients to trade all their block at one price. Woolman continued that retail trading of equity index options has also been “really strong” this year and more retail distribution platforms are opening their doors to futures and options trading.

In 2024 CME launched launched options on six E-mini Select Sector futures, as well as the Bloomberg Commodity Index (BCOM) futures

“We will continue to adding more options on newer products and additional futures products,” said Woolman