By Jonathan Rick, Director of Research of Tradeweb

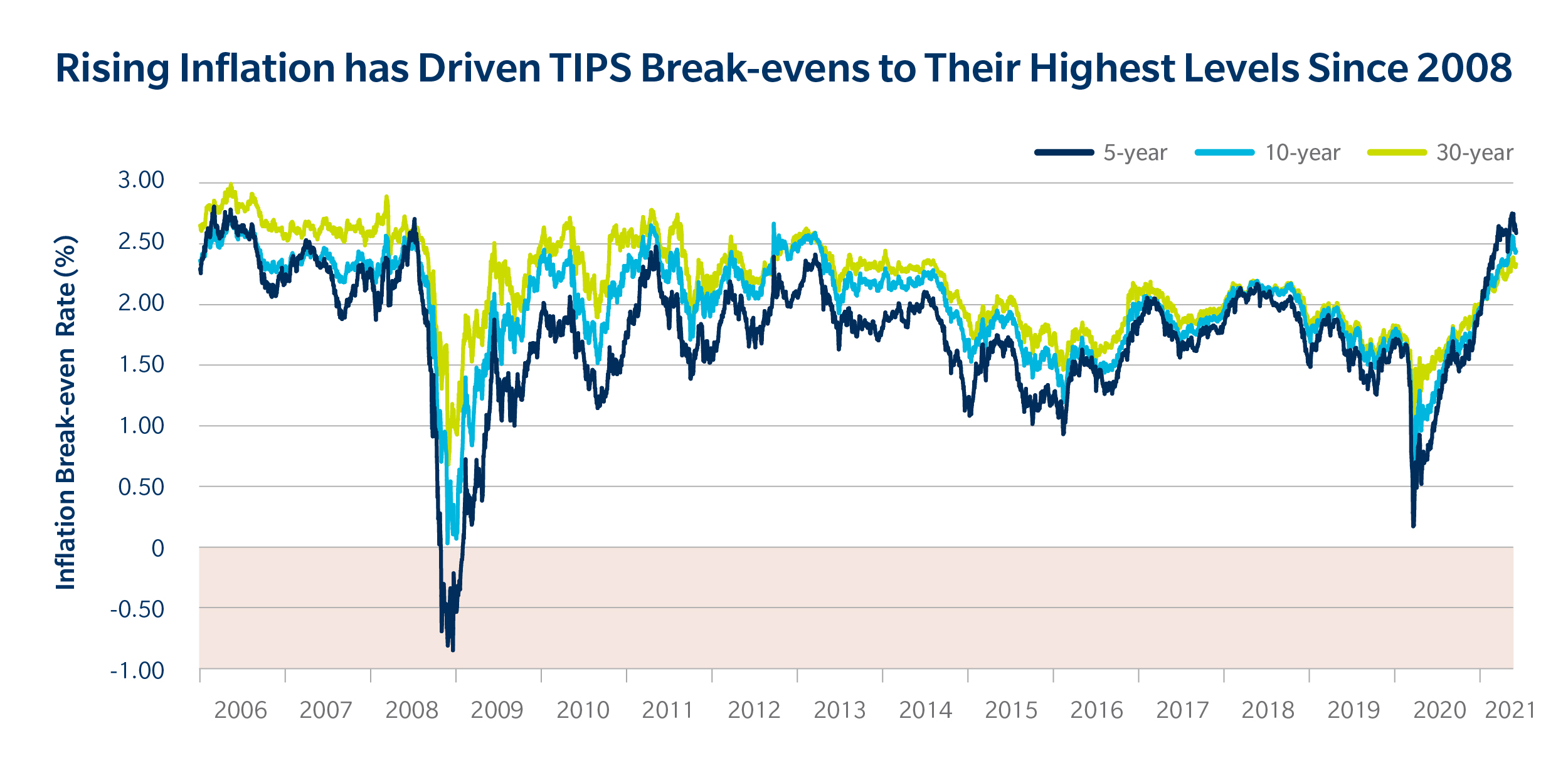

Headline inflation in the U.S. hit 4.2% annualized in April, a level we’ve not seen since 2008. The data surprised economists, stoked rate fears and raised the specter of a market revolt by so-called “bond vigilantes”– fabled as sentinels of the U.S. Treasury market in times of increased government spending and borrowing. Since the late 1990s, Treasury Inflation-Protected Securities (TIPS) have provided an alternative to plain-vanilla Treasuries for re-positioning during times of rising inflation.

