Sean O’Connor, founder and executive vice chairman of global financial services network StoneX Group, said on a conference call on 14 April that the firm was very excited to announce the “transformational transaction” of its acquisition of R.J. O’Brien, one of the oldest and largest independent derivative firms.

On 14 April 2025 StoneX said in a statement it was acquiring R.J. O’Brien, the oldest US futures brokerage, for $900m to create a global leader in the derivatives market.

O’Connor said: “This takes StoneX to the next level in every financial metric, makes us a more significant firm, a bigger part of the global market structure and one of the most significant derivative trading firms on the planet.”

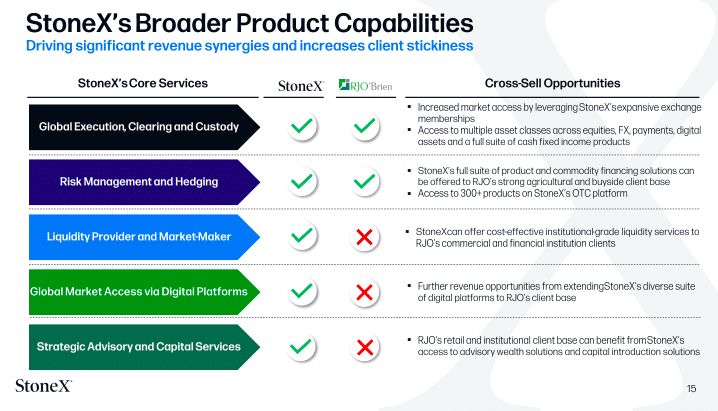

He continued that both firms have been focused on building the best possible financial ecosystem for clients of all types that need access to the global markets. They both provide both high-touch and electronic execution, as well as clearing, custody and prime brokerage across all asset classes.

“This makes us a key part of the global financial market structure,” he added. “Clients have their assets and collateral with us, and this is a unique offering only offered by the bulge bracket banks.”

The acquisition adds 75,000 clients to StoneX, as well as significant expertise from the experienced R.J. O’Brien team. StoneX is a clearing member at over 40 exchanges and also trades over 18,000 over-the-counter products according to O’Connor. The group also has a global retail trading platform for trading every asset class from stocks to indices and commodities, including140 currencies.

R.J. O’Brien has a small retail business, which will fit well with StoneX’s more global efforts, according to Corcoran. He thinks the revenue synergies in the retail business will be “pretty significant” over time.

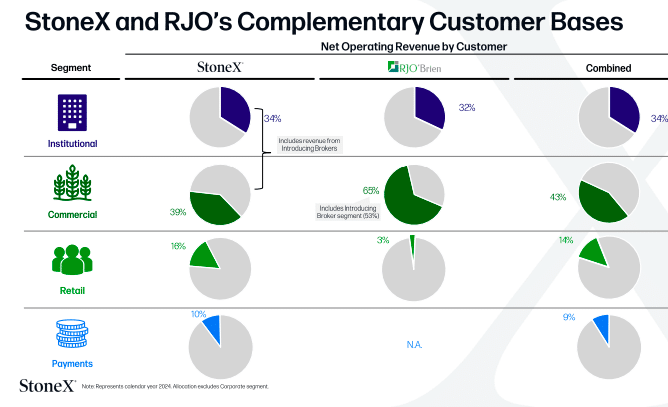

“The most surprising thing is that we see very little client overlap,” he added. “So there are lots of revenue and cost synergies, and very little risk on the revenue side.”

In addition, StoneX has 54,000 institutional, commercial and payments clients and just shy of half a million retail, self-directed clients. There are also just under 5,000 StoneX staff in over 20 countries.

Gerry Corcoran, chairman and chief executive of R.J. O’Brien, will be joining the combined firm. He said on the conference call that the acquisition is “incredibly complementary,” and should be transformative.

Corcoran continued that the R.J. O’Brien board and the O’Brien family have been exploring all the available strategic options since John O’Brien, Sr. passed away in July 2022. In 1986 he became chief executive, and chairman in 2000, of the firm that had been founded by his grandfather, John V. McCarthy, in 1914. He followed in the footsteps of his brother, Robert J. O’Brien, Jr., and his father, Robert J. O’Brien, Sr., in running the company.

R.J. O’Brien was a founding member of the Chicago Mercantile Exchange in 1914, and Corcoran said it is one of the largest global non-bank financial firms with 15 global offices and 600 employees. Corcoran described RJ O’Brien as covering the gamut of products, but with strengths are in agricultural products, fixed income and OTC products. Just over one third, 36%, of revenues come from RJ O’Brien’s introducing broker business.

“We have the largest market share in introducing brokers, and a very strong franchise by geography,” added Corcoran. “We are still heavily US-based at 71%, but five years ago that would have been 99%.”

