Cboe Global Markets launched periodic auctions in the US in April this year after pioneering them in Europe, and may introduce the order type in other geographies.

Adam Inzirillo, head of North American Equities at Cboe Global Markets, told Markets Media that periodic auctions launched in the US on April 14 and that he is encouraged with the number of clients that are currently live.

“We have a global transaction strategy which is unique versus our peers as there are not too many exchange operators in Canada, US, Europe, Asia, and Japan,” he said. “Each market has its own nuance and differences but there are certain similarities.”

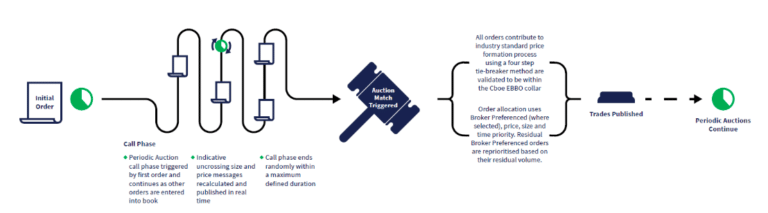

The exchange launched periodic auctions in Europe in 2015 ahead of the incoming MiFID II regulations which changed equity market structure. Periodic auctions last for very short periods of time during the trading day to help market participants find liquidity quickly with low market impact, while prioritizing size and price.

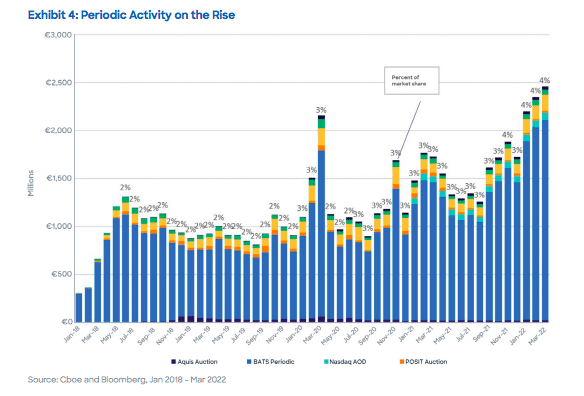

In Europe periodic auctions now represent 4% market share according to data from Liquidnet, the institutional liquidity pool.

Inzirillo said periodic auctions are a great example of an order type that has worked very well in Europe and that Cboe believes has value in the US.

“There are similarities in Canada and other markets that we will definitely look at, not just for periodic auctions, but for all our technology to see what is portable to those regions,” he added.

For example, Cboe recently launched BIDS technology in Canada and the next goal is to bring BIDS to Australia. The BIDS ATS is the largest US block crossing network by volume and was acquired by Cboe in 2021.

In US periodic auctions Inzirillo said a small number of clients are sending in orders daily, another subset of customers are testing, and there is another subset who will start prioritizing the work required to implement the new order type in two to three months. For example, they need to implement the FIX tag in their algos, smart routers, and the order management system downstream to the data in order to review performance.

“It can take a good three to six months to get at least a dozen clients up and running,” Inzirillo added.

He highlighted that a number of Cboe products achieved great success but took six to eight months to get running. For example, Cboe launched Quote Depletion Protection (QDP) to compete with off-exchange trading which took over 12 months to reach very strong volume.

“If we can get to a similar volume in the same timeframe in periodic auctions, that will be a huge win for us,” said Inzirillo.

Some customers, who tend to be small and midsized broker dealers, are using periodic auctions in Europe as well as the US.

There are some differences between the regions. In Europe periodic auctions are in a separate book but in the US they have to be mixed in with Cboe’s continuous book and there is also no broker preferencing.

Cboe also runs periodic auctions differently in the US as they last a standard 100 milliseconds.

“We randomise the message, versus randomising the auction, as it helps to mitigate adverse selection,” said Inzirillo. “In addition, the number of messages and market data updates per second is far greater in the US. We can trade 11 billion shares on a down day.”

Cboe said in its regulatory application that it expects US periodic auctions to help facilitate price discovery, and enhance liquidity and market quality in all equities, particularly thinly-traded securities on Cboe BYX Equities Exchange.

“In periodic auctions, we have had a couple of big prints in some illiquid securities, one of which represented one of the largest volumes traded,” added Inzirillo. “However, periodic auctions are not constrained to only illiquid securities”.

Equities business

In its results for the first quarter of 2022 Cboe reported that North American equities net revenue decreased by 3% year-over-year against some difficult comparisons to the first quarter of 2021. Cboe said industry volumes were lower by 12% and market share declined by 70 basis points versus the first quarter of 2021.

“On a sequential basis, market share improved by a full percentage point and industry average daily volume was up by nearly 20%,” said the results statement.

Inzirillo said the first priority for the business is to make sure that the group continues to use Cboe Insights and push out data to customers to further enhance Cboe’s US equities brand and help customers satisfy their best execution obligations.

“Number two is continuing to focus on attracting non-displayed liquidity to the public market which we are doing through Retail Priority and QDP, which mitigates adverse selection for non-displayed passive orders,” he added. “We hit a milestone of north of 10 million a day with QDP.”

Cboe will also work with regulators and other market participants to see if there are potential opportunities to attract more order flow to the public market without over burdening the investor community.

Inzirillo continued that retail equity trading volume peaked in the first quarter of 2021 at about 25% of the market and is now between 10 % and 12%.

He said: “When volatility increases there is a massive rotation and an increase in liquidity provisioning for market makers with a reduction in meme stock trading activity.”