The iShares Bitcoin Trust, BlackRock’s spot bitcoin exchange-traded fund, has become the fastest ETF to reach $10bn in assets under management, taking just 37 trading days.

The Kobeissi Letter, which provides commentary on global capital markets, said that just 4% of all exchange-traded funds have reached the $10bn mark.

BREAKING: BlackRock's Bitcoin ETF, $IBIT, hits a record $10 billion in assets under management.

This is the fastest an ETF has hit $10 billion in assets under management, at 37 trading days.

Just ~4% of all ETFs have reached the $10 billion mark.

More history made by #Bitcoin. pic.twitter.com/aCgZ7jOB2V

— The Kobeissi Letter (@KobeissiLetter) March 1, 2024

$IBIT the newest member of the $10 Billion Club, fastest ever to get there.. Only 152 ETFs in this club (out of 3,400) incl $GBTC. First $10b so touch bc so much has to come from flows (in $IBITs case 78% of aum is flows). Second $10b easier bc mkt appreciation bigger variable pic.twitter.com/FwysL4GSGk

— Eric Balchunas (@EricBalchunas) March 1, 2024

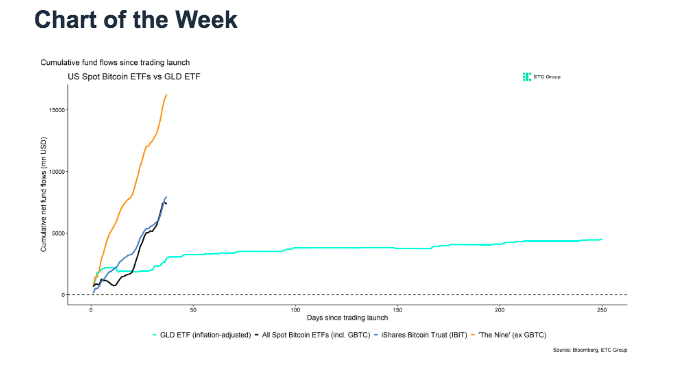

ETC Group, the European fund manager of digital asset-backed securities, said in a research report that inflows into US spot bitcoin ETFs have vastly surpassed historical inflows into the gold ETF, which started trading in 2004.

The research report also highlighted that there were record daily inflows into US spot Bitcoin ETFs last week.

“Significant bitcoin net exchange outflows from both Coinbase and Binance implied increased institutional buying interest as well,” added ETC Group. “There were also rumours of a potential sovereign buyer of Bitcoin.”

ETC warned that many sentiment and positioning indicators are implying that bitcoin sentiment is euphoric, and positioning appears to be stretched, so a short-term pull-back off the recent highs appears to be quite likely. However, the asset manager continued that net inflows into US spot bitcoin ETFs are bound to stay strong as Bank of America and Wells Fargo are amongst the firms that have recently said they will offer bitcoin ETFs to their clients.

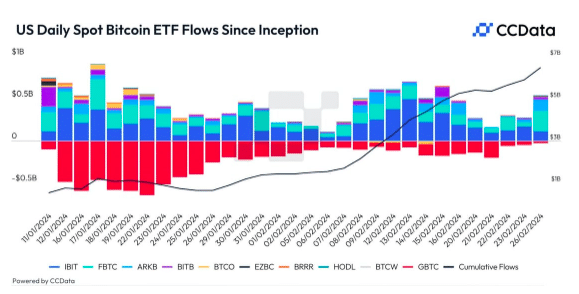

Crypto data provider CCData said in a report that the growth of US spot bitcoin ETFs continued last month with inflows reaching $6.03bn by 26 February as the price of bitcoin hit a peak of $59,502 up to 28 February.

“BlackRock’s iShares and Fidelity’s FBTC, which are among the top 10 ETFs, secured inflows of $6.02bn and $4.23bn, respectively, demonstrating strong investor confidence and market momentum,”added CCData.

BlackRock’s iShares also led trading volumes of U.S. spot bitcoin ETFs in February of $7.89bn, a 569% rise month-over-month.

“Notably, VanEck’s HODL ETF saw the highest growth rate in February, with its trading volumes skyrocketing by 2000% to reach $584m,” said CC Data,

Greg Cipolaro, global head of research at bitcoin financial services and infrastructure firm NYDIG, highlighted in a report that the timing difference between trade execution and settlement requires a substantial amount of capital for both the securities and crypto market makers and liquidity providers.

As ETF trades settle the day after a trade, T+1, the funding costs for trading activities typically amount to one calendar day from Monday to Thursday, but there is an additional cost of two days of funding over the weekend which significantly impacts the ability to finance trading activity.

“On a percentage basis, this translates into a 39% decrease in outflows and a 28% decrease in inflows associated with the weekend funding costs,” added Cipolaro. “Given the intense rivalry in the spot bitcoin ETF market, it should be imperative for fund sponsors to address this crucial aspect.”