The Commodity Futures Trading Commission will hold a CEO Forum of industry-leading firms to discuss the launch of the CFTC’s digital asset markets pilot program for tokenized non-cash collateral such as stablecoins. Participants will include Circle, Coinbase, Crypto.com, MoonPay and Ripple. Further information on the CEO Forum will be released once details are finalized.

“I’m excited to announce this groundbreaking initiative for U.S. digital asset markets,” said Acting Chairman Caroline D. Pham. “The CFTC is committed to responsible innovation. I look forward to engaging with market participants to deliver on the Trump Administration’s promise of ensuring that America leads the way on economic opportunity.”

Acting Chairman Pham has previously proposed a CFTC pilot program as a U.S. regulatory sandbox to provide regulatory clarity for digital asset markets and ensure that robust guardrails are in place. The CFTC has had success with pilot programs dating back to the 1990s.

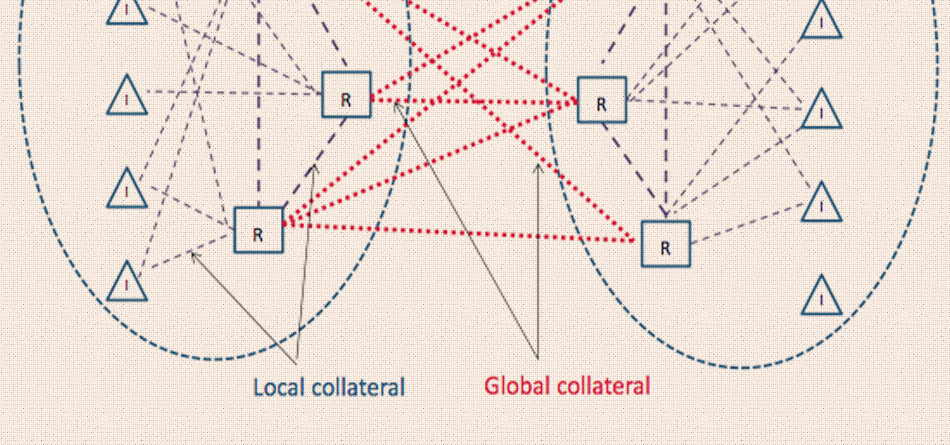

The CFTC’s Global Markets Advisory Committee, sponsored by Acting Chairman Pham, released a recommendation last year by its Digital Asset Markets Subcommittee on expanding the use of non-cash collateral through distributed ledger technology.

Source: CFTC