Nearly all financial services firms are using alternative data for competitive advantage according to research from LSEG Labs.

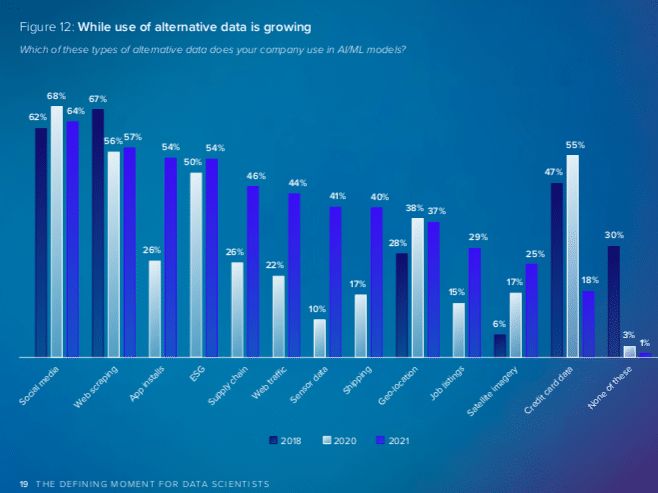

The report, The defining moment for data scientists, found that only 1% of companies do not use alternative data, compared to 30% in 2018. The survey is based on 482 telephone interviews between 3 May and 16 June 2021.

Standardized credit card data became much less attractive, dropping from 51% last year to 18%, which the use of specialized data sets such as app installs, Web traffic and job listings has increased.

The study continued that the abrupt change in trade and movement data due to the Covid-19 pandemic has led to a surge of interest in tracking data, ranging from supply chain and shipping to sensor data and satellite imagery.

Source: LSEG Labs

Geoff Horrell, group head of innovation at the London Stock Exchange Group, told Markets Media that one of the interesting trends is a great desire to find better, higher quality information for sustainable finance.

“Firms can use natural language processing to uncover all of the future looking statements to understand how their supply chain is working or use geospatial data or weather data to see how they are going to be impacted by physical risks of climate change,” he added.

However, poor data quality and lack of data availability remain barriers to artificial intelligence and machine learning adoption leading to the use of data annotation and synthetic data. As a result over half, 55%, of companies are yet to deploy artificial intelligence/machine learning across their business.

“The cloud will allow more and more data to be used, lower the total cost of ownership and lead to an explosion in analytics,” said Horrell. “There has been a continued enhancement in capabilities at the major cloud providers.”

Download your copy of a new #AI and #machinelearning research report from #LSEGLabs – the defining moment for data scientists #datascience #dataengineering #fintech #AI #machine learning #NLP: https://t.co/DunDBYriOF pic.twitter.com/N7rApTzihW

— LSEG (London Stock Exchange Group) (@LSEGplc) October 14, 2021

Horrell explained that the use of alternative data sources and maturity in data science capabilities have come along at the same time as data providers are trying to solve those difficult, data-driven challenges of investing in sustainable finance which is a really big growth area.

LSEG Labs

LSEG Labs opened a dedicated sustainable finance innovation unit in Singapore in September supported by the Monetary Authority of Singapore.

Kwok Quek Sin, executive director, green fintech, fintech & innovation group at MAS, said in a statement: “Greater collaboration will be key for the financial sector to explore innovative solutions that can address climate-related risks and mobilise capital towards greener and more sustainable activities. To this end, the setup of LSEG’s sustainable finance innovation unit in Singapore can help bring together the capabilities and stakeholders needed to support sustainability and transition efforts both regionally and globally.”

Sustainable finance spans LSEG’s three business divisions – data & analytics; capital markets; and post-trade. Horrell said the innovation group goes to the different businesses and asks where they need help. For example, they have been working with the post-trade business to help provide deep expertise on cloud, data science and natural language processing.

Innovation sits at the group level alongside strategy at LSEG to help set priorities.

Geoff Horrell, LSEG

“In LSEG Labs we try to bring our strategy to life by working with our business lines, heads of strategy, and clients to find the great exciting opportunities to build,” Horrell added. “It involves user experience, market landscape analysis, excellence in engineering, data science and commercialization of those opportunities.”

Another of Horrell’s aims is to enable an innovation culture and capability across the group through openness, training and providing tools and advice.

“We also partner with early adopters – firms, regulators and industry bodies who are at the forefront of innovation in finance such as the Monetary Authority of Singapore on sustainable finance,” he said.

It can be hard to measure success in innovation but Horrell said the group tries to measure the process such as whether an idea was validated, if the risk hypothesis was performed rapidly or if all stakeholders were engaged.

“We are trying to add those kinds of key performance indicators and metrics as well as the bottom line,” he added. “We are trying to create high value options for the business so they might use that idea, make an acquisition, or change strategy.”