Global asset owners continue to increase allocations to alternative investments with nearly all, 86%, of portfolios containing private assets according to a Northern Trust study.

Northern Trust surveyed 180 global asset owners with investment portfolios ranging from $1bn to over $500bn, for its Asset Owners in Focus: Global Asset Owner Peer Study 2025 report. Responses came from senior leaders of pension funds, OCIOs and multi-managers, family offices, sovereign wealth funds, endowments and other institutions.

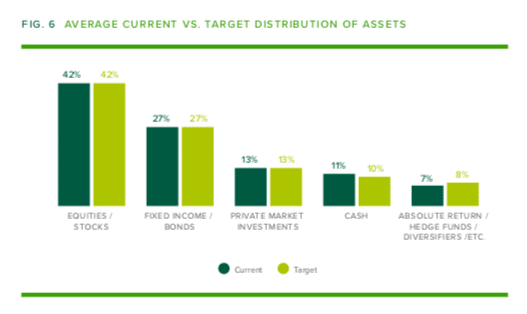

On average, asset owners continue to favor equities at 42%, and fixed income at 27%. Private market assets, including private equity, real estate and infrastructure, make up 13% of the average portfolio.

Mark Austin, pensions and insurance executive, EMEA at Northern Trust told Markets Media: “Institutions are expanding their asset classes and becoming more sophisticated. They are expecting more from their service providers and there is an evolution in increasingly outsourcing trading and middle office.”

In addition, most asset owners set thresholds for deviating from their targets to accommodate market shifts. Nearly three quarters, 71%, of institutions set a threshold to stay within +/- 10% of their targets, though 11% are more flexible, allowing up to +/- 20% leeway.

“The flexibility offered by these thresholds not only avoids additional trading costs but also saves precious time – for both investment and operations teams – that may have been spent rebalancing portfolios to stay in line with targets,” said the report.

Private assets

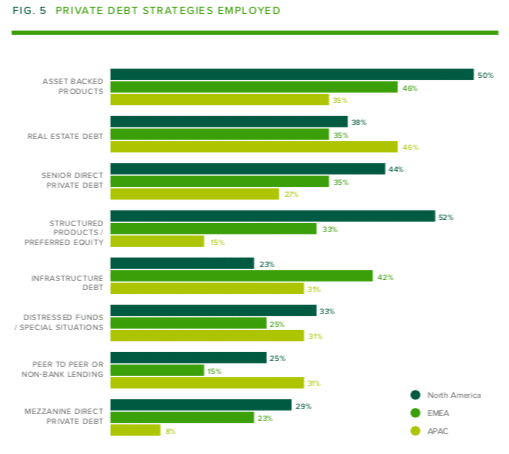

The majority, 86%, of respondents invest in private markets, while two thirds, 68%, invest in hedge funds, absolute return investments and other diversifiers. The report said the growth of private debt within the broader private markets landscape over the past decade “cannot be overstated.”

Austin added: “Asset owners need to balance the risk and opportunity. It also makes liquidity management more important as, for example, alternatives have capital calls.”

In addition one fifth, 21%, of institutions that allocate to private markets invest in cryptocurrencies and other digital assets.

“While current allocations to these assets – which include cryptocurrencies, stablecoins, central bank digital currencies (CBDCs), and digital tokens – are low, this is nonetheless a dramatic shift from just a few years ago, when most asset owners had little to no exposure to this sector,” said the report. “This rise in interest has been supported by the growth of digital infrastructure, as well as digital assets’ role in supporting the growth and development of private assets more broadly, as digitization can enable a greater degree of transparency and efficiency.”

Two thirds, 66%, of asset owners adopt a primarily active management approach for alternative assets that demand specialized expertise.

Technology spending

Liquidity risk is the most important risk metric, ranked as a top-three concern by 54% of respondents. The top three external investment challenges were interest rate changes, geopolitical and domestic political instability.

As a result, asset owners are increasingly recognizing that technology can address both operational and investment risk.

James Wright, head of asset owners, EMEA at Northern Trust, said in a statement: “As regulatory pressures rise and the need for more robust data management grows, asset owners are looking to strengthen their decision-making capabilities and adapt to evolving regulatory landscapes.”

Asset owners are focused on spending on technology for portfolio analytics tools (51%) and compliance and regulatory reporting (48%).

Angelo Calvitto, head of Asia-Pacific at Northern Trust, said in a statement: “Many asset owners are leveraging service providers to scale their operations and focus on core activities, particularly in areas like administration for alternative investments. It’s clear that outsourcing is playing a key role in helping asset owners streamline processes and enhance overall operational performance.”

Austin added that asset owners want their data to be normalised and available in one place. He said: “Half the challenge is data integration and the other half is accuracy. Asset owners also need granularity on a daily basis.”

Michael Aldridge, president and CRO of private markets AI firm Accelex, said in an email that the Northern Trust figures illustrate how the spotlight is shifting from public to private capital markets. he said opacity has historically been a defining challenge of private investments but there have been significant breakthroughs in data accessibility, driven by AI and automation.

“As transparency improves, so too does investor confidence, ushering in a new era where private markets are no longer constrained by obscurity, but empowered by data-driven insights,” added Aldridge.