Algo provider BestEx Research has introduced IS Zero, which founder and chief executive Hitesh Mittal described as a new category of execution algorithm.

Mittal told Markets Media: “One algorithm cannot solve all problems but there is a tendency in the market to take the existing product and push it to clients.”

When portfolio managers are executing trades, they want to minimise their trading cost and information leakage, while accessing liquidity.

“Alpha generation, which takes years to materialise, can apply to one or two strategies,” added Mittal. “Reducing trading costs is the lowest common denominator and one of the biggest opportunities for asset managers to systematically increase returns.”

Asset managers can try to minimise the average implementation shortfall (IS), the difference between price when the decision is made to trade and the final execution price, by trading slowly. Or they can trade quickly, but average slippage may be higher on a day to day basis.

“There are plenty of IS algos available for portfolio managers who want to minimise the variance of slippage when they trade with higher urgency,” added Mittal. “But there are managers who just want to minimize the average slippage rather than the variance of slippage, and unfortunately no IS algos are designed for that.”

As a result, volume weighted average price (VWAP) has become the default choice for asset managers to minimise average slippage when they have no urgency in their execution. A survey by BestEx Research found that nearly three quarters, 72%, use VWAP algos to minimize implementation shortfall for low-urgency trades.

“So it’s not a small group that can benefit from improvement in this area,” added Mittal.

VWAP algos are designed to track the VWAP benchmark, and that creates several deficiencies when the trader’s goal is to minimize average IS. For example, trades occur on a predefined volume schedule when using a VWAP algo. In two periods when volume is the same but volatility is higher in one, a VWAP algo would trade the same amount even though volatility multiplies slippage.

“IS Zero does not replace the traditional liquidity-seeking algorithm, but replaces the VWAP algorithm where the urgency is zero,” said Mittal. “Instead of using a volume profile, it uses a market impact minimization schedule which considers factors such as volume, volatility and the bid offer spread.”

BestEx Research ran a controlled experiment on about $20bn of trades where the firm split orders from clients on a random basis which Mittal said was devoid of any bias. Half the trades were executed using a VWAP algorithm and the other half using IS Zero. Mittal argued that the order sizes, spreads, and participation rates were very similar, and orders were traded under the same market conditions so this was truly an ‘apples to apples’ comparison.

“The slippage reduced by 37% with IS Zero, so that is the money left on the table by those using VWAP for low-urgency orders,” he said.

There is a trade-off between bid offer spreads and adverse selection costs, and BestEx Research ran lots of simulations to determine the optimal flexibility around the schedule and the liquidity of the stock. The firm found that less flexibility is needed for liquid stocks, but more for illiquid stocks.

Mittal continued that the IS Zero schedule has more flexibility than a VWAP algorithm, and allows passive trading to provide liquidity in the market, or to opportunistically take liquidity or expose an order in various dark pools. He said that for VWAP the sweet spot is when the order sizes are less than 5% of daily volume, and the same applies to IS Zero.

“IS Zero incorporates a new way to trade to improve flexibility, regardless of the liquidity of the stock,” he said.

Clients can set up an A/B experiment to run controlled testing if they want to transition slowly into IS Zero after reviewing their own performance data. BestEx Research is beta testing with two very large quantitative asset managers according to Mittal, and the firm is now presenting its findings.

“This is now a sandbox where we can continue to make more optimizations for low-urgency execution,” he added.

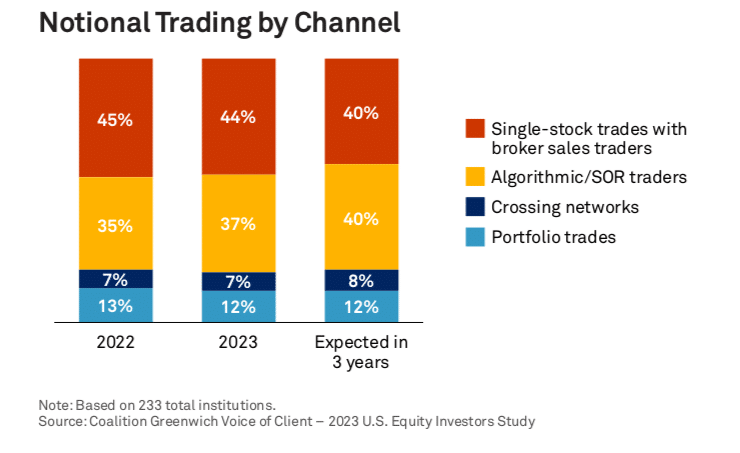

Consultancy Coalition Greenwich said in a report, U.S. Equity Markets 2024: Trends and Opportunities, the buy side used electronic trading for 44% of their U.S. equities order flow by notional value traded in 2023, a rise from the previous year’s 42%. In addition, 37% was executed through algorithms and/or smart order routers, up from 35% in 2022.

Jesse Forster, who advises on market structure and technology globally at Coalition Greenwich, said in the report: “Managers anticipate a continued upward trend, projecting algorithmic trading to reach 40% and crossing networks to increase to 8% within the next three years.”

The survey found that ease of system use, reliability, and high-quality technical support remain paramount criteria for the buy side when selecting electronic trading platforms.

“The industry’s clear emphasis on these factors may point to a maturation in electronic trading, further signaling a departure of the “speed arms race” among brokers,” added Forster.