Larry Fink, chairman and chief executive of BlackRock, said sustainability will be a tectonic shift in the industry for years to come as the fund manager will be adding more environmental, social and governance data to Aladdin, its technology platform.

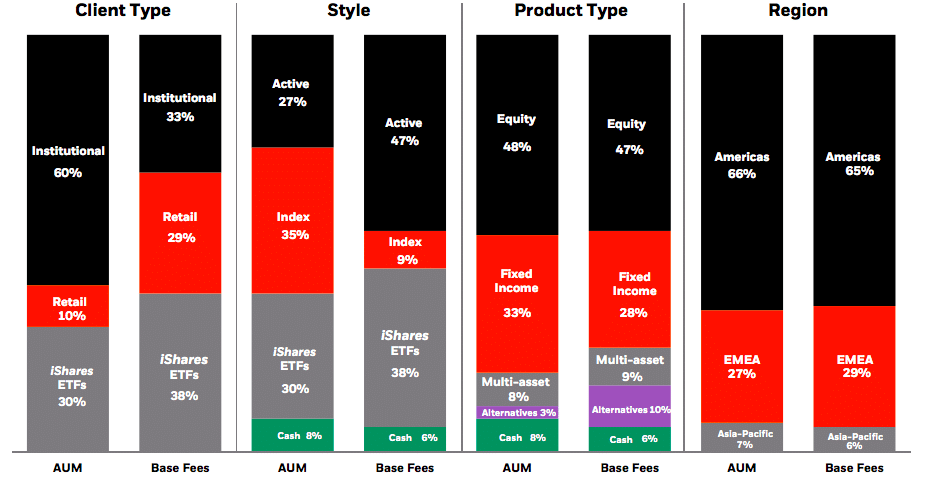

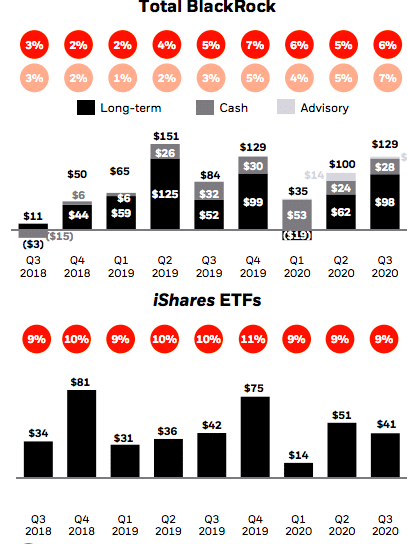

BlackRock reported in its third quarter results today that it had $129bn (€110bn) of quarterly total net inflows with positive flows across all regions, investment styles – both active and passive – and product types.

Larry Fink shares his insights on BlackRock’s Q3 earnings results https://t.co/k7QXvP8EnX pic.twitter.com/B2CQfcAwTO

— BlackRock_News (@BlackRock_News) October 13, 2020

Fink said on the results call today that the net inflows represent 7% annualized organic asset growth in the quarter and 9% organic base fee growth led by fixed income, sustainable investments and exchange-traded funds.

Sustainable investments

He continued that BlackRock manages more than $127bn in sustainable products and the firm stands by its ambition to reach $1 trillion by the end of the decade. BlackRock has about 125 sustainable iShares ETFs with more than an aggregate $50bn in assets, as well as 67 active sustainable products.

“The demand for sustainable products has accelerated and we had inflows of $8bn in the third quarter,” said Fink. “This brings the year-to-date total to $25bn which is more than double all of last year.

Fink said that as a result BlackRock is investing in technology in order to be able to quantify the impact of ESG investing.

He added that one of the structural trends in the the industry is the demand for a unified enterprise and risk management platform like Blackrock’s Aladdin. The platform already has 1,500 ESG metrics and the firm wants to expand this data.

“We are creating Aladdin Climate,” said Fink. “Our ambition is to have a sustainability overlay in everything we do.”

Fink continued that investors across the board believe in climate change. For example, products in Europe do not see real flows without a sustainable lens and clients in Asia are also discussion ESG strategies.

More than 50% of the firm’s total flows were driven by clients in Europe and Asia.

Active strategies

BlackRock had a record $10bn of net inflows into active equities in the third quarter, which was the sixth consecutive quarter of inflows.

Fink said: “This was the strongest performance we have seen in active with 80% of equities and 87% of fixed income outperforming benchmarks over three years.”

Fixed income

Fink continued there was strong demand for fixed income with $70bn of net inflows, including a record $20bn into fixed income ETFs in the third quarter.

“We captured 40% of industry flows into fixed income ETFs,” said Fink. “We believe it will be a multi-trillion dollar market in the years ahead.”

Consolidation

Last week Morgan Stanley announced the acquisition of Eaton Vance in the latest merger in asset management.

Gary Shedlin, chief financial officer of BlackRock, said on the call that it was not a surprise to see mergers accelerating due to the pressure on fees, the need to invest in technology and the requirement to provide global insights and products across asset classes.

“Other firms are hoping to create what we already have,” he said. “We can benefit from the disruption and provide a beacon of stability.”

Shedlin continued that BlackRock was focussed on maintaining its existing strategy and would only consider deals that are accretive to organic growth.

“We have also been using our balance sheet to take stakes,” he added.