Cboe Global Markets plans to offer 24×5 U.S. equities trading, subject to regulatory review and industry developments, and believes it will benefit from its experience of operating derivatives markets over this timeframe.

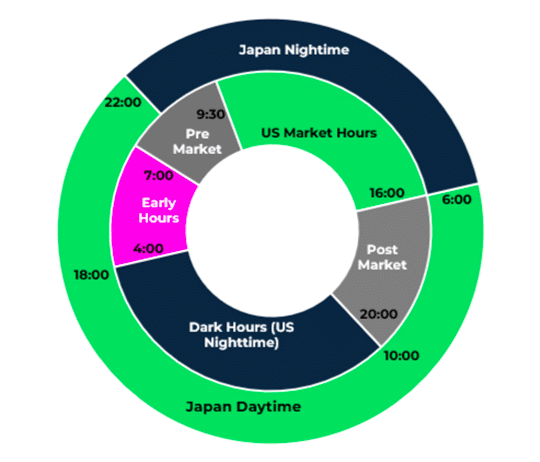

Cboe currently supports extended trading hours for U.S. equities on one of its four US equities exchanges, EDGX. Early order acceptance begins at 2:30am ET, with trading starting at 4:00am ET and closing at 8:00pm ET, Monday through Friday. In February this year, Cboe announced plans to offer trading for 24 hours from Monday through Friday on EDGX to meet demand from overseas investors for US equities, particularly retail investors in Asia Pacific, who want to trade during their day.

Oliver Sung, head of North American equities at Cboe, told Markets Media: “As a global organization on a common technology platform, we have a ‘follow the sun’ model where our operations team is able to support any market at any time. For us, it would be a seamless addition.”

The group operates 27 markets across five asset classes in the US, Asia Pacific and Europe. In its proprietary derivatives suite, Cboe offers near 24×5 trading in its S&P 500 Index (SPX) options, and Cboe Volatility Index (VIX) options and futures markets. In addition, Cboe’s foreign exchange markets already trade 24×5.

“There is institutional knowledge on how to make 24×5 hours available on our equities platform,” added Sung. “Some technology development would be involved but it is manageable and our teams already have experience.”

Cboe said it continues to increase distribution of its US equities market data to complement the planned expansion. The Cboe One U.S. Equities Feed is available to customers globally and offers consolidated, real-time market data from Cboe’s four US equities exchanges, which the firm said account for 21.6% of U.S. equities on-exchange trading.

Chris Isaacson, chief operating officer at Cboe, said on Cboe’s results call on 7 February 2025 that the sale of data is a precursor to clients wanting to trade, and there is a lot of overseas demand for US equities data.

Competition

In October 2024 the New York Stock Exchange announced plans to extend weekday US equities trading on NYSE Arca to 22 hours a day, from 1:30am ET to 11:30pm ET, subject to regulatory approval.

In the following month the US Securities and Exchange Commission approved 24 Exchange, backed by Steve Cohen’s Point72 Ventures fund, which said it intends to launch the first round-the-clock exchange. In the filing 24X said it eventually plans to operate a fully automated electronic trading platform for the trading of listed NMS stocks 23 hours per day, 7 days per week, including certain holidays.

24X National Exchange will be launched in two stages. The first phase will open in the second half of 2025 with the exchange operating from 4am ET to 7pm ET on weekdays.

Outside exchanges, Blue Ocean ATS offers trading of US stocks between 8pm ET and 4am ET from Sunday to Thursday. The ATS can only operate on those calendar days when the NYSE Trade Report Facility (TRF) is open for reporting the following morning.

Dave Howson, president of Cboe Global Markets, said on the Cboe results call that the group has seen increased overseas demand to access US equities market and argued that EDGX can provide a differentiated offering.

“EDGX’s 4am ET to 7am ET market share is in excess of 35% and the platform offers differentiated functionality which appeals to retail investors,” he added.

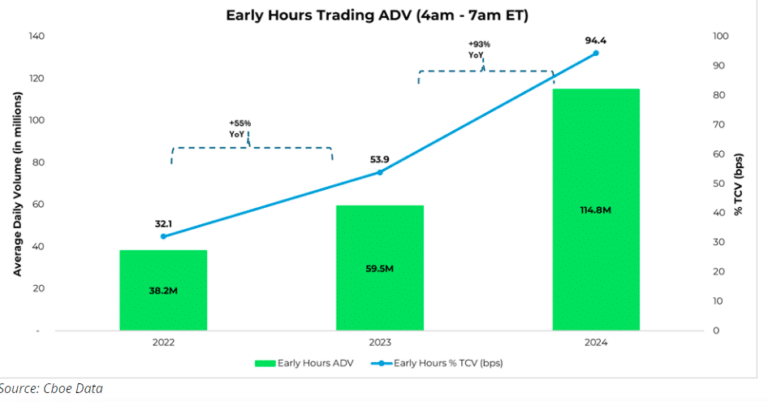

Average daily volumes on EDGX have increased by 135% during its early hours trading session from 4am ET to 7am ET, between 2022 and 2024 according to a Cboe Insights blog.

