Apollo Global Management had its second best quarter of originations with volume of $61bn in the fourth quarter of 2024 and is focussed on growing the business both organically and through acquisitions.

Marc Rowan, co-founder and chief executive of Apollo Global Management, said on the results call on 4 February that the firm will be driven by four fundamental changes – a global industrial renaissance; retirement; individual allocations and a convergence of public and private markets.

Rowan said Apollo is seeing a global industrial renaissance, particularly in the US. This involves not just artificial intelligence but covers fundamental investments in energy, infrastructure, power, data, next generation manufacturing and a host of other things that need to be financed.

“The global industrial renaissance is the largest place we can originate,” he added. “It is not just origination from our 16 platforms, but it is unique bespoke underwriting to build the next generation economy.”

For example, in June last year Apollo-managed funds and affiliates agreed to lead an investment of $11bn to acquire a 49% equity interest from Intel in a joint venture related to the technology company’s Fab 34 semiconductor manufacturing facility.

In the fourth quarter of 2024 Apollo had its second best quarter of originations with volume of $61bn, and $222bn in 2024. Platforms and high-grade capital solutions contributed more than half of total origination volume for the full year.

“Originations are not just about putting capital out the door,” said Rowan. “It’s about putting capital out the door at an excess return per unit of risk.”

Jim Zelter, president of Apollo Global Management, said on the call that origination doubled in 2024 from the previous year, which included more than $95bn from the firm’s 16 origination platforms, and more than $90bn from traditional core credit.

In 2025 Apollo is focused on continuing to scale origination capabilities across warehouse financing, lender finance and direct lending. Zelter said there will be geographic expansion in origination, including in Europe, in high-grade capital solutions, such as the Intel deal, and an increase in partnerships with banks who want to move some assets off their balance sheet.

“There is a massive focus on hybrid origination across the platform, the area between debt and equity,” said Zelter. “You’re going to see a much greater volume of opportunity in the US, Europe and parts of Asia in that hybrid area.”

In January this year Apollo agreed to acquire Argo Infrastructure Partners, a mid-market fund manager targeting essential infrastructure assets in North America with approximately $6bn in assets. Rowan said Apollo will continue to do modest M&A along the same lines to increase origination capacity.

“The single most important factor in deciding to absorb Argo is the team and the capacity to originate for our evergreen retail fund and separately managed accounts,” added Rowan. “All the vehicles on the Apollo platform have been eye-opening to the Argo team, and we will benefit by having a scaled business with an excellent track record joining us.”

Rowan said Apollo will continue to build origination capabilities in hybrid and real asset businesses and in segments where the firm is growing, but not yet at scale.

Retirement

Another driver is retirement which involves not just providing guaranteed lifetime income, but non-traditional products to help people have a better retirement. Retirement generated more than $70bn of organic inflows in 2024, with another $9bn in January this year.

“With legislative change this could be one of the true drivers of our industry, not just our business,” said Rowan.

He explained that a change in legislation would benefit the industry, as the US has a litigation culture that has historically focused on fees, and has prevented widespread allocation to private markets.

“Everywhere in the world where private has been added to retirement solutions, the results are not just a little bit better, they are 50% to 100% better,” he said. “I I believe we are at the very beginning of approaching a $12 trillion pension market.”

Asset management

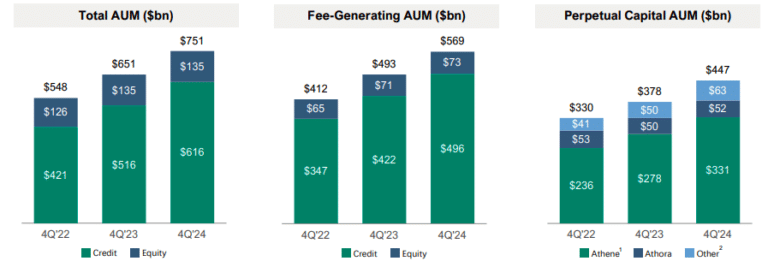

Total assets under management reached a record $751bn at the end of 2024. Assets benefited from inflows of $33bn in the fourth quarter and $152bn during last year, a 15% increase from 2023. Nearly 60% of Apollo’s total assets under management consists of perpetual capital, which the firm said is highly scalable.

The alternatives industry was originally built from institutional allocation buckets. Rowan said: “Individuals have the potential to be as large as institutions in the same sort of products, and will not take anywhere near 40 years to get to that size.”

Global wealth raised a record $12bn of capital in 2024 which Apollo said was from a combination of successful product launches, ongoing distribution expansion, and continued education focused on providing solutions for individual investors

Rowan identified the fourth, and most important driver, as an “entire rethink of public and private.”

“BlackRock made a number of significant acquisitions in 2024 to lay a foundation for an integration of public and private,” he added. “I continue to believe this convergence will be a very important source of demand for private assets.”

He believes traditional asset managers will evolve their businesses to include public and private products. Some traditional asset managers will want to launch new products that are co-branded and some will seek to augment their business with managed accounts with access to private assets from a variety of players, which Rowan thinks will be good for the entire industry.

“I see a very good marriage between our industry, our company, and traditional asset managers who I believe are going to reinvent their businesses due to competitive forces,” Rowan added.

Financials

GAAP net income attributable was $4.5 billion for the full year ended 31 December 2024.

“2024 wrapped up in exactly the way we wanted in terms of growth and execution,” added Rowan.

Apollo reported record annual fee-related earnings of $2.1bn, up 17% year-on-year which the asset manager said was driven by strong growth in fee related revenues and disciplined expense growth. Spread-related earnings were an annual record of $3.2bn which the firm said reflected robust organic growth and higher alternative net investment income.

Rowan said Apollo’s goal over the next five years is to grow fee-related earnings at an average annual rate of 20% and spread-related earnings at 10%.

“In any one year, fee-related earnings should grow between 15% and 20%, particularly in non-fundraising years,” Rowan added. “This is exactly what we hope to do and we are not here to blow the doors off any one quarter.”

The firm said the fourth quarter represented another milestone as Apollo was added to the S&P 500 index in December. Noah Gunn, global head of investor relations, said on the call that since listing on the New York Stock Exchange in 2011, Apollo’s market cap has grown from approximately $2bn to more than $100bn.

Gunn added: “We expect our inclusion will broaden our public shareholder base and enable more investors to gain exposure to private markets by investing in our business.”