Cboe Global Markets has renamed its Data and Access Solutions segment as Data Vantage, which it said better reflects the business as it includes data and access; analytics and execution; and indices.

Adam Inzirillo, global head of Data Vantage at Cboe, told Markets Media that Data and Access Solutions was a good name when the segment was set up, but it does not capture the breadth of the current business.

“We now have data and access, analytics and execution, and indices,” he said. “We have a significant opportunity to distribute all of those services globally, and our rebrand reflects this new vision.”

He explained the choice of the new name. Inzirillo said: ”Data fuels everything that we do and fuels access to our markets. We have a unique vantage point in capital markets versus our peers and we feel that is a significant differentiation.”

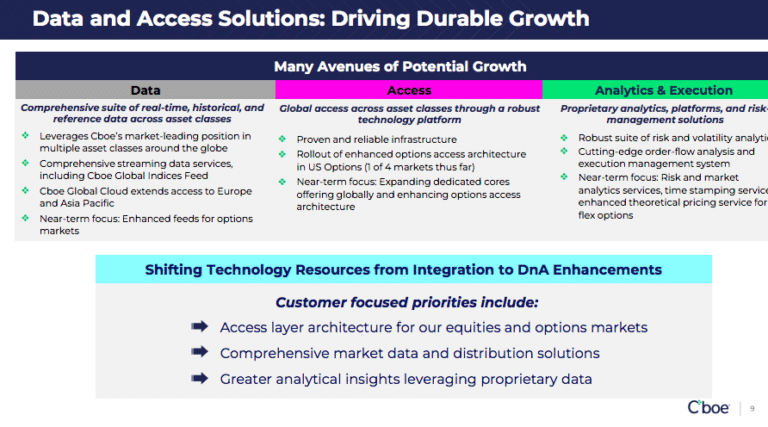

Inzirillo took over the business in October 2023 after almost four years leading Cboe’s North American Equities team. During the past year he has been excited to broaden his understanding of the team and learn how to grow the business globally, according to a blog. The streamlined vision for the business includes three pillars — data and access, analytics and execution, and indices — united by a new client services arm.

Cboe has expanded globally into 27 markets across five asset classes and global distribution of data is helped by nearly all of Cboe’s matching engines sitting on one common technology platform. There is just one technology migration remaining – the acquisition of Neo, a fintech comprised of a fully registered Canadian securities exchange (NEO Exchange), and NEO Connect which provides a distribution platform supporting mutual funds, private funds and private corporates.

In equities, the Cboe One Feed provides reference quotes and real-time market data. In September 2022 Cboe One Feed expanded into Canada following the company’s acquisitions of MATCHNow, an equities dark pool, in August 2020 and NEO in June 2022.

“We have a full North American equity market data product that we can distribute globally,” said Inzirillo.“That means we can explore the provision of a global equities feed.”

For example, a big focus of Asian Pacific brokers is getting access to, and expanding, their connectivity to equity markets globally, including Europe. Inzirillo argued that Cboe is the largest pan-European exchange and so its data frequently represents the best price.

In addition to the Cboe One Feed in equities, Cboe also launched the One Options Feed in March 2023 to provide aggregated quote and trade data from Cboe’s four US options exchanges. In November 2023 Cboe made a regulatory filing to change the Options Price Reporting Authority (OPRA) plan, which the exchange believes will allow for a more cost-effective way to disseminate real-time options market data to retail investors, but this was not approved by the US Securities and Exchange Commission.

Inzirillo said in his blog that Cboe is evaluating how to proceed. He added: “We believe high-quality, real-time data is important for all options traders and believe that a lower cost option is necessary for the betterment of the market.”

