Nearly all the buy side will have digital assets as a permanent part of their asset allocation according to consultancy Crisil Coalition Greenwich.

The consultancy found in a survey that half of its buy-side respondents believe digital assets will be a permanent part of asset allocation in the next 12 to 24 months. David Easthope, who advises on market structure and technology at Crisil Coalition Greenwich, said in a report this will approach 100% in the next three to five years as the “herd mentality of the buy side ensures no one will get left behind.”

“Institutions such as pension funds and endowments can see the portfolio benefits of having bitcoin in traditional portfolios,” said Easthope. “Those not allocating at least a small percentage to crypto might be seen as asleep at the switch.”

Digital assets have grown to a $3 trillion-plus asset class, with bitcoin and ethereum accounting for over $2 trillion according to the report, so asset managers and hedge funds are optimistic about the commercial opportunity to manage portfolios and build investment products.

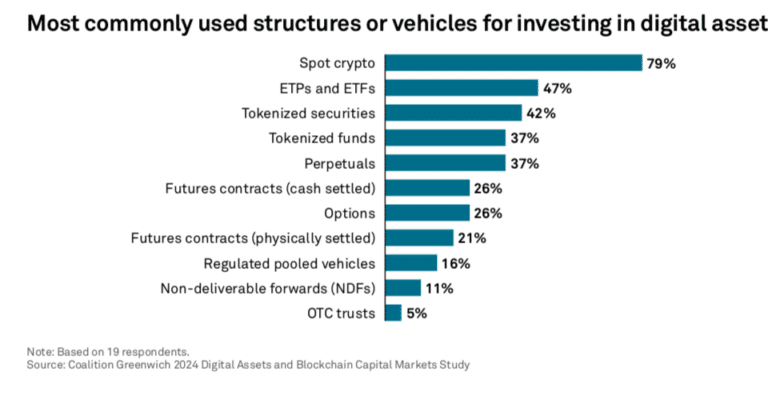

The survey found that most buy-side firms are already or expect to be investing directly in spot crypto assets in the next one to two years, which presents custody challenges. The Securities and Exchange Commission had implemented SAB 121 which required custodians to recognise all digital assets as liabilities on their balance sheets, and the cost prevented regulated banks from holding crypto as custody for their clients. The SEC has repealed SAB 121 under the Trump administration which paves the way for regulated banks to custody digital assets, which is critical for the buy side.

“With the expected alleviation of SAB 121 and the entrance of traditional custodians (in concert with crypto custodians), those considerations can be managed,” said Easthope.

He compared crypto to the parable of the blind men and the elephant as different firms see a different market structure emerging.

“Some visualize crypto as similar to emerging markets foreign exchange, others see fixed income, current and commodities markets with the benefits of tokenization, while others expect more equity-like markets,” he added.

New products

There is clear white space to launch new products and strategies, according to Easthope.

“Just as nearly all large investment firms hold equity and fixed-income assets, we believe close to 100% adoption of digital assets is inevitable, as all types of institutions recognize the benefits of including some bitcoin and other digital assets to their portfolios.,” he added. “Both fear of missing out and the compelling data on correlations will drive this adoption.”

He expects exchange-traded funds to continue to be a popular choice for traditional funds, as they offer a way to invest in bitcoin without taking on the idiosyncratic risk associated with alt coins.

BlackRock’s iShares launched a bitcoin ETF 2024, IBIT, which reached $50bn in assets under management in that year. The fund manager said made it the most successful ETF launch of all time.

This year the fund manager has filed with the SEC to allow investors to redeem IBIT, in bitcoin instead of cash. This allows authorized participants, institutions responsible for creating and redeeming ETF shares in order to accurately track the underlying index or asset, to offer bitcoin for redemption instead of being forced to sell the cryptocurrency for cash. This would make the creation and redemption process more efficient and less costly, potentially lowering fees for retail investors.

In 2024 BlackRock also launched BUIDL, a tokenized treasury fund on the Securitize platform for tokenizing real world assets. BUIDL had assets of $642,2m on 27 January 2025 according to Securitize.

This year Securitize has added daily dividends and intra-day redemptions for BUIDL. Since its launch in March 2024, BUIDL has paid out over $17m in monthly dividends according to Securitize and investors can now receive dividends directly in their wallets daily from Monday to Friday.

Investors can now also redeem their BUIDL holdings at multiple intervals throughout the day, which Securitize said is particularly beneficial for organizations that respond to time-sensitive opportunities or manage intraday financial obligations.

On 25 January 2025 Securitize deployed Wormhole, which allow funds tokenized on its platform to be seamlessly and securely transferred between all blockchain networks supported by Securitize. In addition to BlackRock, Securitize’s clients include alternative managers Hamilton Lane and KKR. Securitize said this is the first use case of multi-chain interoperability between public blockchains for a tokenized money market fund.

Robinson Burkey, co-founder of Wormhole Foundation, said in a statement: “This collaboration underscores the power of multichain tokenized assets for bringing institutional finance on-chain.”

Wormhole said it will provide the infrastructure that will allow investors in tokenized funds on Securitize’s platform access to on-chain yield opportunities, and experience near-instant native transfers and on-chain dividend functionalities.

BREAKING: BLACKROCK GOES LIVE ON WORMHOLE

Securitize just integrated Wormhole for their tokenized funds with BlackRock, Hamilton Lane, KKR, and others.

Enables $1,000,000,000+ in fund LP tokens to easily move cross-chain.$W is now truly institutional-grade. pic.twitter.com/g4K0BlIzfc

— RWA.xyz (@RWA_xyz) January 28, 2025

Jorge Serna, chief product, technology and UX officer (C3PO) at Securitize, said:

(2/11) We leverage @Wormhole’s messaging infrastructure to securely transfer a message from the origin chain, that guarantees that an amount of BUIDL has been burnt there, to a target chain that can mint new BUIDL units on destination based on that message, completing the bridge. pic.twitter.com/kUNWvBQ4fp

— Jorge Serna (@jserna) January 28, 2025

(4/11) The first part of the transaction can be seen in Avalanche:https://t.co/ovC1UH3zEz pic.twitter.com/54C8rzjhuP

— Jorge Serna (@jserna) January 28, 2025

(6/11) The smart contract also receives some payment in AVAX – this is required by the Wormhole network to be able to pay the gas in the destination chain to relay the message and act upon it, in this case do a BUIDL minting.

— Jorge Serna (@jserna) January 28, 2025

(8/11) Here we see the 1M BUIDL being minted again as a result of the message received via the Wormhole network. pic.twitter.com/s62rl0Xnag

— Jorge Serna (@jserna) January 28, 2025

(10/11) The whole process can be monitored through WormholeScan, where instead of getting the fragmented view from each chain we can get the full end-to-end view of the whole bridginghttps://t.co/gVcDib0iao pic.twitter.com/75FJXYlNTK

— Jorge Serna (@jserna) January 28, 2025

(11/11) Now, with $BUIDL, you have the freedom to move seamlessly across different chains, unlocking the unique benefits each ecosystem offers.

Stay tuned for even more advantages as we expand the possibilities of tokenized assets across multiple chains!🔚

— Jorge Serna (@jserna) January 28, 2025