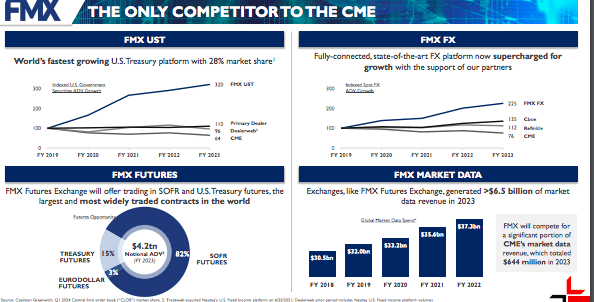

BGC Group, the brokerage and financial technology firm, will offer low or cost trading on its FMX Futures Exchange for U.S. Treasury and SOFR contracts which it aims to launch in September this year to compete with CME Group.

Howard Lutnick, chairman and chief executive of BGC, said on the first quarter results call on 30 April that the firm is not expecting to charge material amounts of money in the first twelve months after FMX launches.

“In the first year our expectation is to charge a very low to no-price, so people can connect, train, grow volume and understand the benefits of our technology and speed,” he added.

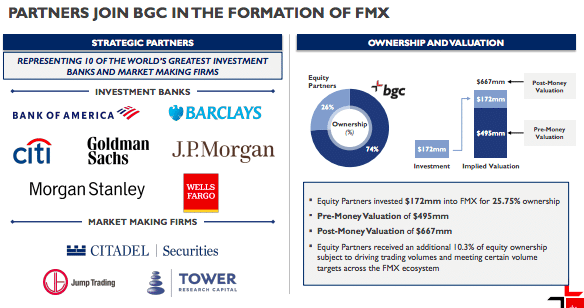

On 24 April 2024 BGC Group said 10 financial institutions have become minority equity owners of FMX, with a post-money equity valuation of $667m. FMX combines BGC’s US. cash treasuries platform with its spot foreign exchange platform and U.S. interest rate futures exchange.

BGC said FMX UST, the cash U.S. Treasury platform (formerly known as Fenics UST), has grown its central limit order book market share each sequential quarter. FMX UST ended the first quarter of 2024 with a market share of 28%, up from 26% in the fourth quarter of last year.

Lutnick said: “The US interest rate markets are the largest in the world and we have built the fastest growing US Treasury platform. With the support of our partners, FMX is the only competitor to CME.”

He continued that the10 FMX partners have growing volume targets across businesses including Treasuries, foreign exchange and futures which are individually crafted to be more attuned to the type of trading of each particular firm. For example, some firms will be more focused on SOFR futures, others on Treasury futures and others on cash Treasuries.

“What is spectacular about these partners is that many of them have the greatest FCMs (futures commission merchants) in the business who can seamlessly connect their clients,” Lutnick added.

The partners have subscription arrangements which grow over time, which Lutnick said will allow them to drive business and volume through the FMX ecosystem without increased marginal cost.

“That is a model that we like to embrace, and we look forward to driving the subscription model across the FMX ecosystem for both our partners and for other companies,” he said.

As a result, the new futures venue is not expected to earn material revenues in the first year but foreign exchange and US Treasury revenues are expected to increase. Over the next two to three quarters, Lutnick expects substantial growth in the Treasury platform in terms of volume, average daily volume, market share and revenue.

Competition with CME

Lutnick believes that the new futures markets will have “wonderful” pricing because 10 of the largest trading firms are partners.

“I think that, early on, people will be surprised by the quality of our markets,” he added. “ With our partners, we have sufficient capacity to light up our markets like a Christmas tree when we open futures.”

However, he also understands that it takes time to connect the global infrastructure of trading firms to a new exchange, and it could take a year.

“We hope many will connect by the time we open in September but it is a reasonable view that some of the biggest teams will be coming on board through the end of the year,” he added.

He expects the first year of FMX Futures Exchange’s operation will be one of adding breath, adding connection and making sure that the playing field is filling with players.

“After a year, we hope to have all the players on the playing field and truly begin,” he said. “Year three will be when the ecosystem is completely connected and available, and everyone is knowledgeable about the benefits of our technology for speed and capacity.”

Lutick claimed that a differentiator for BGC is that trading cash Treasuries against Treasury futures can built into the new exchange’s software.

“CME cannot do this because they bought BrokerTec and their cash businesses is separate from their futures business,” he added.

In addition, Lutnick argued that BGC has the benefits of cross-margining futures against interest rate swaps.

“I think you’re going to see tremendous competition for market share but it’s a process that takes time,” he added.

CME Group reported that its average daily volume for Treasury futures and options reached a record in the first quarter of this year of 7.8 million contracts. There were also quarterly annual daily volume records across ultra 10-Year futures, ultra treasury bond futures, and 2-year treasury note options.

Terry Duffy, chairman and chief executive of CME Group, said on the results call: “I have sat here for 22 years as chairman and CEO of this company and I’ve seen nothing but competition my entire career so this is no different.”

However, Duffy argued that the capital efficiencies that CME can offer are a powerful differentiator.

“We believe that capital efficiencies are the name of the game and it is hard to walk away from $7bn to $8bn a day in efficiencies,” said Duffy. “It’s also hard to walk away from an additional 80% that they are receiving from our new offering with DTCC.”

In January this year CME launched an enhanced cross-margining arrangement with DTCC, the US post-trade market infrastructure. The partnership enables capital efficiencies for clearing members that trade and clear both U.S. Treasury securities and CME interest rate futures.

Suzanne Sprague, global head of clearing and post-trade services at CME, said on the results call that some clearing members are seeing upwards of 75% to 80% in margin savings. In addition, CME’S portfolio margining programme between our interest rates, futures, options and swaps, delivered average daily savings of about $7bn in the first quarter.

CME is also due to launch new credit futures on 17 June 2024, pending regulatory review, which will have automatic margin offsets against interest rate and equity index futures, adding more capital efficiencies. Tim McCourt, global head of financial & OTC products at CME, estimated on the results call that there will be a 70% margin offset between US Treasury futures and the investment grade credit future, and a 50% offset against E-mini equity contracts for high yield.

Financials

BGC’s first quarter revenues grew by 8.6% to a record $578.6m. Sean Windeatt, chief operating officer of BGC Group, said on the call that this reflected broad-based growth across all geographies and across energy, commodities, shipping, rates and foreign exchange.

From the start of this quarter, BCG renamed energy and commodities to energy, commodities and shipping to better reflect the integrated operations of these businesses.

Energy, commodities and shipping revenues grew by 32.1% to $118.5m.

“This asset class has become our second largest, providing additional diversification to our client base and macro drivers,” added Windeatt.

Total brokerage revenues grew by 7.3% year-on-year to $528m in the first quarter of 2024. Rates revenues increased by 6.3% to $175.1m over the same period, which Windeatt said reflected strong growth across interest rate derivatives, government bonds and emerging market rates products.

Windeatt continued that BGC expects to generate total revenue of between $520m and $570m in the second quarter of this year, up from $493.1m in the same quarter of 2023.

Lutnick agreed that revenues will grow because the subscription price for the FMX partner exceeds the amount of revenue that BGC currently receives.

He also said BGC has been investing in its US Treasury platform and in FMX Futures and Lutnick said the lion’s share of those investments are now over. “He added: “We are in harvesting mode.”

For example, the 10 partners can connect to BGC’s foreign exchange business, which will increase market share and allow others to transact at very attractive prices.

Lutnick added: “The growth in Treasuries and foreign exchange will more than satisfy the expense of our futures exchange.”