Baton Systems, the fintech which provides post-trade solutions, has integrated with LCH, the London Stock Exchange Group’s clearing house, to expand its network for automating the end-to-end collateral workflow for derivatives.

Alex Knight, head of global sales & EMEA of Baton Systems, told Markets Media: “We are live with LCH, CME, Eurex and SGX so we are positioned to handle a material share of the overall collateral that is placed on deposit at CCPs. We are looking to extend that network according to our clients’ priorities.”

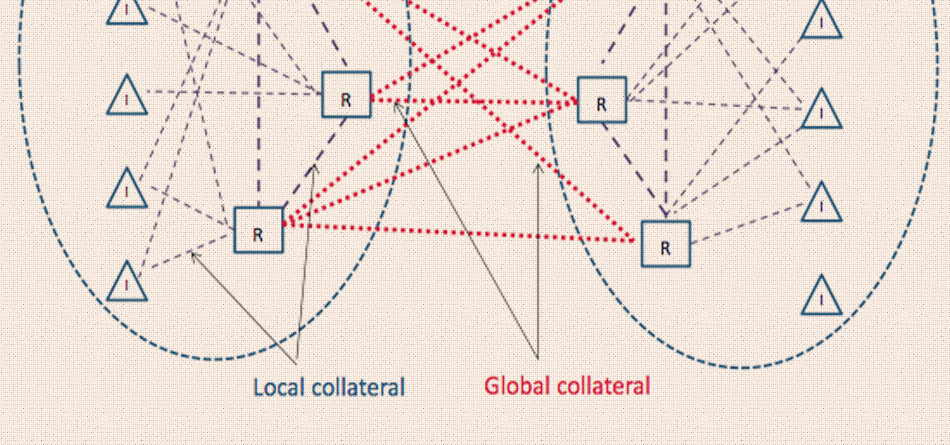

He continued that clearing members run complex businesses, where multiple legal entities are often facing multiple CCPs and acting on behalf of clients, in addition to their own in-house business. Baton allows firms to view all this information in a single dashboard.

“We allow firms to see normalised aggregated information on an intra-day basis to allow them to make better decisions,” added Knight.

Christopher Giancarlo, Willkie Farr & Gallagher

Baton was founded in 2016 by technology, payments and capital markets veterans. In April this year J. Christopher Giancarlo, former chairman of the United States Commodity Futures Trading Commission, joined Baton as senior advisor. Giancarlo is currently senior counsel to law firm Willkie Farr & Gallagher and a co-founder of the Digital Dollar Project to advance consideration of a U.S. central bank digital currency

Giancarlo said in a statement: “Baton is enabling a solution that is working today to improve the speed and precision of collateral management.”

LCH

In May this year Baton said J.P. Morgan will be the first client to manage their collateral at LCH using its platform. In 2019 Baton and the bank developed a solution that enables the near real-time orchestration of cash and collateral transfers to multiple clearing houses.

Baton Systems has integrated with @LCH_Clearing to automate the end-to-end collateral workflow for derivatives participants. @jpmorgan will be the first of Baton’s clients to manage their collateral at LCH using the Baton platform. https://t.co/AOg2P8lZ7x#fintech #derivatives

— Baton Systems (@batonsystems) May 6, 2021

Knight said the LCH integration was a really important step in the further development of Baton’s network for automating collateral workflow for cleared derivatives.

“Establishing a two-way connection with LCH was very high on the list of requirements from our clearing member clients,” he added.

Baton consumes end of day and intra-day data from clearing houses regarding positions, margin requirements and eligibility information. Clearing members’ instructions for the movement of collateral are then integrated back into the CCP by Baton.

Anthony Fraser, head of global clearing operations and cost & commission services at J.P. Morgan, said in a statement: “This will bring further efficiency in our collateral management process and will provide greater real-time visibility of our margin and collateral holdings.”

Alex Knight, Baton Systems

Knight explained that Baton also allows clearing member firms to see their obligations and the holdings they have at their custodians. In addition, by having up-to-date information on eligibility and concentration limits etc. and data from the CCP on haircuts being applied to assets, the decision making process becomes much more robust.

Baton also performs pre-checks with the CCP to determine if the instructions, individually or collectively, will result in a breach and a likely rejection.

“By automatically tracking the progress of instructions and collateral movement we provide a huge amount of visibility, flexibility and control to the clearing firm,” Knight added.

Clearing firms can also set up automatic alerts or automated collateral movements when certain thresholds are breached so there is straight-through processing for collateral posting with little manual intervention required.

Margins

Knight continued that clearing firms often hold excess collateral at CCPs and by having access to better data and being able to respond more quickly, this can be reduced and lead to a material benefit in lowering the cost of funding.

“Clearing firms can receive a meaningful uplift in net interest income which has become more important because collateral or margin requirements at the CCPs are now so high,” he said.

Clarus Financial Technology, the derivatives analytics provider, said in a blog that initial margin for interest rate swaps remains close to record highs.

What’s new in CCP Quant Disclosures – 4Q20? https://t.co/AMKb3iTbtG

— Clarus (@clarusft) April 14, 2021

CCPs publish more than 200 quantitative data fields including margin, default resources, credit risk, collateral, liquidity risk, back-testing under the CPMI-IOSCO public quantitative disclosures.

Amir Khwaja, chief executive of Clarus wrote that initial margin for swaps has remained at the record highs from 31 Mar 2020, the Covid-19 crash quarter.

“A little surprising that initial margin has not come down given the lower market volatility, but then again the risk position of members at CCPs on 31 December 2020 will not have been the same as on 31March 2020,” added Khwaja.

Knight continued that Baton experienced an uplift in interest after the very high volatility last year due to the Covid-19 pandemic as the operational processes of many firms struggled to keep up because of the manual intervention required. In addition visibility of data was a problem as most firms relied purely on end-of-day reports.

“The need to have up-to-date data was really important when firms were scrambling for liquidity,” added Knight. “One clearing member said after the event that they spent many hours cobbling together reports so the benefit of aggregation and seeing data in a consistent, reliable format is huge.”

In addition, one of the impediments to scaling a clearing business can be the highly manual processes between the clearing firms and their underlying clients. “That is a space where we can do some great work and we are talking to a couple of our customers,” said Knight.

He continued that Baton’s distributed ledger technology means firms can fund their liquidity as efficiently as possible as they can choose to run multiple settlement cycles during the day.

“The industry pays hundreds of millions of dollars a year to fund liquidity, so trying to help to solve this issue is really key,” Knight added.

FX

Before joining Baton Systems, Knight spent 18 years at Citi, where he was most recently global head of sales and client coverage for Citi’s FX Prime Brokerage and had also set up and run the bank’s Asia Pacific FX Prime Brokerage business from Singapore.

In January this year 2021 Baton entered into a partnership to combine its payments infrastructure with Cobalt, the foreign exchange and digital asset infrastructure provider, to provide a seamless end-to-end FX settlement solution.

Company announcement: Cobalt and Baton Systems partner to streamline post-t… https://t.co/VxFzR12TiE #fintech

— Finextra (@Finextra) January 19, 2021

Arjun Jayaram, chief executive of Baton Systems, said in a statement that the the increased market volatility in 2020 exposed the underlying issues with liquidity, operational infrastructure and settlement that have hindered the industry for decades.

“By integrating our real-time payment versus payment FX settlement process with Cobalt we can deliver improved visibility and control over the settlement process to a new segment of the market, eliminating many of the systemic risks currently plaguing the industry,” added Jayaram.