Frax Finance, a decentralized stablecoin cryptocurrency protocol, has launched a stablecoin backed by a tokenized fund from BlackRock as digital fungible collateral is expected to transform capital markets.

On 2 January 2025 Frax Finance said in a statement that it was launching frxUSD, a stablecoin backed by BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL).

Stablecoins are a type of cryptocurrency designed to maintain a stable price over time by pegging its value to a reference asset which is often a fiat currency, such as the US dollar, or a commodity as it is backed by collateral. BlackRock launched BUIDL on the ethereum blockchain in March 2024 in partnership with Securitize, the real-world asset tokenization platform. BUIDL invests in cash, US Treasury bills, and repos.

📢 BUIDL Dividend Update: $17.2M Distributed!

The @BlackRock USD Institutional Digital Liquidity Fund continues to showcase the power of tokenized finance, paying out over $17 million in dividends since its launch in March. 🌟

With availability on six blockchains— @Ethereum,… pic.twitter.com/RhbRFhjIDT

— Securitize (@Securitize) January 2, 2025

Frax Finance said the new stablecoin marks a “milestone” in the integration of traditional finance and blockchain technology, as it is the first stablecoin to offer seamless fiat on/off-ramping capabilities via Blackrock’s BUIDL infrastructure. Sam Kazemian, founder of Frax Finance, said in a statement that frxUSD combines the transparency and programmability of blockchain technology with the trust and stability of BlackRock’s prime treasury offerings.

Carlos Domingo, co-founder and chief executive of Securitize, said in a statement: “This collaboration exemplifies the next stage in financial evolution, demonstrating how traditional and decentralized systems can work together to redefine asset management strategies.”

David Mercer, chief executive of LMAX Group, the fintech operating an institutional exchange for FX and crypto trading, said in an email that the ability to tokenize assets will make trading more efficient, fungible and accessible and revolutionize markets.

He said fractional ownership and instantaneous transfer of title will democratize access, enabling every tier of market participant to transact seamlessly at scale.

“Stablecoins and other digital fungible collateral, backed by reputable frameworks will underpin this transformation,” added Mercer. “By acting as a bridge between fiat and digital currencies, the world’s monetary systems can become more intertwined with the broader digital assets ecosystem.”

Galaxy has predicted that there will be at least ten stablecoin launches backed by TradFi (traditional finance) partnerships in 2025 in the digital asset and blockchain firm’s 23 Predictions for Crypto in 2025.

Galaxy said that between 2021 and 2024 the number of stablecoin projects has grown to 202, including several with strong ties to TradFi.

Growth in transaction volumes have also been greater than that of major payment networks such as Visa. For example, the US-licensed FV Bank supports direct stablecoin deposits and Project Pax involves Japan’s three largest banks collaborating with payments system SWIFT to make cross-border money movements more efficient.

Jianing Wu, research associate at Galaxy, said in the report: “Looking ahead, with growing regulatory clarity, TradFi players are expected to integrate stablecoins into their operations to stay ahead of the trend, with first movers poised to gain an edge by building the foundational infrastructure for future business development.”

Alex Thorn, head of firmwide research at Galaxy, predicted that stablecoin legislation will pass both houses of US Congress and be signed by President Trump in 2025. He said the growing number of stablecoins backed by the US dollar is supportive of the currency’s dominance and Treasury markets, and lead to significant growth in stablecoin adoption.

Hunter Horsley, chief executive of Bitwise Asset Management, the digital asset exchange-traded fund issuer, said:

2025 is going to be the year Wall Street arrives:

I expect ~1/2 of traditional wall street firms are going to launch spot trading, spot custody, ETF access, or a stablecoin.

— Hunter Horsley (@HHorsley) January 2, 2025

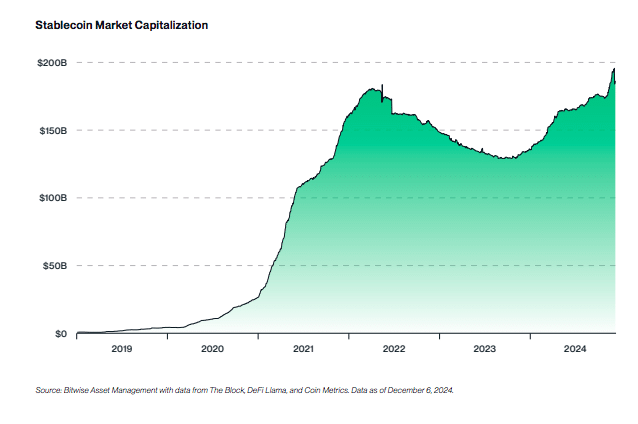

Bitwise predicted that Stablecoin assets will double to $400bn when the US passes long-awaited stablecoin legislation as one of its 10 Crypto Predictions for 2025.

“Clear answers to big questions—Who regulates stablecoins? What are the proper reserve requirements?— will spark massive new interest among issuers, consumers, and businesses,” added Bitwise. “When that happens, expect some large traditional banks like J.P. Morgan and others to enter the space.”

Stablecoin Monthly Volumes Reach FedWire Levels

"Still, the opportunity here feels to be in its infancy given the inherent logic of the use case & potential for a comprehensive Stablecoin Bill to be signed into law." -Canaccord

Good to see VanEck's @withAUSD front & center pic.twitter.com/NtMMCuWvBB

— matthew sigel, recovering CFA (@matthew_sigel) January 2, 2025