Laurence Fink, chairman and chief executive of BlackRock, said the asset manager does not see systematic risks despite the market downturn in US equities and Treasuries since the administration announced widespread tariffs.

Fink said on the first quarter results on 11 April that uncertainty and anxiety about the future of the markets and the economy are dominating each and every client conversation.

“I was traveling in Europe last week when the sweeping US tariff announcements were announced and went beyond anything I could have imagined in my 49 years in finance,” he added.

He continued that the market downturn this year is different from other shocks since the financial crisis. However, BlackRock does not see systemic risks as the financial system has been resilient in the face of increased trading volumes. Despite the volatility, Fink said the markets have proven to work quite well.

“Obviously there is near-term uncertainty, but the big macro trends that were in place 80 days ago are still around. I remain very optimistic about capital coming into the markets over the long term,” he added. “We have not seen any capitulation with clients at all.”

He believes there is a huge reserve of money that will be put to work in the future in capital markets. BlackRock is having a lot of conversations related to fixed income, and thinks more clients will extend out on the yield curve as it continues to steepen. In equities, Fink said more clients are asking when they should come in and buy.

“Obviously, a lot of people think at this time that you don’t buy the dip,” said Fink.

Fink also discussed whether Europe could become a better destination for capital now that the region is focussed on growth. He added: “We have not yet seen a systematic reallocation into other parts of the world from the US, but that’s a good question to be raising.”

ETFs

At the end of the first quarter, BlackRock had record assets under management of $11.6 trillion. Over the last 12 months the firm accumulated $670bn of new assets from clients, resulting in a 60% increase in assets from a year ago.

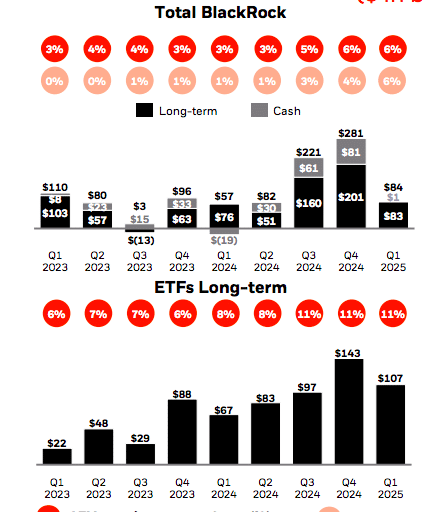

BlackRock reported $84bn of quarterly total net inflows in the first quarter, which excluded low-fee, institutional index outflows driven by rebalancing, and reflected 3% annualized organic asset growth. Total net inflows in the first quarter were $140bn.

Inflows were led by a record first quarter for iShares, its exchange-traded fund franchise, alongside private markets and active net inflows. ETF net inflows of $107bn were positive across all channels, led by 46bn for core equity and $34bn for fixed income.

Fink said the European ETF platform crossed over $1 trillion for the first time in the first three months of this year, and the business is well positioned with approximately 40% of market share by assets under management.

“The European ETF market opened 2025 with record demand,” Fink said. “In iShares, European net inflows have more than doubled compared to the flows at this time last year.”

Active ETFs contributed $9bn of net inflows, and digital asset ETPs generated another $3bn of net inflows. Martin Small, chief financial officer of BlackRock, said on the results call: “Inflows into these higher-fee categories contributed to 7% annualized organic base fee growth for ETFs in the first quarter.”

BlackRock recently launched its Bitcoin ETF in Europe, following the launch in the US in 2024 and in Canada in January this year. Fink said that in the first quarter BlackRock saw large opportunities for growth in digital assets, and, more broadly, for blockchain and tokenization technology.

Private markets

Fink said that it has become clear how sensitive public markets are to uncertainty, and how quickly they can move in reaction to policy proposals. He argued that these dynamics could drive even more capital flows into private markets as investors look to insulate portfolios from the impact of tariffs and seek attractive income and growth.

“Last year we invested in enriching our private markets and data platform, and we are seeing the results today,” added Fink.

