BIDS Trading, the independent subsidiary of Cboe Global Markets, is excited about developing a trajectory cross as it looks to continue to develop new order types and expand geographically.

Stephen Berte, president of BIDS Trading, told Markets Media that the block marketplace is dynamic and constantly changing due to the rise of systematic and automated ways of executing the benchmark. As a result, most efficient execution may not involve a point-in-time cross and there are an increased amount of streaming liquidity opportunities.

“One of the things that we are excited about is the development of trajectory cross that would be a utility for match algos using certain criteria,” he added.

Despite the rise in systematic strategies, Berte continued that clients around the world tell BIDS that their first port of call is a point-in-time cross, which they still find extremely valuable.

Berte became president of BIDS Trading in April 2022 from Tourmaline Partners where he founded and led the Boston office of the buy-side technology provider. He previously held roles at Standard Life Investments, including global head of equity trading and head of investments execution for all asset classes in the Americas across equity, fixed income, derivatives, FX and money markets.

Overseas expansion

He took on his role at BIDS just after Cboe BIDS Canada was launched in March 2022.

“Canada has been an incredibly successful launch,” Berte added. “We have the number one block market share and I think we are just scratching the surface.”

The Canadian exchange group, TMX Group, has announced the launch of a new Canadian trading platform consisting of lit order book Alpha-X and dark book Alpha DRK with the aim of enhancing execution quality.

Berte said BIDS embraces competition and has worked diligently to differentiate itself from competitors.

“Competition makes us better, makes the marketplace better and helps promote the value of the block,” he added. “I am happy for TMX and excited for the Canadian marketplace.”

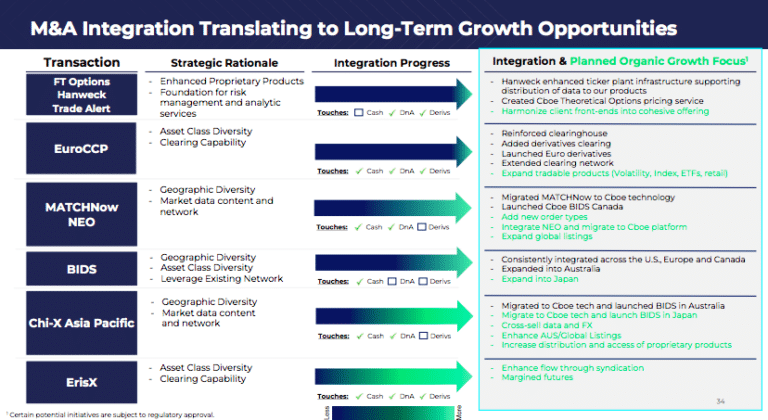

Cboe BIDS Australia launched in March this year with sell-side access, which extended to the buy side in September. In its third quarter results this year, Cboe said Australian market share grew to 17.9%, up from 16.7% in the third quarter of 2022.

In Japan Cboe completed the migration of Cboe Japan to its proprietary technology platform on 13 November 2023 and also launched Cboe BIDS Japan for large-in-scale equities trading. As in Australia, the first phase allows brokers to access the BIDS pool through their trading algorithm and the second phase, expected to roll out in the first half of next year, will enable broker-sponsored buy-side access through the BIDS Trader front-end.

Cboe said the migration equips Cboe Japan with the performance and capacity to accommodate more than double the peak volume directed at Cboe Japan’s Alpha and Select markets, and more than double the market data volume generated by other markets in Japan.

“I am incredibly excited about the opportunity in Japan,” said Berte. “The marketplace is very VWAP focused, but we think there is a lot of momentum and excitement for a point-in-time cross.”

BIDS has started marketing to the asset managers in Japan and Berte said a number of firms are in the pipeline for the buy-side launch. Approximately 500 global buy-side organisations have BIDS on their desktop and Berte anticipates that these firms will include trendsetters who will introduce the concept of a point-in-time cross to their Japanese peers.

“All of these geographic expansions have been in concert with Cboe, our parent company, and it’s been a hugely collaborative effort between the organisations,“ said Berte. “We have a remit to join them in that journey and we also have a remit to grow our business in markets which Cboe may not look to disrupt, so we are looking at opportunities around the world.”

He gave the example of Brazil, which has introduced the concept of competition and is allowing blocks to trade without an auction and off-exchange.

Cboe maintains BIDS as an independently managed and operated trading venue and broker/dealer, separate from and not integrated with the Cboe U.S. securities exchanges.