Jerald David, president of Arca Labs, told Markets Media that it is “super important” that the asset manager’s treasury fund has become the first tokenized ‘40 Act fund to become available for secondary trading on an alternative trading system (ATS). He said: “This is another important milestone and just the beginning of what we are going to see in digital assets.”

The tokenized treasury fund, with assets of approximately $405,000, can be traded on Securitize Markets, enabling Arca to reach the objectives it set since the asset manager first started thinking about launching a blockchain-enabled offering in 2018. Securitize is a blockchain platform for tokenizing real-world assets and is a registered broker-dealer that operates an ATS.

David added: “This is a super important development as it shows there are regulatory compliant ways whereby digital asset securities can be utilized in ways that people envisioned when they first started thinking about blockchain back in 2015 or 2016.”

He continued that it has taken Arca almost six years to realize what the set out to, but it now has a blockchain-enabled fund that is regulated by the SEC and has three different points of liquidity for investors.

Arca started to think about being able to offer a regulated blockchain-enabled US Treasury fund in 2018 and began conversations with the US Securities and Exchange Commission. In 2020 the Arca US Treasury Fund became effective with the SEC and was able to accept subscriptions.

The fund is regulated under the Investment Company Act of 1940 as a closed-end fund investing in US Treasuries. Blockchain technology has been used to create ArCoin, a digital asset security which represents a share in the Arca US Treasury Fund.

“Our thinking was to create an instrument that can ultimately utilize blockchain technology to accelerate transfers, mitigate risk and create transparency,” added David. “The novel part was to allow tokens to be delivered on the ethereum blockchain, a concept that was far ahead of its time.”

After the fund became effective, Arca began working to make the fund more usable for investors. The first leg of the stool was enabling peer-to-peer transfers on the ethereum blockchain.

Interest was accrued daily but originally paid directly to ArCoin holders on a quarterly basis. The second leg of the stool was being able to offer monthly redemptions which David said was important to increase liquidity.

The third, and final, leg of the stool was enabling intra-day liquidity through secondary trading via an ATS.

“We worked with the SEC to create something that has never been done before,” said David. “It is the confluence of traditional finance with the enhancement of blockchain and digital assets in a way that is meaningful for investors.”

Arca operates a web portal from Securitize Markets, who will offer ArCoin alongside the other digital assets that can be traded by their customers. Investors have to complete anti-money laundering and know-your-customer processes before being onboarded, and receiving Arcoins directly into their own wallet or a wallet maintained by a third-party custodian.

“This is unique and something that has not been done before,” said David. “This is one of the most novel use cases of blockchain and demonstrates how the technology can be used to create a regulatory compliant path forward, which many people in this industry have been struggling with.”

David claimed that other funds do not have the ability to transfer a token in an unencumbered fashion. In contrast, he said investors can transfer Arcoins from their wallet without authorization from a transfer agent.

“The process uses smart contracts and the SEC has permitted us to allow seamless transfers on a public blockchain,” he added. “This unlocks a whole host of different use cases, such as collateral management, treasury management and settlement.”

Competition

Since Arca launched its tokenized treasury fund, other asset managers have also launched similar products. For example, traditional asset manager BlackRock launched its first tokenized fund this year and it gathered more than $500m in record time. The BlackRock USD Institutional Digital Liquidity Fund (BUIDL) was launched on the ethereum blockchain on 20 March in partnership with Securitize.

David said other tokenized Treasury funds cannot be traded on on ATS. In addition, investors need to check whether the funds are on a public or private chain, and whether they are SEC registered.

“There are a couple other initiatives that have elements of what we have created, which we knew was going to happen,” he added. “There is no intellectual property on publicly filed documents and we look at our prospectus as being open source.”

He believes that traditional firms, such as BlackRock and Franklin Templeton, launching tokenized funds is a step forward for the entire market.

“We are strong believers in regulatory compliance,” he added. “ We can’t help but look at other initiatives that are embracing regulation in order to offer products and evangelize the importance of digital assets within the financial industry.”

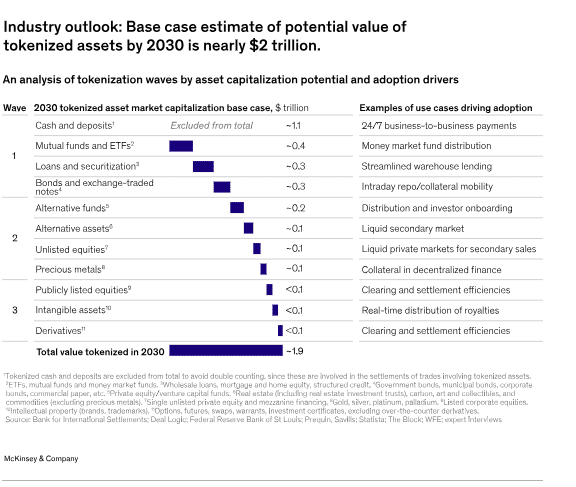

Consultancy McKinsey said in a blog in June this year that tokenized money market funds have attracted more than $1bn in assets under management, with funds available from both traditional fund managers and digital natives.

“Tokenized money market funds will likely see sustained demand in a higher-interest-rate environment, potentially offsetting stablecoins as on-chain stores of value,” added McKinsey. “Other types of mutual funds and ETFs could offer on-chain capital diversification to conventional financial instruments.”