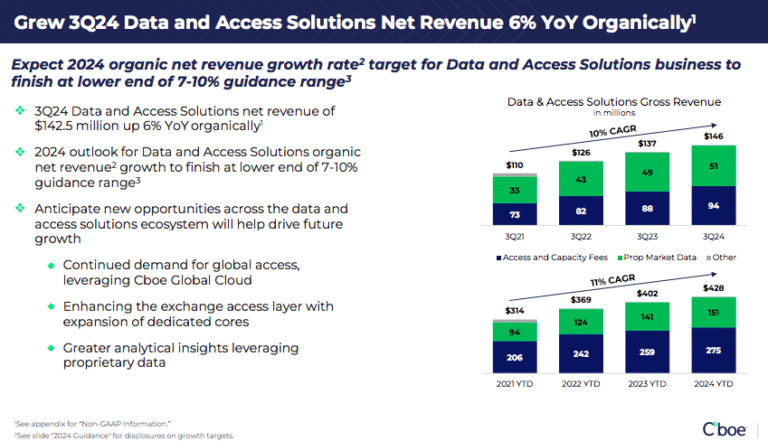

For the third quarter of this year, Cboe reported that more than 40% of new data sales were outside of the US, with the business segment delivering 6% year-over-year net revenue growth for the quarter. Cboe said: “Comprehensive suite of data solutions across geographies and asset classes translated to solid revenue results.”

Inzirillo said that demand from outside the US has continued since into the fourth quarter. Cboe wants to have sales teams around the globe who understand the cultures of different regions and can help establish local partnerships and open new doors, and also provide feedback from clients which is instrumental for building new products.

“Across our asset classes, we can provide empirical evidence to customers to guide them on how to trade in our markets, and the benefit of using derivatives in their portfolios,” he added. “The big focus for 2025 is further exporting our data globally and importing more trading into our markets.”

Data distribution

A lot of Cboe’s in-house data is on Snowflake, the AI data cloud company, and Cboe is making it available for Snowflake users externally. Recently, Cboe made end-of-day summary and tick data for seven Cboe Global Indices Feed channels available via Snowflake, and the firm will soon have a Snowflake Marketplace presence where these datasets and more can be purchased.

“We are excited about working with Snowflake more to meet market participants where they are,” he added.

Cboe wants to provide market participants, especially retail investors, with seamless access to data and so is using new technologies, such as Snowflake and AWS, Amazon’s cloud, in addition to exploring capabilities with Google. Some clients are latency sensitive and need depth of book, so Cboe will figure out ways to bring solutions to them, said Inzirillo.

The group has a DataShop, which Inzirillo described as its “Amazon storefront,” where clients can see and purchase a plethora of data at their leisure. He added: “We are continuously figuring out ways to deliver data more easily to them, such as using Snowflake.”

Exchanges

Other exchange groups are also investing in their data businesses. London Stock Exchange Group said in a statement that it is launching historical analytics available through Snowflake, which offers customers access to analytics in a way that suits them best.

The new offering combines LSEG’s pricing services with Yield Book analytics to provide pricing information for over 2.9 million bonds for more than over 20 years. The analaytics can be used for regulatory reporting and risk management; security valuation and portfolio analysis; and research, index strategy and historical simulations.

Emily Prince, group head of Analytics at LSEG, said in a statement: “These tools allow customers to backtest portfolios, optimise strategies, and manage risk effectively. By offering this through Snowflake, we ensure seamless access to advanced analytics, enabling more efficient, scalable, and integrated solutions for our clients.”

Hong Kong Exchanges and Clearing Limited said in a statement that it is launching the HKEX Data Marketplace, a web-based platform that offers data users a more intuitive experience in accessing HKEX’s historical and reference data. Initially, the marketplace will offer shareholding data from the Central Clearing and Settlement System (CCASS) for commercial use, as well as historical full book data from HKEX’s securities and derivatives markets, and securities market daily non-trading reference data.

HKEX will then add more products and functionality, including tools to customize data, and additional options for data delivery.

Bonnie Chan, chief executive of HKEX, said in a statement that investors globally are looking for richer and more insightful data to help inform their investment strategies. She added: “Data and analytics will complement our core business and present new and exciting opportunities for us as an adjacency.”

The Chinese interface of the HKEX Data Marketplace will be available in the first half of 2025.