CME Group this month launched its third new foreign exchange analytics tool since the summer as the exchange prepares to migrate EBS Markets for FX trading to CME Globex, its proprietary platform, next year.

The exchange acquired EBS as part of its purchase of NEX Group in 2018.

Paul Houston, global head of FX products at CME, told Markets Media: “We have launched three new FX analytics tools in recent months. All are aimed at demonstrating the value in our markets and allowing users to make more informed decisions.”

This month CME released the free FX Market Profile tool, powered by powered by EBS Quant Analytics. The exchange said users will be to synchronize bid offer spread and liquidity metrics across CME Group’s listed and cash FX marketplaces for the first time.

“The tool synchronises data across listed FX futures and EBS cash FX markets for ease of comparison allowing users to optimize execution across both markets,” added Houston.

In addition to increasing transparency, the tool includes prices for 11 currency pairs, including EUR/USD, GBP/USD and USD/JPY, and so will also help clients to uncover new trading opportunities.

Jeff Ward, global head of EBS, said in a statement: “The tool provides data to help traders determine the optimal time of day to transact in either market, calculate execution efficiencies, determine slippage costs and minimize the market impact of trades.”

Since the summer CME has also launched two other free FX analytics tools. The exchange said FX Swap Rate Monitor provides the only public price reference point for the swaps market. FX Options Volatility Converter can help direct over-the-counter FX market participants to specific CME Group option equivalent products.

Houston continued: “The big area of focus next year is to migrate EBS Markets to CME Globex.”

FX volumes

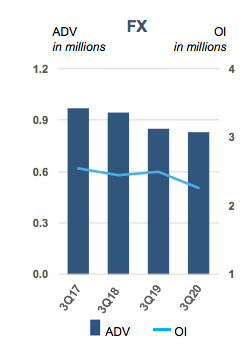

CME reported in its third quarter results that FX average daily volume was up 14% sequentially from the previous quarter.

“Minimum price increment (MPI) reductions of 50-60% in the G5 currency pairs have led to record levels of open interest combined with elevated levels of risk transference during the September roll,” said CME.

The exchange also said euro futures and options reached record open interest of 1,083,652 contracts on September 15.