BlackRock and State Street Global Advisors have announced initiatives to widen investor access to private markets, as an additional $1 trillion in retail assets could be invested in alternatives over the next five years.

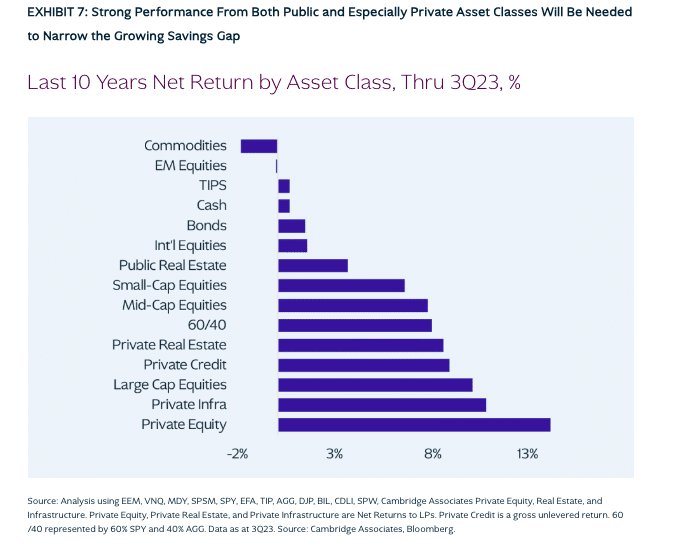

Henry McVey, chief investment officer of KKR’s balance sheet and head of global macro and asset allocation, said in a report that the private alternatives market is likely to surpass the current estimate of $24 trillion by 2028. The alternative investment firm’s report, An Alternative Perspective: Past, Present, and Future,” said private alternatives can help close the global gap in retirement savings shortfalls, estimated to be around $70 trillion, and that private capital will be needed for key areas of economic investment, especially infrastructure, and to finance the global energy transition, including renewable energy development and brown-to-green transformations.

“Individual investors are increasingly embracing the use of alternatives, with estimates suggesting that an additional $1 trillion in retail assets could be invested in alternatives over the next five years,” added McVey.

The demand for access to private markets has been shown by the announcement of initiatives from both BlackRock and State Street Global Advisors in September 2024 as they look to democratize access in different ways.

State Street and Apollo

State Street Global Advisors, the asset management arm of State Street, said it is working with Apollo Global Management, an alternative assets and retirement solutions provider to expand investor access to private market opportunities, including private investment grade credit. As of 30 June 2024, Apollo reported more than $145bn of origination in the previous twelve months.

Anna Paglia, chief business officer at State Street Global Advisors, said in a statement that demand for private assets is expected to continue to grow in the coming decade, but they have only mainly been open to large institutions and ultra-high net worth investors. As a result, State Street Global Advisors will be working with Apollo to democratize access to private asset exposures through exchange-traded funds and other investment products.

“It is our goal to bring these investments to scale and help facilitate the process of making private assets more accessible and liquid over time,” added Paglia. “We see this as only the beginning of a new wave of innovation as public and private markets increasingly converge.”

State Street’s planned private credit ETF may herald a new era according to asset management data provider Morningstar. Brian Moriarty, associate director, fixed-income strategies and Ryan Jackson, manager research analyst, passive strategies at Morningstar, said in a report that State Street and Apollo Global Management have filed with the US Securities and Exchange Commission to launch an actively managed exchange-traded fund that invests in public and private credit in one ETF portfolio, which is the “first ETF of its kind.”

“The announcement raised a flurry of questions while the SEC decides whether to approve SPDR SSGA Apollo IG Public and Private Credit ETF,” they added.

The Morningstar analysts highlighted that private credit is unavailable to most investors because it requires high investment minimums and long lockup periods.

“Other ETFs have attempted to offer private credit exposure through public investments, but this one would be the first to hold private credit directly—a strategy that comes with challenges,” they said.

These challenges include that private credit is illiquid, as these instruments are typically wholly owned by the lender, and valuation as private credit managers usually have to rely on third-party firms to value their investments as they rarely trade.

In order to overcome these challenges Apollo has entered a contractual agreement with the fund to act as a liquidity provider, according to Morningstar, and so will sell these instruments to the fund and promise to buy them back at the request of State Street. The portfolio could become illiquid if Apollo fails to provide the bids. Morningstar said the SEC filing does not disclose any reference to a financial arrangement between the fund and Apollo.

“However, there are several issues with this proposed ETF, all of which boil down to the fact that one firm (Apollo) appears to be the valuation provider, originator, buyer, and seller of the fund’s private credit investments, which may constitute the bulk of this ETF’s portfolio,” added Morningstar. “The ball is now in the SEC’s court.”