Activity in TIPS has picked up noticeably in recent months at Tradeweb. With that rising interest, we’ve seen traditionally active clients become more involved in these bonds.

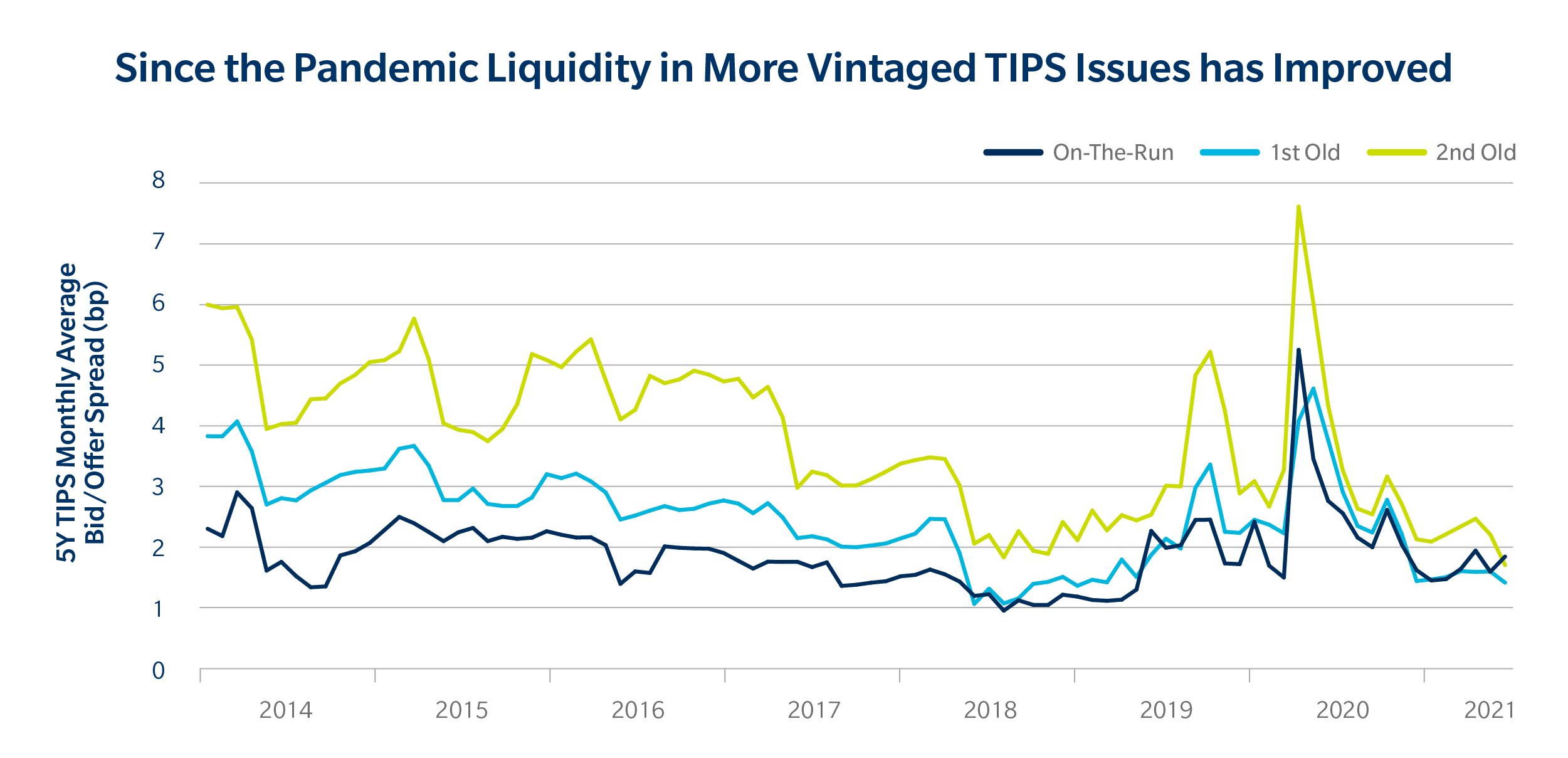

The effect on bid-offer spreads has been a net positive in an asset typically owned by a specialized niche of buy-and-hold investors. The added liquidity has created more opportunities to adjust to the realities of the highest break-even inflation data we’ve seen in more than a decade.

