Investors may be perceiving environmental, social and governance funds as ‘pandemic-proof’ as flows into US exchange-trade funds were 4.6 times higher for ESG than conventional ETFs during the crisis.

The European Capital Market Institute today published a policy brief by Jean-Jacques Barbéris, head of institutional and corporate clients coverage at asset manager Amundi and Marie Brière, head of investor research center at Amundi, affiliate professor at Paris Dauphine University and member of the ECMI academic committee. The paper examined the the impact of the Covid-19 pandemic on global equity markets and investment behaviour.

#ESG resilience during the Covid crisis: Is green the new gold? by J. Barbéris and M. Brière, European Capital Market Institute (ECMI) #SustainableFinance @Amundi_ENG

https://t.co/08Nk8BoPjI pic.twitter.com/9p0aSq5OjM— PubAffairs EU News & Debates ?? (@PubAffairsEU) July 9, 2020

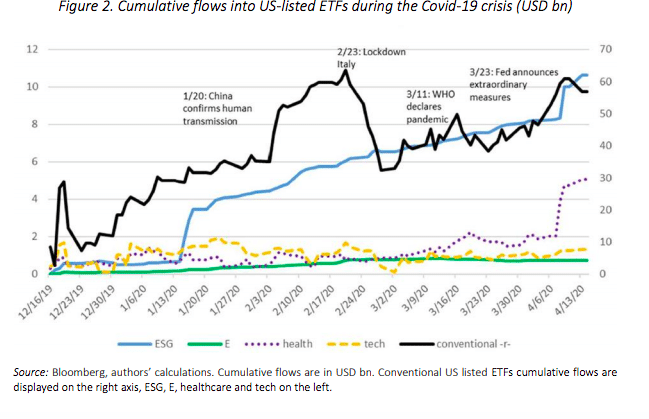

The research found that during the Covid-19 crisis the daily growth rate of ESG ETFs was 1.28%, which was 4.6 times higher than the 0.28% for conventional ETFs.

“In our view, it is possible that investors have perceived ESG as ‘pandemic-proof’ funds,” said the report. “Investors perceived their strong performance as a defensive characteristic and cumulative flows continued to increase while massive sales occurred in traditional funds.”

The research analysed investment flows in 1,662 ETFs listed on the US market, including 75 classified as ESG, 24 specialising in environmental issues (low-carbon, water, clean energy, etc), 53 specialising in healthcare and 30 in tech.

In addition, the MSCI World index dropped 14.5% in March, but 62% of large-cap ESG funds outperformed the index said the study.

“During the Covid-19 crisis – which clearly has strong social and environmental implications – it seems that investors perceived a strong ESG performance as a defensive characteristic,” said the study.

Green bonds

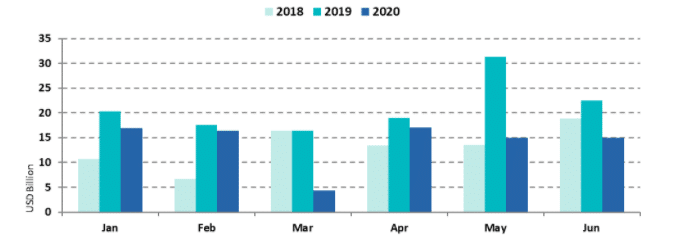

In contrast in fixed income, green bond market issuance was $84.7bn in the first six months of this year, half of the issuance of $172.2bn in the first half of 2019 according to the Climate Bonds Initiative, an investor focused not-for-profit, promoting investment in the low-carbon economy.

“The impact of the pandemic is clear in the comparative figures,” said the Climate Bonds Initiative in a blog. “Absolute volume for each issuer type decreased by at least 29% – apart from government-backed entities which saw an increase of 12%.”

However, governments have tied green projects to their stimulus packages. The blog gave the example of Scotland making a £5.5m ($6.8bn) investment in local renewables and low carbon heat.

Temperature ratings

Amundi has also become the first asset manager to use temperature ratings developed by non-profit CDP in order to grow its ESG research capabilities and measure the temperature of its investment universe.

? #Innovation | Amundi collaborates with the @CDP to launch new #ratings dataset that provides a temperature pathway for over 4,000 global companies, based on emission reduction targets covering all relevant #GHG emissions in a company’s value chain ⤵https://t.co/X8sW1ad1cT

— Amundi (@Amundi_ENG) July 7, 2020

CDP has launched a new temperature ratings dataset which provides a temperature pathway for over 4,000 global companies, based on emission reduction targets covering all relevant greenhouse gas emissions in a company’s value chain.

“This data is key for investors to better manage climate transition risk and future-proof their portfolios and funds from costly climate change,” said CDP in a statement.

Amundi said the temperature ratings will bolster Amundi’s forward-looking assessment capabilities in order to identify priorities for engagement and the degree of action required to set more ambitious, science-based emissions reduction targets.

Jean-Jacques Barbéris, member of the executive committee & head of institutional clients coverage and ESG, said in a statement: “Investors need to back the companies that are supporting a faster transition of our economy to a low-carbon model, and encourage others through targeted engagement. By being better equipped, investors can future-proof their investment universe from the impact of climate change and improve corporate dialogue.”