Sustainable assets at BlackRock more than doubled in 2021 to $509bn (€446bn) as the fund manager’s total assets under management broke through the $10 trillion barrier.

Larry Fink shares his insights on BlackRock’s Q4 earnings results https://t.co/k7QXvPqffv pic.twitter.com/UpTfry3Ufv

— BlackRock_News (@BlackRock_News) January 14, 2022

Larry Fink, chairman and chief executive of Blackrock, said on the results call that momentum in sustainable investments continued in 2021.

“We generated a record $104bn of net inflows in 2021 as client demand for sustainable strategies accelerated,” he added. “One of the biggest opportunities of this generation will be helping our clients navigate the global transition to a net zero economy.”

More than $4 trillion of capital has moved from traditional investment to sustainable funds in the last two years according to Fink. He said this is just the beginning as the transition will not happen overnight and require significant investments in technology.

BlackRock is working with companies across a wide range of carbon-intensive sectors that are proactively transforming their businesses and whose innovation will be critical to the world’s decarbonization agenda, which present an important investment opportunity for investors.

“We are intensely focused on helping our clients participate in these opportunities and understand the impact of the transition on their portfolios through better data and analytics,”said Fink. “Our vision is to move more capital and transition than anyone else.”

Sustainable investing is contributing nearly 20% of organic growth each year at BlackRock and analysts expect the firm’s environmental, social and governance assets to reach $1 trillion before the end of this decade, from just $100bn in 2018.

Fink said: “In Europe today you will not be awarded any mandates if you do not have a sustainability lens. In the United States it’s still quite mixed depending on the institution but it’s growing.”

Approximately $61bn of sustainable flows came from Europe in 2021, $31bn from the US and $8bn from Asia-Pacific. Fink continued that US growth is coming from BlackRock’s ability to create customized portfolios using Aladdin, its technology platform.

“This is the power of Aladdin for those clients who are looking to start looking at sustainability as an investment opportunity and a risk,” he said. “I believe this will continue to drive flows in the coming years.”

ETFs

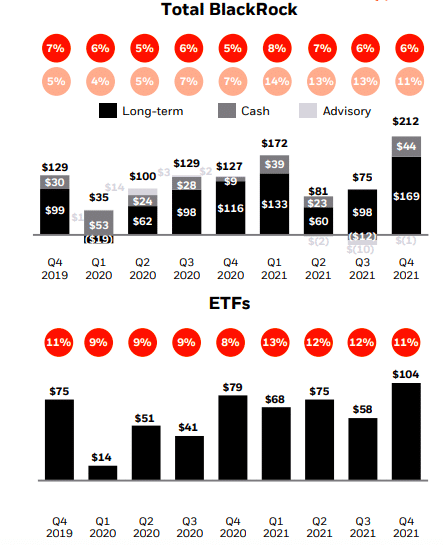

BlackRock had $540bn of full-year total net inflows in 2021, reflecting 6% organic asset growth and 11% organic base fee growth, led by record flows in exchange-traded funds and active strategies.

iShares, BlackRock’s ETF business, generated a record $306bn in net inflows in 2021 with sustainable and fixed income funds as the largest contributors in the fourth quarter. Sustainable ETFS nearly doubled to $150bn in assets under management in 2021 and core ETFs had more than $100bn in net inflows for the first time.

Fink said: “Our fixed income ETF platform grew by double digits to $750bn, even in one of the most challenging macro environments for fixed income in several years.”

He continued that BlackRock benefited from the diversity of its product range across inflation-linked bonds, municipal bonds, sustainability and emerging market exposures, and the diversity of its client base as many are using ETFs for active portfolio construction.

In addition he is optimistic for future growth as at the end of last year the New York Department of Financial Services permitted insurance firms to treat diversified liquid fixed income ETFs as bonds for the purpose of risk-based capital.

“This puts bond ETFs on a level playing field with bonds in an insurance portfolio,” added Fink. “We are really excited by the initial client feedback and interest in ETFs because of this rule.”

Active strategies

Active strategies, including alternatives, contributed over 60% of 2021 organic base fee growth, as net inflows were $267bn. BlackRock generated a record $49bn of active equity net inflows for the full year, which it said was led by top-performing franchises in technology, health sciences and US growth equities, as well as quantitative strategies.

Gary Shedlin, chief financial officer of BlackRock, said on the results call: “We remain well positioned for future growth in our active platform with over 75% of our fundamental active equity, systematic active equity and taxable fixed income assets performing above their respective benchmarks for pure median for the trailing five-year period.”

Fink continued that the active platform, including alternatives, contributed $267bn in inflows – the second consecutive year of record inflows and nearly half of total net inflows. Active assets under management reached $2.6 trillion.

“Our results in active investment strategies is really one of the core transformations of BlackRock over many years,” Fink added.

Clients are increasing allocations to alternative strategies as they search for diversification and higher yields and BlackRock has built a platform across infrastructure, private credit, real estate and private equity.

“To meet that demand we raised a record $42bn in client capital in 2021 to accelerate our growth as a leader in private markets,” said Fink.

For example, infrastructure has significant secular tailwinds driving growth and will be an important engine of fiscal stimulus for economies looking to build for their future and BlackRock is one of the largest infrastructure managers. Fink said the infrastructure platform has grown fourfold in the last five years and the firm will launch new vintages in its flagship fund and innovative strategies in this asset class.

Results

In the fourth quarter total net inflow was $212bn across all client types, investment styles and regions – BlackRock’s seventh consecutive quarter of organic base growth above its 5% target.

Full-year revenue increased 20% to $19.4bn which included record organic growth, record performance fees and continued growth in technology services revenue.

Shedlin said: “We grew organically at our fastest rate ever even as our assets under management reached new highs. We’ve continually invested to develop industry leading franchises in ETFs, private markets, technology, our active investment platform and more recently in ESG and China.”

He continued that BlackRock will continue to heavily invest to scale and extend capabilities in high-demand areas such as whole portfolio, private markets, wealth and sustainability.

“We are once again targeting record investment in our people, strategic priorities and platform infrastructure during 2022,” Shedlin added. “At present, we would expect headcount to increase by as much as 10% with a continued focus on optimizing our talent pyramid for more junior roles.”

The asset manager is also investing in migrating Aladdin to the cloud and expanding the technology platform’s ESG capabilities.

In June 2021 BlackRock announced a partnership with Rhodium Group to work with the independent research firm to define datasets for use in the asset manager’s physical risk models. In the same month BlackRock announced the acquisition of Baringa’s climate change scenario model for Aladdin Climate technology.

Fink said: “Our long-term strategy remains to accelerate growth in iShares, build out illiquid alternatives, continue to differentiate our technology to deliver a whole portfolio solution and become the global leader in sustainable investing.”