Foreign investors increased ownership of U.S. equities by 124% from $6.1tr in 2016 to $13.7tr according to Howson in a Cboe Insights blog, which cited data from the US Treasury.

Sung said: “We are the only global exchange group with markets in every region, with a global support model and experience trading 24×5 with our proprietary derivatives.“

New normal

Stefanos Bazinas, senior manager, product development at NYSE said in a blog that there is a “new normal” in off-hours US equities trading.

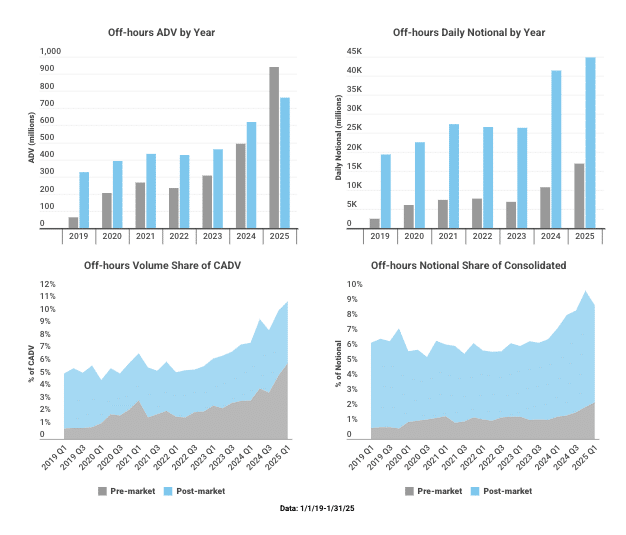

Extended hours trading accounted for over 11% of all US equity trading as of January 2025, according to Bazinas, more than doubled since the first quarter of 2019 when it was just over 5%.

“Even through the lens of aggregate notional value traded, extended hours trading has exploded higher since the start of 2024 finishing the year at a daily average of over $61bn and accounting for over 9.8% of the total dollar value traded in Q4 2024,” added Bazinas.

There has also been a shift from a concentration of extended hours from post-market, (4pm ET to 8pm ET), to pre-market trading (4am ET to 9:30am ET) due to increased retail participation.

In the first quarter of 2019 post-market trading accounted for over 83% of all off-hours trading. In contrast, in the first quarter of 2025 pre-market trading accounted for over 55% of the shares traded during extended hours. The pre-market session has grown 15 times since 2019, compared to 2.3 times for the post-market session and just over twice for the rest of the trading volume, according to Bazinas.

“While a lot of questions remain around the further extension of on-exchange off-hours trading, it is beyond doubt that this trend is here to stay,” he added.

Obstacles

The questions around the further extension of on-exchange off-hours trading involve regulatory approval from the SEC and changes to the Securities Information Processors (“SIPs”), the consolidated tape for US equities.

Sung said: “The SEC seemed pretty clear in their comments around 24X’s approval that nobody can make trading available in the hours that the SIP is not available.”

The SEC requires that exchanges report trades and quotes to the SIPs in real-time, and they are not currently open between 8pm ET and 4 am ET, which could take significant time to change. Isaacson said Cboe will be ready when the industry infrastructure is ready, including consolidated tapes and the clearing facility.

“24×7 is a market infrastructure readiness question,” Isaacson added. “The industry getting to 24×5 is the first big step as having a consolidated tape on the weekends in the US would require some substantial plumbing changes within the industry.”

ION Group, the trading and workflow automation software provider, highlighted in a blog that as algo trading continues to become more popular, fewer orders are directly dependent on human intervention so traders do not necessarily need to supervise them outside standard office hours and potentially open up new sources of liquidity.

However, Ion also highlighted that SIFMA, the securities industry trade association, wrote the SEC in 2024 to outline some of their key concerns about 24-hour trading, which included the effects on price transparency and costs for market participants.

“SIFMA’s final point is crucial,” said Ion. “Although algo orders can work independently to some extent, most brokers are unwilling to remove human oversight entirely. 24-hour trading would therefore require overnight traders, or staff in other time zones – both of which add financial and organizational overheads.”