Morningstar expects the State Street-Apollo venture to be “the first of many private-market ETF proposals.”

BlackRock and Partners Group

BlackRock and Partners Group said in a statement that they have partnered to launch a multi-private markets models solution by providing access to private equity, private credit and real assets in a single portfolio which is not currently available to the U.S. wealth market. They described this “first-of-its-kind solution” as empowering advisors to offer a diversified alternatives portfolio with the simplicity, efficiency and practice management benefits of a traditional public markets model.

Mark Wiedman, head of BlackRock’s global client business, said in a statement: “In a world where private markets are growing by $1 trillion or more every year, many financial advisors still find it too difficult to help their clients participate. We aim to crack that.”

Steffen Meister, executive chairman of Partners Group, added that this separately managed account solution has the potential to revolutionize the wealth management industry.

“The financing of business has undergone a major transformation in recent decades with private markets playing a key role in the real economy, so it is vital that investors have access to private markets investments as part of a balanced portfolio,” said Meister.

BlackRock and Partners Group continued that retail wealth investors are leading the adoption of private markets and allocated $2.3 trillion to private markets in 2020 . They are expected to increase their allocations to $5.1 trillion by 2025 according to a Morgan Stanley/Oliver Wyman Study.

Managed models also present a significant growth opportunity. BlackRock expects managed model portfolios to roughly double in assets under management over the next five years, growing into a $10-trillion business.

Larry Fink, chairman and chief executive of BlackRock, has said he believes the asset manager can lead the indexing of private markets, in the same way that indexing has become the language of public markets.

In June this year BlackRock agreed to acquire Preqin, an independent provider of private markets data, for £2.55bn, or approximately $3.2bn in cash.

Fink said on a conference call about the acquisition that the deal is about driving evolution and growth in private markets by measuring them, understanding their drivers of performance and making them more investable.

“We envision we can bring the principles of indexing, and even iShares [BlackRock’s exchange-traded funds business], to the private markets,” he added. “We anticipate indexes and data will be important future drivers of the democratisation of all alternatives, and this acquisition is the unlock.”

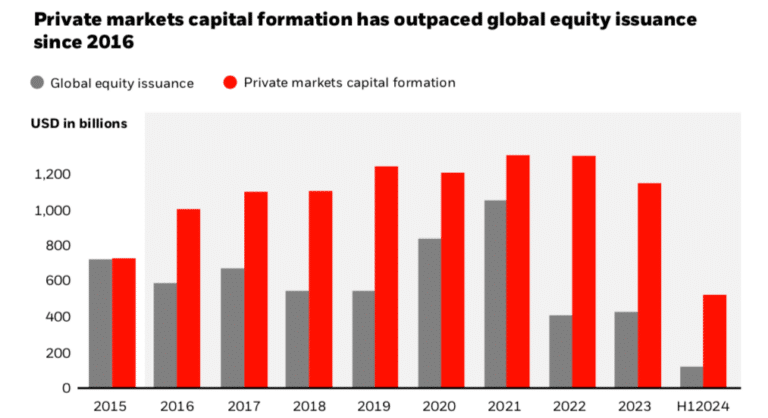

BlackRock and Partners Group said in a report that the growing role of private markets in financing the economy has increased fundraising for the asset class, which has now surpassed global public markets equity issuance each year since 2016.

The report said private markets are financing a broad cross-section of the economy, with around 87% of US companies that have over $100m in revenue being privately owned as of last year.

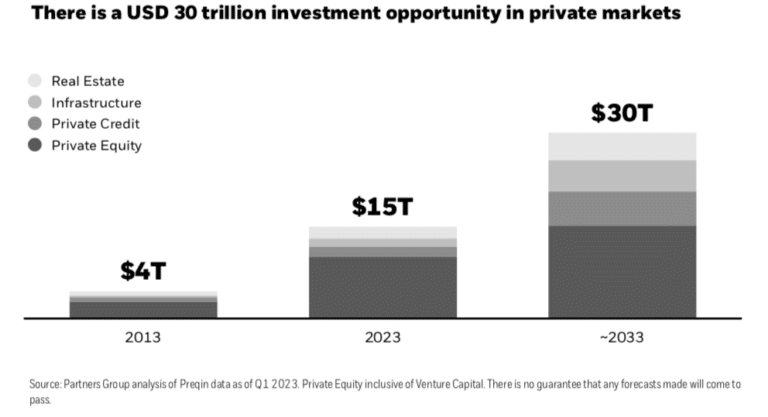

“Total assets under management across private markets asset classes is expected to reach U$30 trillion by the early 2030s, up from $15 trillion last year,” added the report.