Revenue opportunities

The combination of the two businesses will create a global derivatives clearing firm with significant revenue opportunities from cross-selling opportunities, according to O’Connor. The biggest portion of R.J. O’Brien’s institutional client base is advising banks and financial institutions on how to hedge their interest rate risk. O’Connor said a business where StoneX is not involved at all.

However, StoneX provides the same clients with cash traded products on the broker-dealer side and has a very active business in products such as asset-backed, Treasuries and repos.

“In fact, the balance sheets that RJ O’Brien is hedging is the balance sheet we trade with the banks,” said O’Connor “Combining this effort will make us the one-stop-shop for the banks around the world.”

In addition, StoneX provides banks with other products including global payments and foreign exchange. Some banks use StoneX to clear equities for their high net worth business.

“Between the two organizations, we will have a very significant offering for mid-sized and regional banks in the US and around the world,” said Corcoran. “So that’s a very exciting opportunity.”

He added that since the financial crisis, banks have shed smaller trading clients and hedge funds. O’Connor argued that StoneX has been a natural place for those clients because it has an ecosystem that is :unrivalled” in the second tier space, and that has driven growth. Therefore, he expects the combined firm to be the counterparty of choice for these clients.

O’Connor described the industrial logic of the transaction as “pretty self evident” with significant revenue opportunities. He said: “We saw the opportunities where 1 +1 can equal 3 on the revenue side.”

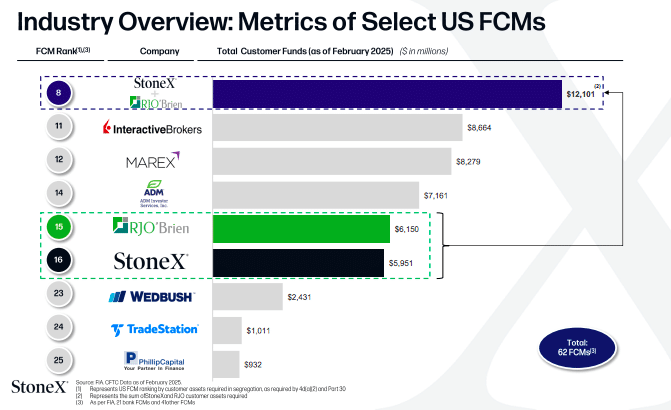

RJ O’Brien is primarily a listed derivatives business, and StoneX is also an FCM (futures commission merchant), which provides clearing and settlement services for futures and options trades.

“The combination of these two listed derivatives businesses will result in us being one of the most significant derivatives firms globally, offering execution and clearing on almost every derivatives exchange around the globe,” said O’Connor.

Derivatives trading volumes have been growing significantly with more exchanges launching more products. So, O’Connor argued that the combined firm will be a meaningful player in a growing market.

In derivatives StoneX has significant OTC structured product capabilities according to Corcoran. The firm also has the capability to assist clients with their physical and logistics requirements, and can also embed price protection into physical products. Corcoran said: “Clients don’t have to deal with hedge accounting, and there’s almost no one out there who can do that.”

He believes that the combined product set will be a “tremendous” opportunity for the introducing brokers and the brokers at R.J. O’Brien who can offer a full toolkit to their commercial clients.

“It will make the clients more sticky, make us more important to clients and obviously drive revenue,” said Corcoran. “We have very good empirical evidence that shows that we make more from these other products than we do with derivatives for commercial clients, so the opportunity is pretty significant.”

Financials

StoneX Group will be acquiring 100% of RJ O’Brien for $900m, subject to normal price adjustments, and will also assume up to $143m of subordinated debt.

The consideration will be paid out as $625m in cash and approximately $275m in StoneX shares to RJ O’Brien shareholders. StoneX has obtained fully committed bridge financing for the cash portion of the consideration and plans to issue approximately $625m of long-term debt prior to the closing date.

R.J. O’Brien generated $766m in revenue and approximately $170m in EBITDA during calendar 2024.

Speaking on behalf of the O’Brien family, the majority shareholders in RJ O’Brien, board member Bob O’Brien, Jr. said in a statement: “So many of our family members have been privileged to lead the company and provide guidance and counsel. This merger is the natural next step in the history of the company, and the O’Brien family is enthusiastic about playing a new role as major shareholders in another great company that will build on that legacy.”

Bill Dunaway, chief financial officer of StoneX Group, said on the conference call that he expects it will take around 24 months to realize upwards of $50m in expense synergies from combining the FCM, trading operations and removing duplication of clearing platforms etc.

O’Connor added that he believes that the synergies on the revenue side will be multiples of the expense synergies.

The acquisition is due to close in the third quarter of this year, subject to regulatory approvals. R.J. O’Brien will be StoneX’s largest acquisition and O’Connor said the combination replicates what it has today, but provides scale and operational leverage.

O’Connor added: “The thing we are most proud of since we founded StoneX in 2003 is we have compounded our revenue, stock price and equity capital at the firm at a compound rate of 30% for 23 years.”