Source: Tradeweb

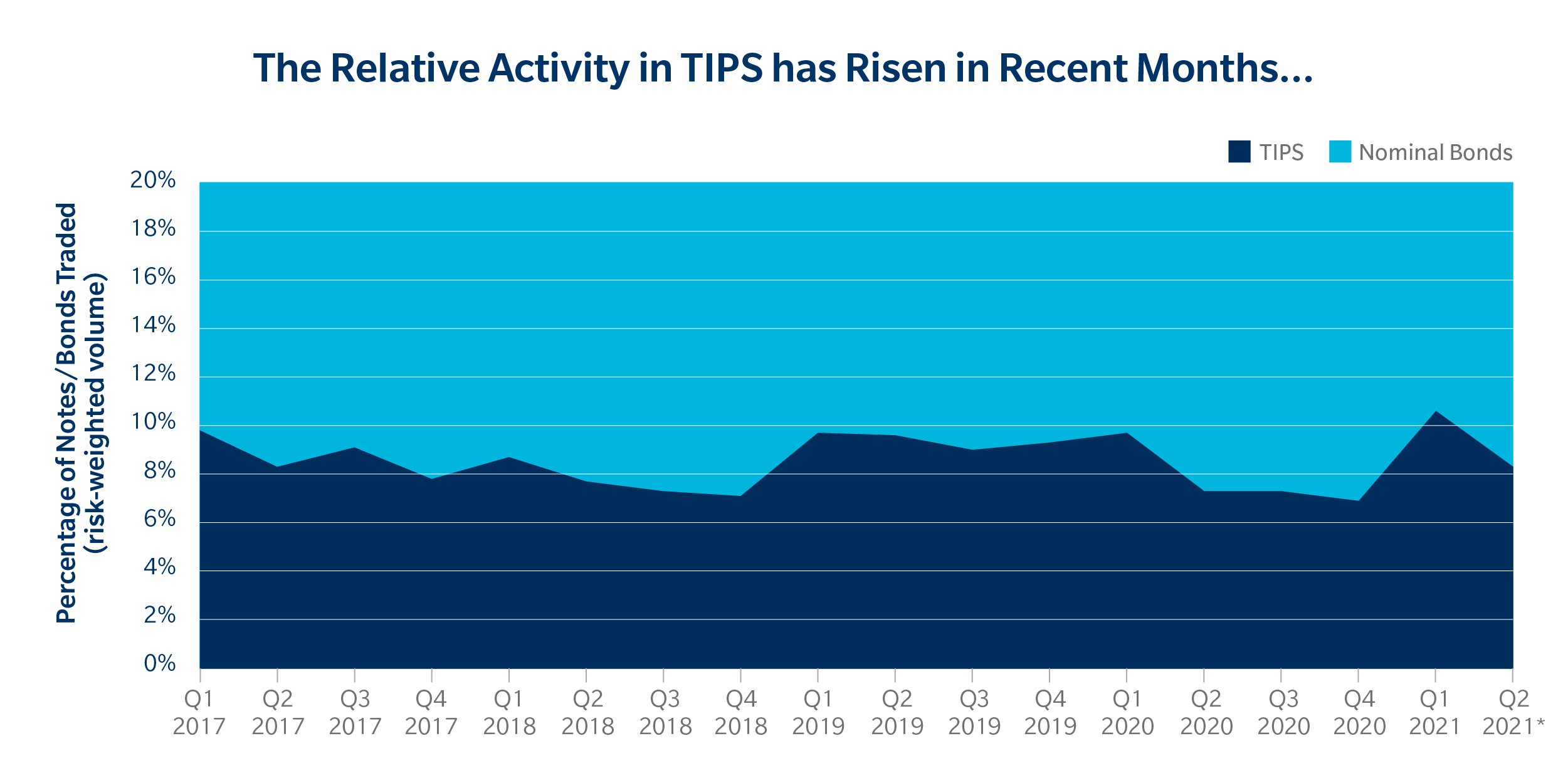

Since 2014, TIPS have represented a fairly consistent 10-11% of total Treasuries debt outstanding[1] (excluding bills and floating-rate notes). Still, on the Tradeweb institutional platform, TIPS trading has, on average, represented just 6%[2] of overall quarterly notional volume.[3]

That changed in the first quarter of 2021. TIPS trading accounted for 8.9% of volume, or 10.6% on a risk-weighted basis.

