BNP Paribas and Citi have become the first institutional investors in digital transformation platform United Fintech, as a study found that a divide is growing between leaders and non-leaders in transforming their technology.

United Fintech acquires and scales fintechs in the capital market space to create a one-stop-shop for banks, hedge funds, and asset managers to help them accelerate their digital transition. Christian Frahm, founder and chief executive of United Fintech, describes the firm as a technology company operating a platform for digital transformation.

Frahm told Markets Media: “We think we can find the best companies in different areas in banking, capital markets and asset management. We put our own money behind them and put them on a central platform so institutions can quickly access their products.”

The fintechs can then operate on United Fintech’s infrastructure which centralises functions such as invoicing and financing so they can focus on product development.

After previously working at Bloomberg and Saxo Bank, Frahm set up CFH Group (renamed Finalto) in 2008 to sell trading systems and liquidity to institutional clients, and took the company to a $120m exit. In 2020 Frahm founded United Fintech.

“I have worked with large investment banks and buy-side companies and they all had similar problems,” he said. “They were looking at the next 15 to 20 years and how to change infrastructure, get out of legacy technology and save costs.”

Frahm explained that most fintech founders who provide institutional technology for wholesale banking or asset management have worked in the industry and so have really good products, but find it difficult to scale because institutions have a long onboarding process. Therefore, he believed there was a way to bring them onto a platform and provide easier access for large institutions.

In March this year BNP Paribas and Citi became the first institutional investors in United Fintech and their investment will be used to expand the firm’s core platform and onboard new fintechs.

“We have invested in five fintechs that Citi and BNP Paribas can access very efficiently using the same platform and they can use different products on the same contract,” said Frahm. “We invest in companies that have applications for many different banks and buy-side firms and bring speed and cost saving.”

United Fintech also has about 60 buy-side customers according to Frahm.

Financial institutions invest in fintechs themselves but Frahm argued they only should invest in companies that offer them a differentiator. He said: “However, 80% of their problems are solved by products that do not give them any competitive edge.”

Banks have also formed consortiums to launch new technology but Frahm said these can take years and have a lot of risk as all the participants have to agree on the development. In contrast, United Fintech is a commercially driven private enterprise.

“We have an infrastructure, people and distribution so putting us in the middle accelerates the process,” said Frahm. “We can facilitate a solution that could be live in a few months.”

In the next year United Fintech intends to become more closely aligned with the strategic roadmaps of customers and open up to more industry collaboration.

“There is a lot of backing for our model because it is an industry play, as we do not want to solve challenges specifically for one institution,” added Frahm. “Our governance structure has been created with rotating board seats as it is very important to be seen as a neutral industry platform.”

BNP Paribas and Citi will initially have two rotating board seats as part of their deals. United Fintech has committed to host quarterly industry roundtables on shared challenges and innovation to facilitate industry dialogue and foster a collaborative ecosystem.

Junaid Baig, head of strategic investments & co-Head of strategy at BNP Paribas Global Markets, said in a statement: “Managing to combine the best of both worlds, we see this as the beginning of a new era where industry participants can grow together.”

Digital transformation gap

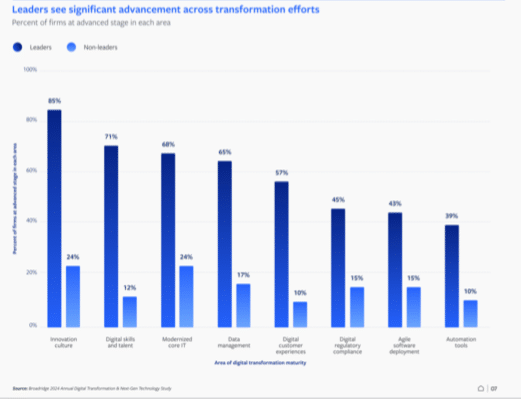

Making the right technology investments has become increasingly important as a divide is growing between leaders and non-leaders in digital transformation according to a new study from Broadridge Financial Solutions.

The 2024 Digital Transformation and Next-Gen Tech Study surveyed 500 global C-suite and senior executives across the buy side and sell side and categorized firms as digital “leaders” versus “non-leaders” based on their advancement levels across ten essential aspects of digital transformation, including modernized core IT, the use of automation tools, innovation culture, data management, and digital customer experiences, among others.

“When it comes to infrastructure, more than 80% of all executives indicate that they are making the biggest day-to-day investments in building an advanced IT cloud platform,” added Broadridge. “Meanwhile the majority also expect to maintain or increase their investment in next-gen technologies like artificial intelligence, quantum computing, crypto/digital assets, and blockchain over the next two years.”

GenAI

More than half, 52%, of the respondents and 70% of leaders said they are prioritizing their AI investments in customer interaction to fuel stronger and more meaningful customer engagement. In generative AI, 44% of leaders are more likely to be making large or moderate investments in the technology, more than twice the level of non-leaders.

Broadridge said: “Despite the higher levels of investment by leaders, the lower cost of entry to deploy GenAI may allow non-leaders to get in on the action more easily, enabling them to catch up in their efforts to deploy the technology to both customer-focused and internal use cases.”

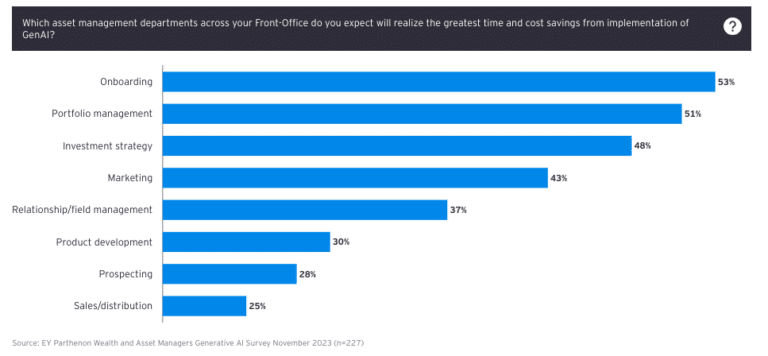

New EY-Parthenon research found that the GenAI era has arrived in wealth and asset management and the majority of firms are actively investing, making plans and building teams.

Three quarters of firms in EY-Parthenon’s study of more than 225 senior decision-makers are mobilizing GenAI teams. These findings agreed with Broadridge as 69% of respondents said they were using GenAI for client experience enhancements.

“The research makes it clear that leaders see GenAI as a means to address areas of the business that have long needed improvement,” added EY-Parthenon. “For instance, the automation of manual processes and administrative tasks that will free resources to focus on higher value activities.”

However, 63% of respondents are concerned about external data in GenAI use cases. Data accuracy (67%), data quality (45%) and data privacy (42%) were also their top concerns.

EY-Parthenon said in a report: “Addressing these issues is critical especially because external data can maximize the usefulness of large language models (LLMs) and client-facing applications.”

The survey also found that 66% of wealth managers and private banks and 70% of asset managers said that they are considering partnerships to execute on GenAI priorities in the front office.

“Looking beyond transactional outsourcing and software-as-a-service relationships, full ecosystems and strategic partnerships with technology or other firms can promote assistance in LLM access, application development and other critical areas,” added EY-Parthenon.