Goldman Sachs’ asset and wealth management platform is the key driver for growth and increasing management fees will be key to meeting the firm’s targets.

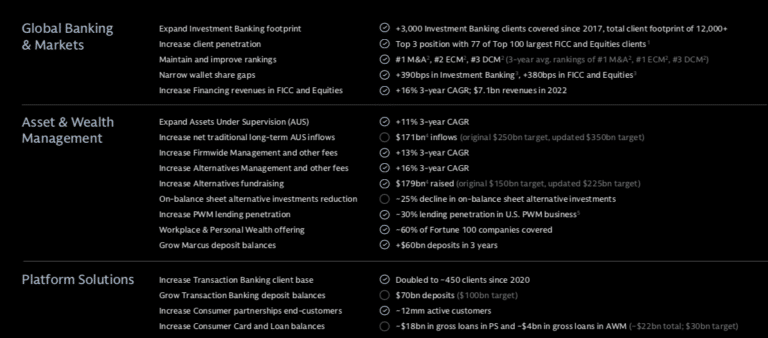

David Solomon, chairman and chief executive of Goldman Sachs, said at the bank’s investor day on 28 February that the group had identified four growth opportunities at the first investor day three years ago – asset management; wealth management; transaction banking; and consumer banking – and set targets and metrics in order to be held accountable and create more transparency for investors.

“Nobody could have imagined just a few weeks after we stood on this stage that the pandemic would break out, and the world as we know it, and the economic and business world as we know it. would be so disrupted,” Solomon added. “We worked at elevating the performance of global banking and markets, which has really improved over the course of the last few years. We also worked hard to drive inflows, particularly around alternatives and our asset management business.”

He continued that asset and wealth management is the key driver for growth and driving management fee growth is key to meeting firm-wide targets.

“We have made specific management changes to that business to help us execute,” said Solomon.

In October 2022, when reporting its third quarter results, Goldman Sachs announced a restructuring of its businesses into three operating segments – asset and wealth management; global banking and markets and platform solutions.

Marc Nachmann was named global head of the asset and wealth management division; Ashok Varadhan, Dan Dees and Jim Esposito became co-heads of global banking & markets; while Stephanie Cohen took on the role as global head of platform solutions.

John Waldron, president and chief operating officer of Goldman Sachs, agreed at the investor day that Goldman Sachs expects a substantial improvement in margins and returns from the asset and wealth management. He described the business as unique due to its global scale in active asset management, alternatives and a scaled wealth management platform. Waldron argued that asset and wealth management benefit significantly from being part of the broad Goldman Sachs ecosystem, which is a key competitive differentiator.

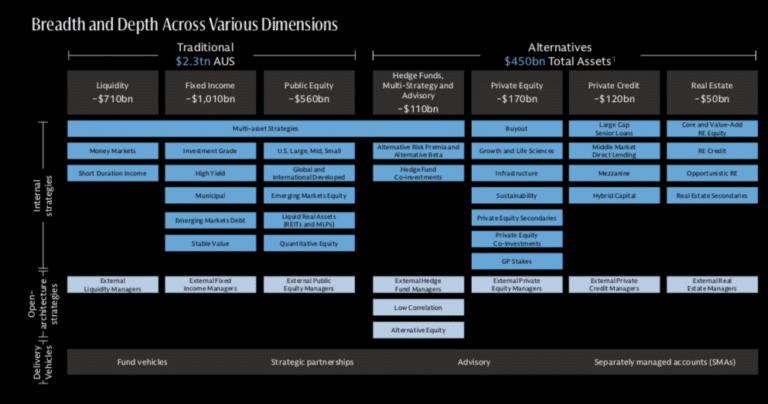

“We are a top five global active asset manager, as well as a top five global alternatives manager with a premier wealth management franchise,” said Waldron. “This is a scaled business with over $2.5 trillion in assets under supervision on a platform that is global, broad and deep, with a significant market opportunity to grow across these two businesses.”

