Active Managers Will Own Equities That are Private, Not Private Equity

12.11.2024

Marc Rowan, co-founder and chief executive of alternatives manager Apollo Global Management, said that a universe of private companies will continue to grow and be owned by active managers of the future.

Rowan spoke at the Goldman Sachs Financial Services Conference in New York on 11 December. He described a “sea change” in the equities market with the number of public companies falling to around 4,000. In addition, more companies are staying private, rather than holding an initial public offering, such as Spotify, the music streamer, and OpenAI, the generative artificial intelligence firm.

“We are going to end up with a whole universe of companies that are private,” he said. “We will own equity that is private, rather than private equity.”

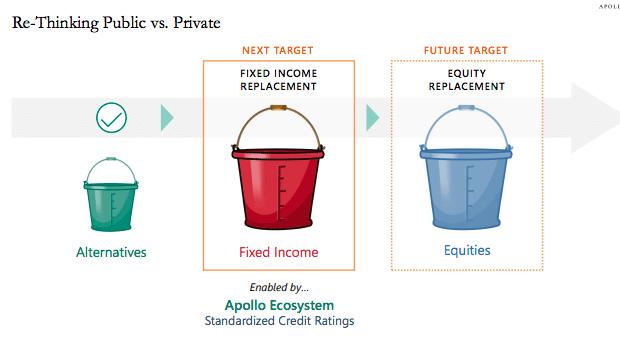

As a result he argued that, over time, active management of the future will require the private equity skill set, but without the leverage, and will require a new way of thinking for both institutions and for individuals. Institutions are currently set up to invest in public equities, public debt or alternatives, which have a really high cost of capital. Rowan said there are many hybrid opportunities which fall between fixed income and equity.

“We have watched over the past 15 years of the best risk/reward in the market which is neither the lowest risk nor the best reward, but has not had a home,” he added. “Even in a market awash in capital, excess returns have come to this area.”

The vast majority of Apollo’s principal capital is invested in hybrid securities and the firm’s flagship fund in this area has only had one down quarter in the last 40 quarters according to Rowan. Apollo has its first large institutional client who has inherited a portfolio with very few alternatives but want to be diversified by adding hybrid. Rowan believes hybrid will be a great product for institutions, for retirement schemes and in the equity sleeves of public mutual funds. He said almost every public equity mutual fund has a 15% sleeve for private markets, and they have historically used it for investment in technology firms.

“The best risk/reward for an asset class is hybrid,” he said. “I don’t see capital formation happening in scale anytime soon and to close this gap will require fundamental change.”

Private credit

Private credit has been a growth area as banks have cut down on leaning and capital intensive businesses.

“For the last five to six years we have taken 300 to 400 senior bankers so there has been a movement of knowledge, a movement of relationships and a movement of competency,” added Rowan.

The incoming Trump is likely to deregulate banks, which may allow them to increase lending. Rowan argued that private credit will continue to thrive even as banks become stronger competitors, due to the scale of capital that is required to build infrastructure, to invest in next generation data and power and for reindustrialization of the US.

The asset manager has spent 15 years building origination and it is the largest investment Apollo has made in both time and money. Apollo has invested around $8bn in the private credit business and built the team to approximately 4,000 people,

“Everyone else is just waking up to this, and they are waking up in a climate where it is going to be harder for them to build what we have built,” said Rowan. “This gives us confidence to provide $11bn for Intel and it will not surprise me to see the first $15bn or $20bn deal in private markets this year.”

For example, Apollo is a lender to technology company Intel. In June this year Intel said Apollo-managed funds and affiliates will lead an investment of $11bn to acquire a 49% equity interest in a joint venture entity related to Intel’s Fab 34, a high-volume manufacturing facility designed for wafers using the Intel 4 and Intel 3 process technologies.

Jamshid Ehsani, Apollo partner, said at the time that the capital transaction is among the largest private investments of its kind and showcases the firm’s ability to provide creative, scaled capital solutions to leading corporations and infrastructure.

Priorities for 2025

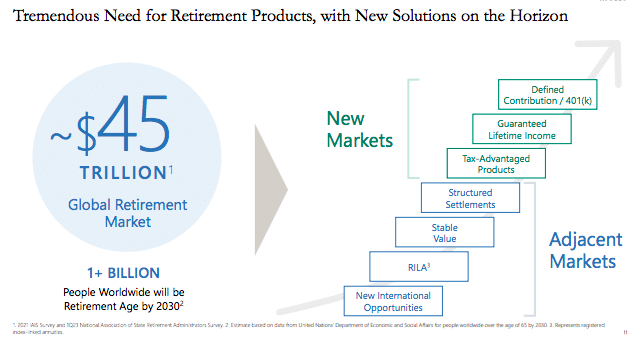

Rowan leads Apollo Global Management which has two subsidiaries – Apollo Asset Management and Athene, its retirement services business. Two months ago Apollo held an investor day and set long-term targets which included 20% average growth over the next five years for fee-related earnings; 10% for spread-related earnings, a new measure for the performance of the retirement business; and $275bn of annual originations.

In asset management, Rowan said the firm has made a series of choices on what not to do. He added: “We have to figure out what we think is scalable and where we have a right to win.”

He identified these areas as fixed income replacement, direct lending and hybrid equity which are driven in part by the need for capital and the global industrial renaissance.

In the retirement business, Rowan identified the next leg up of growth as products that do not yet exist.

“The industry has not been a great creator of product, and I think there’s an opportunity for massive disruption by getting it right,” he added. “I think we are well positioned to get it right.

Rowan said Apollo has an “unbelievable” set of opportunities as stock markets and bond markets have been through major changes including indexation, concentration and the growth of passive investments. As a result, investors have had very concentrated and very risky returns.

“We gave essentially levered the retirement of most Americans on the outcome of Nvidia,” he said.

In contrast, where private assets have been introduced into retirement schemes around the world, investors have got better outcomes according to Rowan.

“Investors have got 40% to 50% better outcomes with lower risk and greater diversification,” he said. “This is in Australia, this is in Mexico, this is in Israel.”

Rowan is optimistic that the US will allow retirement schemes to increase their allocation to private markets. In addition there are opportunities to provide private market investments to family offices, high net worth individuals and to serve investors indirectly, through products and structures such as exchange-traded funds; interval funds; and public and private co-mingled products.

Apollo and State Street Global Advisors have applied for regulatory approval of an ETF that invests in both public and private credit.

“We are going to offer a product that is 100% investment grade that will outperform not just the index, but the people who are taking risk below investment grade,” he added. “I think we can do that in almost every category of fixed income, because every category of fixed income is ripe for change.”