A newly-published report by global consulting firm BCG and ADDX, the digital exchange for private markets, forecasts that asset tokenization will expand into a US$16.1 trillion business opportunity by 2030. This growth comes as the crypto winter is prompting capital to focus on more viable blockchain use cases.

The projected growth in tokenization of assets is driven by demand from a wide range of investors for greater access to private markets. Tokenization and fractionalization of assets lower barriers to investment in private markets by sharply reducing minimum lot sizes.

Assets being fractionalized and tokenized on platforms such as ADDX can reduce minimum investment sizes from millions of dollars to just thousands of dollars. Previously investments of this kind were only available to institutions. Tokenized investments can also be effectively ‘borderless’, allowing investors around the world to invest in markets they were previously unable to access.

Asset tokenization refers to the creation of tokens on a blockchain to represent an asset, in order to facilitate more efficient transactions. Historically, many of the world’s assets have been held in illiquid formats, with past studies estimating the share of illiquid assets at more than 50% of overall assets. Illiquid assets face challenges such as imperfect price discovery and trading discounts compared to liquid assets, the report said. Tokenization creates liquidity by making it easier for the assets to be distributed and traded among investors.

The report by BCG and ADDX lists five indications that asset tokenization may be on the cusp of wide global adoption:

- increased trading volume in tokenized assets

- strengthening stakeholder sentiment across many countries

- recognition among monetary authorities and regulators

- more asset classes being tokenized1

- a growing pool of active developer talent in the blockchain space

Major institutions have already begun to tokenize private funds on ADDX’s platform. Partners Group2 listed its Global Value SICAV Fund on the platform in September 2021, while Hamilton Lane’s3 Global Private Assets Fund launched on the platform in March 2022.

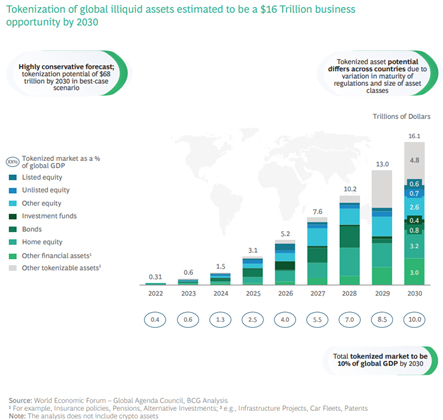

Globally, growth in tokenized assets is expected in real estate, equities, bonds and investment funds, as well as less traditional assets such as car fleets and patents4. With a 50-fold increase predicted between 2022 and 2030, from US$310 billion to US$16.1 trillion, tokenized assets are expected to make up 10% of global GDP by the end of the decade.

While the concept of asset fractionalization has been around for some time, its impact has hitherto been felt mainly in the public markets, with structures such as fractional shares, ETFs5 and public REITs6. In recent years, there has been a significant pivot with the emergence of asset tokenization players that apply blockchain technology to private markets and alternative assets.

Titled “Relevance of on-chain asset tokenization in ‘crypto winter’”7, the report published was authored by Sumit Kumar, Rajaram Suresh, Bernhard Kronfellner, and Aaditya Kaul from global management consultancy firm BCG and Darius Liu from private market exchange ADDX.

In anticipation of a more widespread acceptance of asset tokenization, the report makes several recommendations to current and potential stakeholders. For example, financial institutions might consider finding ways to pilot and deploy asset tokenization projects by upgrading existing business models, rather than looking to replace them.

Developers could design standard architectures and protocols to ensure an easier, more seamless ‘on-ramp’ to the tokenization world. Companies should also work to improve financial literacy among clients to help them understand tokenization as well as the underlying asset classes it provides access to. Regulators could establish sandboxes to promote innovation and set clear rules around tokenization, while monitoring how tokenization might impact investor and consumer protection and market integrity, the report said.

Sumit Kumar, Managing Director and Partner, BCG South East Asia, said: “The crypto winter has tightened the purse strings for the overall blockchain sector. Some Web3 companies will be adversely impacted. But projects that can demonstrate inherent value, scalability and the potential to enhance the traditional financial ecosystem could actually benefit against this new backdrop. Our analysis shows asset tokenization projects could emerge strongly. They are more likely to demonstrate viability in this capital-constrained environment and are therefore better positioned to attract the attention of investors, who continue to have a significant store of dry powder to deploy. This report projects that even using a conservative methodology, asset tokenization would be a US$16.1 trillion business opportunity by 2030. In a best-case scenario, that estimate goes up to US$68 trillion.”

Oi-Yee Choo, CEO, ADDX, said: “Asset prices can only rise to their true economic value if the barriers to investor participation and ownership transfer can be lowered. For years, the technology for overcoming those barriers was expensive and therefore available only on public exchanges. Blockchain changes the game because it can be applied cost effectively to private markets and alternative assets, where investors are fewer in number, albeit wealthier, and products are more bespoke. The result should set our hearts racing: assets can be liquid for both public and private markets. The potential economic benefits are considerable. Recognizing assets for what they are truly worth should translate into more investments and better capital allocation, which will in turn generate economic growth and jobs. The real winner here is the real economy.”

- Including assets such as real estate, equities, bonds and investment funds, as well as less traditional assets such as car fleets and patents

- Since 1996, Partners Group has invested over US$185 billion in private equity, private real estate, private debt and private infrastructure on behalf of its clients globally. The SIX Swiss Exchange-listed firm (symbol: PGHN) has US$131 billion in AUM as of 30 June 2022.

- Hamilton Lane has $832.5 billion in assets under management and supervision, composed of $108.3 billion in discretionary assets and $724.2 billion in advisory assets, as of June 30, 2022.

- The analysis excludes crypto assets.

- Exchange Traded Funds (ETFs)

- Real Estate Investment Trusts (REITs)

- The report can be downloaded here: https://www.bcg.com/publications/2022/relevance-of-on-chain-asset-tokenization

Source: BCG