This article first published as FLASH FRIDAY on Traders Magazine. FLASH FRIDAY, a weekly content series looking at the past, present and future of capital markets trading and technology, is sponsored by Instinet, a Nomura company.

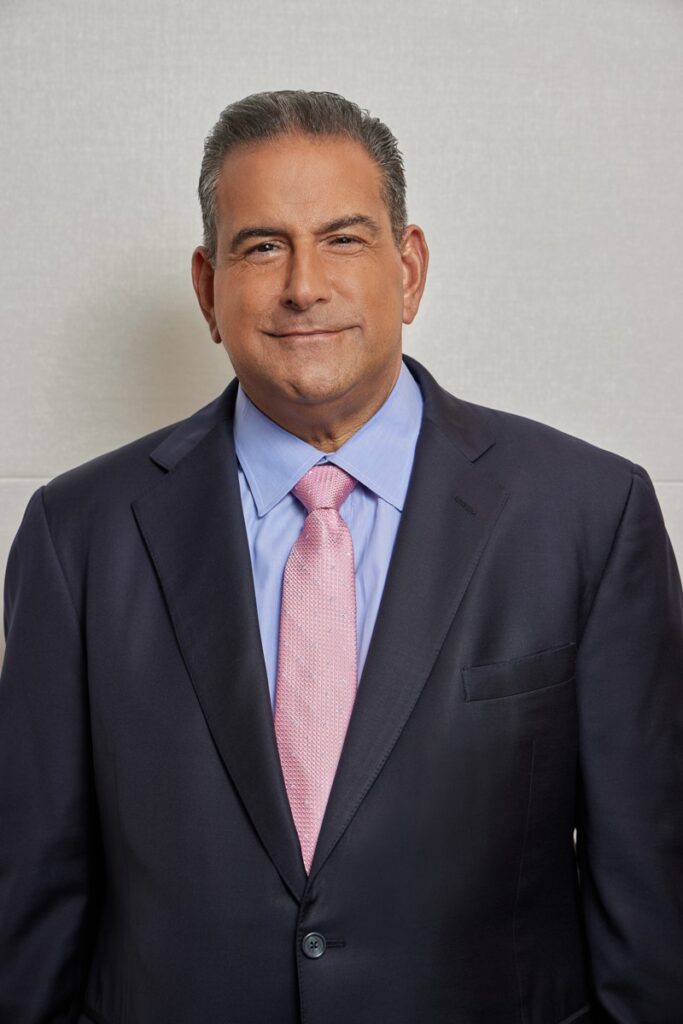

Traders Magazine spoke with Luke Mauro, Managing Director, Global Head of Operations and Commission Management at Instinet, about the shortening of the settlement cycle from T+2 to T+1, effective May 28, 2024.

What is most challenging about T+1 for the industry?

Certainly, the cutoff times are a huge factor. Going from two days to one means that trades need to be affirmed by 9pm on trade date, rather than 11:30am on T+1. That’s a large difference, and firms need to be sure that they have updated their processes. A lot of clients wait until the end of the day to send allocations, so I think the time compression is going to be a big issue, especially for overseas clients because Europe has gone home, Asia is at home, and they need to have things done in real-time to settle the next day. You lose that one day of lag time to fix any mistakes.

How has Instinet been preparing for the transition?

In regard to preparedness, Instinet allocates approximately 80,000 institutional trades daily, and we receive 99.999% of all the account allocations for our US client business on trade date already. Clients are receiving confirms of their trades right away from us. We were also an early adopter of the DTCC initiative, Match to Instruct (M2i), so if a client uses CTM, the client and the custodian don’t need to do anything to affirm a trade. Currently, DTCC has over 100 clients on M2i.

Our institutional settlement rate also shows our readiness. Monthly DTCC metrics show that we settle 99% of our buy-side trades on settlement date, and have clients that do thousands of trades on a T1 basis each day. Additionally, we have our own proprietary middle office system, Midway, that’s geared for T+1. In fact, over the past several years, we’ve been white-labelling Midway as a tool for other brokers to use.

What still needs to happen between now and May 2024 for the industry to transition to T+1?

Between now and May, clients need to work with their agents to update their process in order to send allocations and affirm their trades closer to real time. If they allocate at 4pm, it only leaves them a few hours to affirm the trade to make the 9pm cutoff. Whereas, before they would run a batch process, maybe at 2am on T+1, and have more than enough time to make the cutoff by the next day. So, they need to update their systems to handle real-time processing and also exception processing. They have to be able to go back to their clients with real-time breaks to say, “Hey, this trade’s not matching.” Because, if they wait until the next morning, it’s settlement day and it’s too late.

Is there anything the industry might be under or overestimating with regard to T+1?

There may be some underestimation of the percentage of fails that are likely. Some don’t realize that there are still a lot of banks doing things the old way with faxes and emails. For overseas clients who have to wait until something goes through the next day, I think we’ll see a bit of an increase in fails, especially for the first six months or so. This is because overseas clients tend to come in and work on their local markets first, and then get to the US market later because they had the time. But now it’s already going to be settlement date.

How will T+1 benefit Instinet clients?

Our clients will benefit by having access to their funds sooner and with less exposure in the market. They won’t see any operational differences because firms like Instinet, that have robust automated processes and have invested heavily in technology, will perform solidly. For example, we have clients that trade until 8pm, and within 15 minutes the trades are automatically allocated and sent out to the industry to affirm. The firms that are just tweaking old technology will struggle.

Do you envision any possible unintended consequences of T+1?

I think there may be an issue around recalls. In the current environment, long-only clients lend their portfolio and have two days to recall the stock to make settlement. But in the T1 environment lenders will need to recall the stock for the next day in order to make settlement date. This means firms will need to staff for later hours to handle the recalls and earlier cutoff times.

Is there any date or milestone coming up that people are looking at as a next step toward T+1?

DTCC is pushing hard to get clients on M2i. It’s a big change because it takes out a whole step in the process, they’re eliminating the step to affirm the trade. Instinet has always been a proponent for market innovations and efficiencies, so we’ve been engaging with clients early on and encouraging them to join, in order to save them a step and move up the process.

Other than that, I think everyone’s just working towards the date and getting ready. We’re live and we’re automated, so clients are not worried about us getting there. But the firms that are not automated will need to do some analysis on their gaps and how they will get their own process to settle on T1.