Management fees have grown at a compound annual growth rate of approximately 13% since 2019.

“With $8.8bn in management fees, we are well on our way towards our $10bn target,” Waldron added. “ “The same goes for fees in alternatives, which stand at more than $1.8bn versus our $2bn target. These targets are clearly not the limit of our ambitions.”

Goldman Sachs is also making meaningful progress towards reducing the total size of direct investments and alternatives on its balance sheet as the group works to complete the journey towards a scaled, funds-driven business according to Waldron.

“The successful execution of our journey through reducing our balance sheet and growing our assets under supervision and management fees consistently, may in fact be the largest value unlock for the firm.over the next several years,” he added.

Nachmann said at the investor day that the division brings together the premier ultra-high net worth wealth management franchise with a leading global asset management business that has scale across public and private markets. The business has delivered strong investment performance across all asset classes and has a history of durable growth.

“Some people told me that being a captive asset manager as part of a large bank is a disadvantage but I disagree,” added Nachmann. “The ability to leverage the wider Goldman Sachs ecosystem is an incredible competitive advantage that drives our ability to deliver differentiated client experience and generate strong investment performance.”

For example, Nachmann argued that Goldman Sachs is number one in M&A, which directly benefits deal sourcing and idea origination capabilities; and the investment bank’s research feeds into the investment process.

Marc Nachmann, Goldman Sachs.

“Furthermore, our leading FICC and equities businesses keep us close to the heartbeat of the markets in a way our standalone competitors simply can’t,” he said.

Nachmann described the business as deeply diversified so it is not dependent on any one strategy or market environment, with scale in liquid products, public fixed income and equity strategies, as well as a broad spectrum of alternative assets. He added that the ability to invest across public and private markets has allowed the creation of bespoke co-mingled investment strategies that can take advantage of the changing relative value opportunities across these markets. The external investment group is an important part of the model, allowing Goldman Sachs to offer strategies to clients with external asset managers.

“This approach cuts across the entirety of our platform, enabling us to construct portfolios that cover the full spectrum of asset classes with both proprietary and third-party investment strategies,” said Nachmann. “As a third dimension, we deliver our investment strategy through a variety of vehicles and meet our clients’ needs in a manner that few, if any, can match.”

On its first investor day Goldman Sachs set a five-year $150bn fundraising target, which was achieved two years ahead of schedule, so the target has increased to $225bn. Goldman Sachs has also set a new target of $2bn in alternative management fees by 2024.

Nachmann said the growth strategy is based on organically growing revenues, which will translate to more durable earnings growth and lower capital intensity.

“We remain committed to reducing the capital intensity of our business to drive higher returns and greater earnings stability for shareholders,” he added. “Since our first investor day we’ve made meaningful progress, reducing our historical principal investments by $34bn. We expect harvesting efforts to drive further reductions to below $15bn by the end of next year, and zero over the medium term.”

Our Chairman and CEO David Solomon spoke with @SquawkBoxCNBC on our strategic priorities moving forward at the firm’s second-ever #GSInvestorDay: https://t.co/scqRTJvm81 pic.twitter.com/LghMRzWqYb

— Goldman Sachs (@GoldmanSachs) February 28, 2023

Consumer business and platform solutions

Solomon said he had been reflecting on Goldman Sachs launching a consumer banking business.

“I certainly think that we could have done a better job in bringing you the full activities around our consumer business in a more substantive way,” he added. “We laid out a realistic assessment of the investment that would be necessary and the progress that would be made over a three year period. There were some clear successes, but there were also some clear stumbles. We learned a lot.”

He continued that it became clear that Goldman Sachs did not have a competitive advantage and did too much, too quickly, which affected execution. However the firm is working on a drive to profitability with a smaller, more focused set of emerging businesses and will be nimble and flexible.

“We’ve significantly narrowed our ambitions for our consumer strategy,” said Solomon. “As we drive toward pre-tax profitability, we are also considering strategic alternatives for our consumer platforms.”