Clearstream has reached €10bn of digital issuance volume on D7, its digital post-trade platform, and Deutsche Börse Group’s post-trade services provider aims to expand into Luxembourg and digitize the eurobond market next year.

In October this year Clearstream said in a statement it had reached €10bn of digital issuance volume on D7, as it aims to digitize the entire post-trade value chain. D7 has already processed more than 250,000 digital issuances, and is adding up to 15,000 new digital issuances every week.

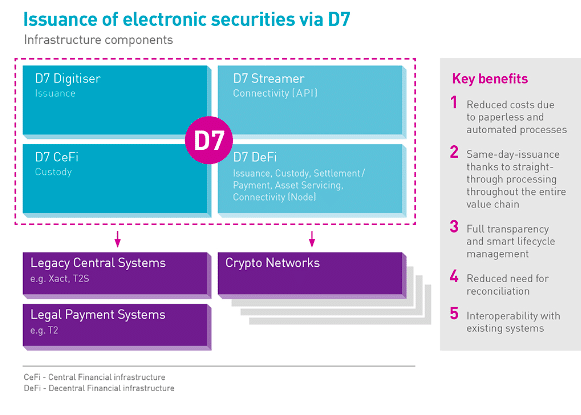

Jens Hachmeister, head of issuer services and new digital Markets at Clearstream, told Markets Media that D7 is like a plug-in hybrid car.

“The highly efficient combustion engine is dematerialization and digitization, where we use multi-party workflows, micro services, APIs and the pre-defined data model,” he said. “Investors can access our digital products as they use them today on secondary markets and for securities financing.”

D7 currently supports two product families – fixed income and structured products, which is the main driver behind the high number of weekly digital issues. An advantage of D7 is that issuers can launch structured products on the same day. They previously had to decide the design of products and parameters, like strike prices, three days in advance, which incurs more risk.

“We are preparing to finalize the last mile, which is intraday listing and then intraday trading,” said Hachmeister,

If firms issue at scale, they can therefore reduce the cost per unit and increase sales of their structured products, which is important as Clearstream launches five million structured products each year.

“In the next 12 to 18 months we expect to see most of the structured product volumes on our current platform switching to D7,” he added.

Fixed income

Digital issuance volumes were also boosted by KfW, Germany’s promotional bank, using D7 for issuing its two latest euro benchmark bonds as central register securities. KfW issued a three-year €4bn digital bond in June, which was subsequently increased to €5bn, and issued another €3bn digital bond in October, with a seven-year maturity.

Hachmeister said a broad variety of digital bond issuers have connected to D7, and that many commercial paper and medium term note (MTN) programs are being transferred to the platform. He continued that it is critical that the industry sets and defines a standard around product specific data models and datasets to help issuance processes become completely automated.

“For many clients, the challenge is to connect their system to D7 and at the same time make their internal processes straight-through processing (STP)-ready,” he added.

Growth

Hachmeister argued that digital market infrastructure will not be adopted unless it offers additional value or dramatically increases market efficiency. He compared D7’s distributed ledger technology (DLT) to the electric engine in a hybrid car as it is not easy for investors to pick up tokenized securities because they need to integrate infrastructure, such as wallets to custody digital assets.

In addition, tokenized securities typically sit on investor’s balance sheet because there is only limited ability to use secondary markets, or to use a digital asset in securities financing.

He added that digital capital markets need five ingredients – secure and legally sound digital securities; digital money; a technical framework; regulation and a sound digital representation of market participants, i.e digital identities.

As a result, Clearstream is taking part in trials with the European Central Bank as DLT Market Operator which Hachmeister described as a critically important first inroad into connecting the Eurosystem to enable delivery versus payment on a digital asset chain. The trials explore the potential of new technologies for wholesale digital payments targeting a central bank digital currency (CBDC). Successful live DLT transactions on D7 have involved participants from across Europe, such as DekaBank, DZ Bank, Eurex Clearing, JP Morgan, NatWest, the German state of Saxony-Anhalt and the German central bank, Deutsche Bundesbank.

“This is just one of the steps we need before we can digitize markets and the ECB can leverage this momentum now,” he added.

On 8 November 2024 Clearstream and Italian bank Intesa Sanpaolo said in a statement that they jointly issued and distributed a commercial paper using DLT as part of the ECB trials. The D7 platform was used for issuance and the transfer of the assets from the issuer to the investors. For this use case, Intesa Sanpaolo was using a direct connection to the D7 DLT platform.

The next big step would be to involve cash and upgrade to repo according to Hachmeister. There is a demand for intra-day repo and this would also be one of the driving use cases for the mobilization of collateral.

“We are one of the drivers behind HQLax digital collateral network,” he said. “The current use cases are very much delivery versus delivery [e.g a tokenized collateral basket swapped against a collateral basket.]”

Fund asset managers such as BlackRock, Franklin Templeton and UBS Asset Management have launched tokenized money market funds which have the potential to be used as payments and as collateral. Tokenised ETFs are another opportunity.

However, Hachmeister also warned that betting purely on new digital issuance means that transforming the entire market into tokenized securities will probably take decades, and so existing securities need to be mobilized.

“In the advertisement for the first iPod, Steve Jobs said he had 1,000 songs in his pocket, which included 950 digitizing old records,” he said. “As an industry, we need to mobilize the existing stock to get the tokenized securities ecosystem going.”

There also needs to be a broader acceptance of tokenized securities by custodians, clearinghouses and central securities depositories. Hachmeister continued that Clearstream has good ideas to mobilize the €19 trillion the business holds in custody and to create easy access to D7 at scale.

“Next year we want to move into Luxembourg and digitize the eurobond market,” he added. “We look forward to more ECB trials and building connectivity.”