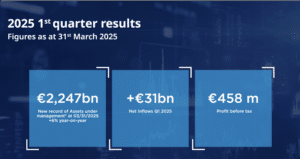

Sharp increase in profit before tax⁸ +11% compared to the first quarter of 2024, thanks to top line growth

Profit before tax8 reached €458m, up +10.7% compared to the first quarter of 2024.

It includes contributions from Alpha Associates as well as aixigo, acquisitions of wich were finalised in early April and early November 2024 respectively, and were therefore not included in the first quarter 2024. Their cumulative contribution to the profit before tax8 in the first quarter reached +€4m.

The growth in profit before tax was mainly due to the increase in revenues.

Adjusted net revenues8 amounted to €912m, +10.7% compared to the first quarter of 2024,+9% on a like-for-like basis, driven by all sources of revenues:

- Net management fees increased by +7.7% compared to the first quarter of 2024;

- Performance fees, which are traditionally more moderate in the first quarter due to the lower number of fund anniversaries during this period, nevertheless increased by +30.7% compared to the first quarter of 2024;

- Amundi Technology‘s revenues, at €26m, continued to grow steadily compared to the first quarter of 2024, amplified this quarter by the consolidation of aixigo;

- finally, the Financial and other revenues8 amounted to €39m, up sharply compared to the first quarter of 2024 thanks to capital gains on the private equity portfolio in seed money and a positive mark-to-market from equity holdings, despite the impact of the fall in short-term rates in the euro zone.

The increase in adjusted8operating expenses, €478m, is +8.8% compared to the first quarter of 2024, +6% at constant scope. It remains lower than that of revenues, thus generating a positive jaws effect of nearly 3 percentage points excluding the scope effect related to the acquisition of Alpha Associates and aixigo, reflecting the Group’s operational efficiency.

In addition to the scope effect, this increase is mainly due to:

- investments in the development initiatives of the 2025 Ambitions plan, including technology, third-party distribution and Asia;

- provisioning for individual variable remuneration, in line with the growth in results.

The cost-income ratio at 52.4% on an adjusted data basis8, improved compared to the same quarter last year and is in line with the Ambitions 2025 target (<53%).

The adjusted gross operating income8(GOI) amounted to €434m, up +12.9% compared to the first quarter of 2024, +11.8% at constant scope, reflecting revenues growth.

Share of net income of equity-accounted companies9, at €28m, down slightly compared to the first quarter of 2024, reflects the decline in financial revenues of the main contributing entity, the Indian Joint-Venture SBI FM. The decline in the Indian equities markets resulted in negative mark-to-market in the Joint-Venture’s financial revenues, which nevertheless continues to benefit from strong growth in its activity with management fees up of over +20% compared to the first quarter of 2024.

The adjusted8 corporate tax expense for the first quarter of 2025 reached -€155m, a very strong increase – +60.8% – compared to the first quarter of 2024.

In France, in accordance with the Finance law for 2025, an exceptional tax contribution must be booked in fiscal year 2025. It is calculated on the average of the profits made in France in 2024 and 2025. This exceptional contribution is estimated10 to -€72m for the year as a whole, but it will not be accounted for on a straight-line basis over the quarters. It amounted to -€46m in the first quarter of 2025, with the rest spread over the next three quarters. Excluding this exceptional contribution, the adjusted8 tax expense would have been ‑€109m and the adjusted8 effective tax rate would be equivalent to that of the first quarter of 2024.

Adjusted net income8 amounts to €303m. Excluding the exceptional tax contribution, it would have been close to €350m, up +10% compared to the first quarter of 2024.

The adjusted8net earnings per share in the first quarter of 2025 was €1.48, including -€0.22 related to the exceptional tax contribution in France. Excluding this exceptional tax contribution, adjusted8 earnings per share would therefore have been €1.70, up +9.6% compared to the first quarter of 2024.