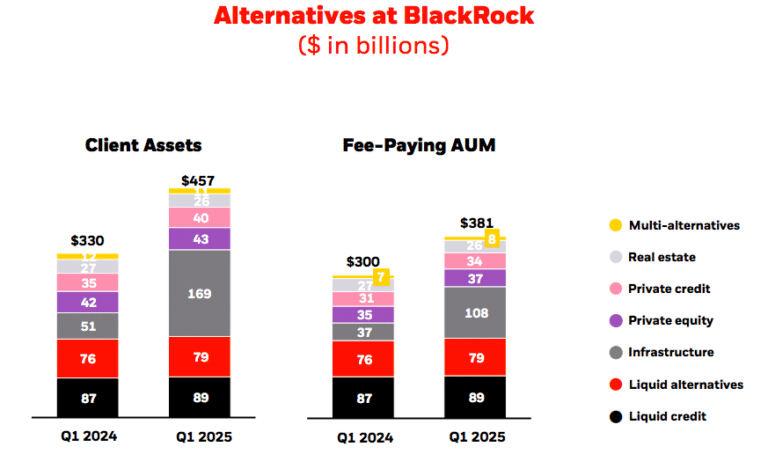

BlackRock completed the acquisition of infrastructure fund manager Global Infrastructure Partners (GIP) in November 2024 and added approximately $170bn in assets under management. In March this year BlackRock completed its acquisition of Preqin, the private markets data provider.

Over time, BlackRock will integrate Preqin’s proprietary data and research tools with Aladdin, its technology platform, and eFront, its end-to-end alternative investment management software and solutions provider.

Fink said the combination with GIP has already unlocked differentiated opportunities for BlackRock clients. Infrastructure deals with GIP include an announcement to buy some ports operated by Hong Kong-based CK Hutchison Holdings, including CK Hutchison’s 90% interests in Panama Ports Company; and another partnership to invest in data centers with Microsoft and MGX.

“These announcements are early confirmations of the power and value of GIP pairing with BlackRock,” said Fink. “It’s unlikely either of us on our own would have been part of these transactions.”

There has been no change in client demand for infrastructure, despite the market volatility, according to Fink. He argued infrastructure strategies can throw off mid-teen returns and protect against inflationary pressures over the long term. He said: “The opportunity in infrastructure probably is as great as at any other time that we have seen.”

In December 2024 BlackRock agreed to a $12bn acquisition of HPS Investment Partners to create an integrated private credit franchise. Fink said this will scale BlackRock’s private credit assets under management to approximately $220bn.

“The upcoming addition of HPS represents even more opportunities to extend our insurance relationships across all private credit markets,” Funk added. “We also expect HPS to advance our position in the fast growing alternatives to wealth space.”

In March 2025, BlackRock was part of an investor consortium that acquired Viridium Group, a Germany insurance company. The transaction is expected to close in the second half 2025 subject to regulatory approvals and other customary closing conditions, when Blackrock will own a non-controlling, non-consolidated minority equity investment.

Martin Small, chief financial officer of BlackRock, said on the results call that BlackRock will help Viridium access a broader range of private markets investment opportunities.

“We expect that growth to be in private credit strategies, infrastructure and corporate debt as well as asset-based finance,” said Small.

He added that the institutional channel delivered 7% long-term organic based fee growth in the quarter as it benefitted from demand for private markets and systematic strategies. Private markets had an aggregate $7bn of net inflows, led by infrastructure and private credit.

Liquid alternatives added $2bn of net inflows, primarily into global equity market neutral and multi strategy funds run by the systematic teams.

Financials

Small argued that BlackRock has built its platform to help clients in all market environments, even against a sharp change in markets and uncertainty in fiscal and monetary policy.

He added that BlackRock’s decision to anchor its business in structural growth engines helped deliver 6% quarterly organic base fee growth, above the 5% target.

“Organic base fee growth in the first quarter represented our best start to a year since 2021, and secular strength against a complex market backdrop,” said Small.

On 3 March 2025, BlackRock completed its acquisition of Preqin. The private markets data provider added $20m to first quarter revenue.

BlackRock reported a 12% increase in revenue year-over-year to $5.3bn. The firm said this reflects the positive impact of markets, organic base fee growth and fees related to the GIP transaction, as well as higher technology services and subscription revenue, partially offset by lower performance fees.

“When markets are strong, we’ll grow faster,” he added. “When markets are weaker, we may grow slower, but we will still grow.”