* Data through May 2021

Source: Tradeweb

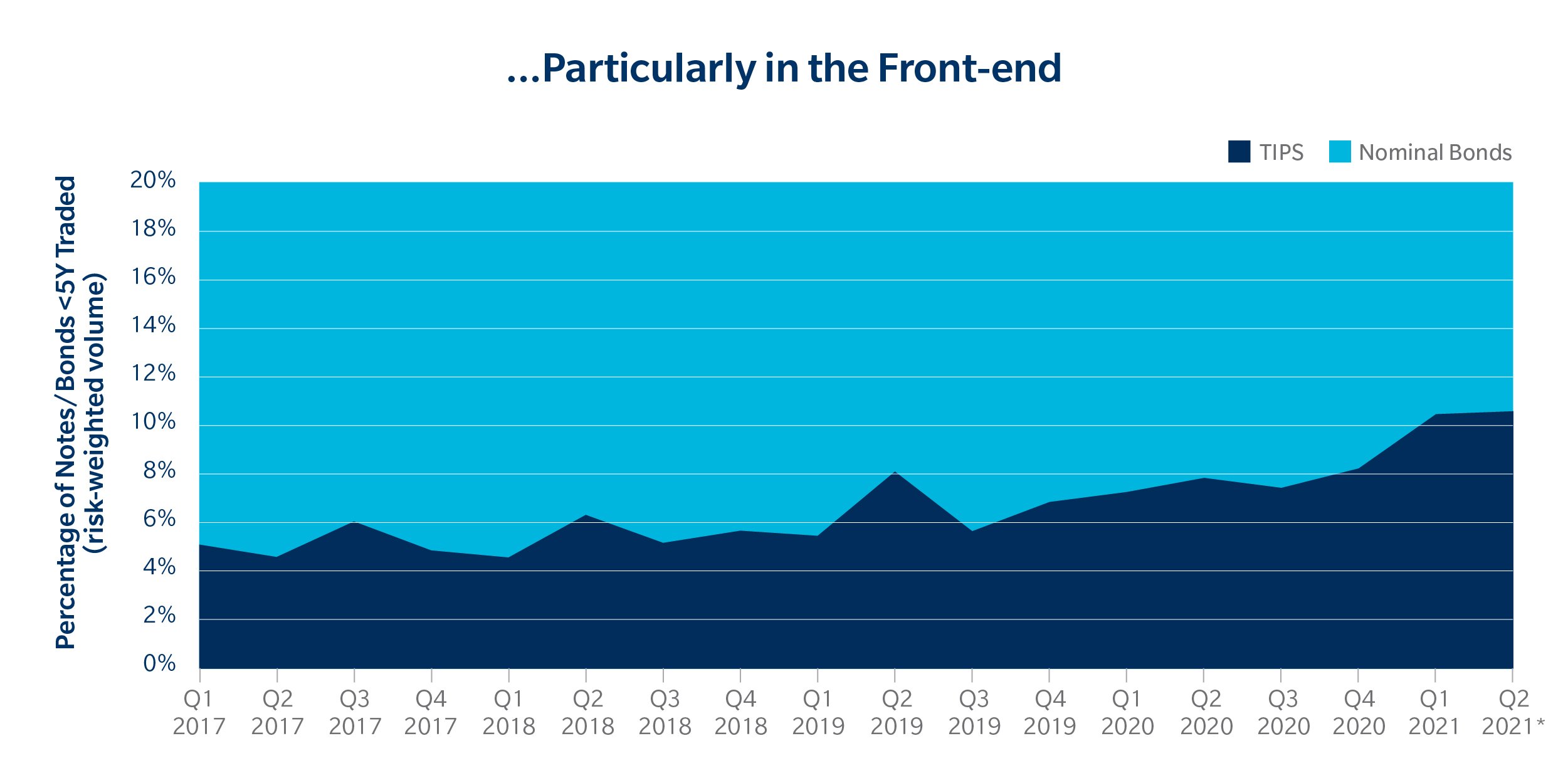

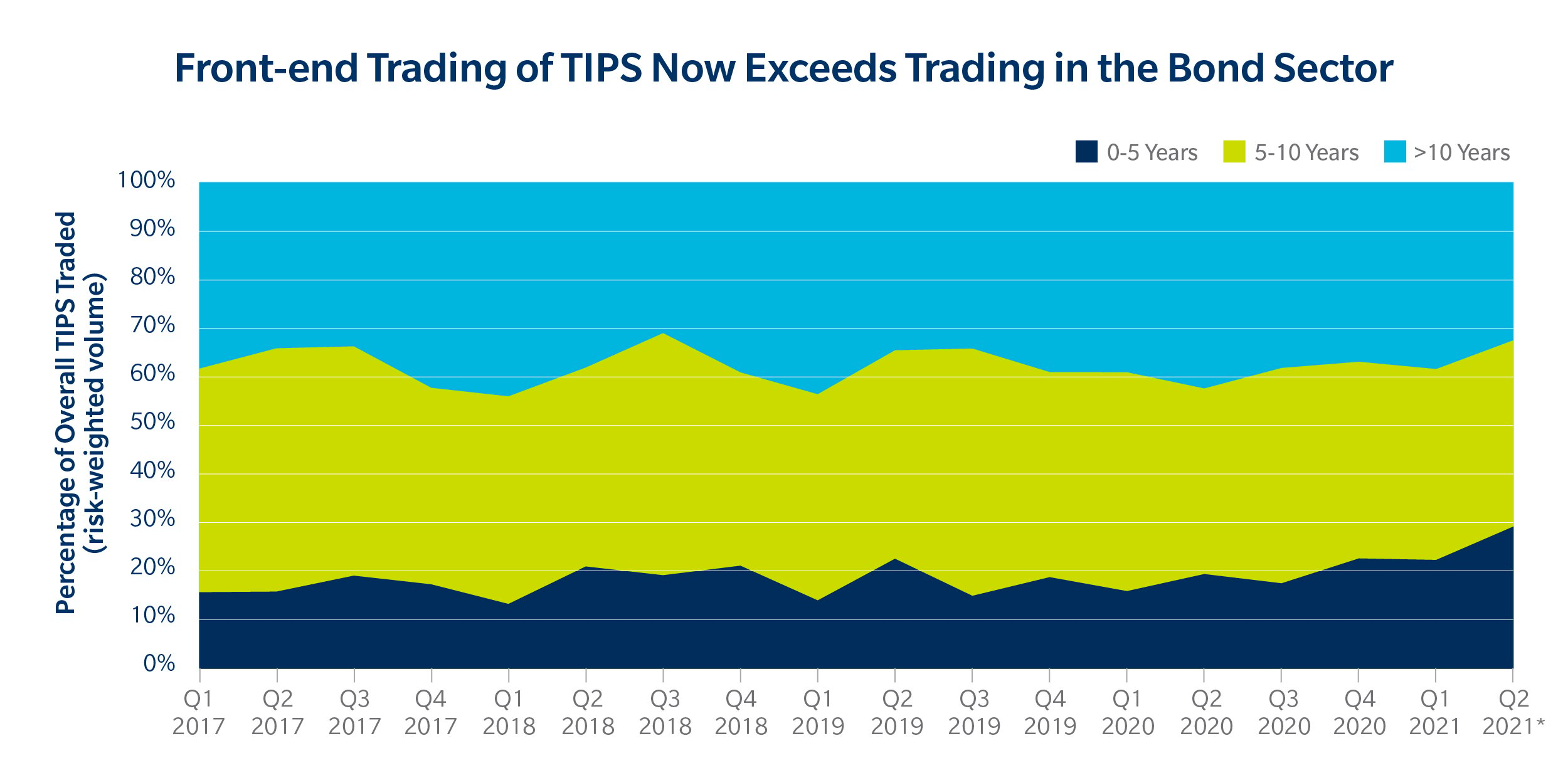

At the front-end of the curve, the uptick is more pronounced. So far this quarter, trading in TIPS with maturities under five years has jumped to 8.7% (10.6% risk-weighted), from an average of 5% per quarter over the past seven years. We saw an acceleration in trading of those TIPS, exceeding 30% of overall TIPS volume (risk-weighted), having averaged about 20% per quarter since 2014. This is the first quarter in which their activity will likely surpass activity in the bond sector.

* Data through May 2021

Source: Tradeweb

* Data through May 2021

Source: Tradeweb

Given that concerns, at least for now, are on shorter-term inflation, the focus on TIPS maturities of five years and under is not surprising. As a result, bid-offer spreads on off-the-run versus on-the-run issues in that part of the curve have compressed, while traditionally active clients have become a greater proportion of volume in those tenors. As an example, bid-offer spreads for the first and second old[4] five-year TIPS have tightened noticeably since 2019 and are now roughly aligned with the on-the-run security.

That said, on-the-runs still dominate trading, accounting for about 50% of volume on a risk-weighted basis.

Source: Tradeweb

It remains to be seen whether this interest is ephemeral at a time most economists expect inflationary pressures to be transient. Whether bond vigilantes are returning to markets is a further unknown for the TIPS market and Treasuries in general.

Source: Tradeweb