Euronext is launching the first mini futures to be cash-settled on European government bonds, which is said is the initial step to diversify into fixed income derivatives.

Stéphane Boujnah, chief executive and chairman of the managing board of Euronext, described the new futures as one of the most significant innovations in financial derivatives in recent years on the results call on 14 February 2025.

The mini futures are designed to provide greater accessibility and flexibility for retail investors, asset managers, and private investors. The derivatives will be introduced on the Euronext Derivatives Milan market in September 2025. They will be available on the Optiq trading platform, Euronext’s proprietary trading system, and supported by dedicated market makers and Euronext Clearing, Euronext said the launch of its own clearinghouse has enabled the group to launch innovative derivatives products.

Clearing revenue was up 19% to €144.3m in 2024, which the group said reflected the “successful and timely execution of the last steps of the pan-Europeanisation of Euronext Clearing.” Commodity derivatives on Euronext legacy markets were integrated following the Euronext Clearing expansion on 15 July 2024, and financial derivatives were integrated after 9 September 2024.

Anthony Attia, global head of derivatives and post-trade, said on the call: “This is a first step to diversify into fixed income derivatives, and there will be other steps.”

He said there had been client demand following the expansion of Euronext clearing across all of the group’s markets and due to the group’s “very strong” fixed income footprint in Europe through MTS, its bond trading platform.

“MTS combined with a very strong retail and institutional network, makes us the natural partner for clients who want to diversify into this asset class,” he added.

Fixed income

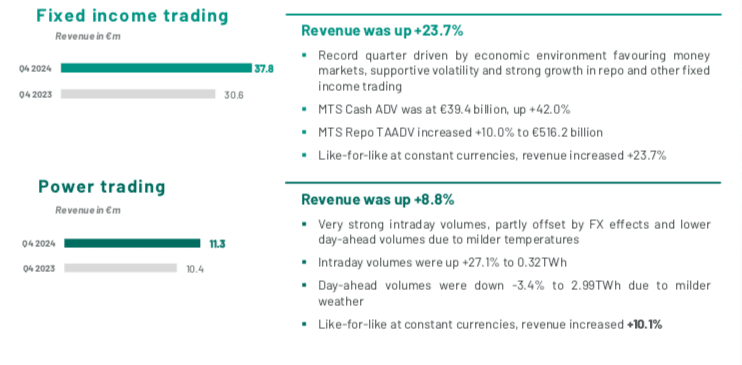

Giorgio Modica, chief financial officer of Euronext, said on the results call that fixed income continues to be a key contributor to top-line growth. Fourth quarter fixed income trading revenue grew by 23.7% from a year ago to reach a record €37.8m. For the full year, fixed income revenue reached €145.5m, up 35.5% from 2023.

“This increase reflects record quarterly volumes in MTS , cash and repo, driven by an economic environment favoring money markets,” said Modica.

He added that a number of elements contributed to the “stellar” performance of MTS. This included an increase in the number of co-located clients and an increase in the primary dealers on the platform.

“There is also increased traction on our dealer-to-dealer platform, MTS BondVision, which is now posting stronger performance,” he added. “The partnership with dealers is starting to bear fruit.”

Total trading revenue for the group grew 14.2% year-over-year to €559.4m, driven by record results in fixed income, foreign exchange and power trading and solid growth in cash trading revenue.

Investment

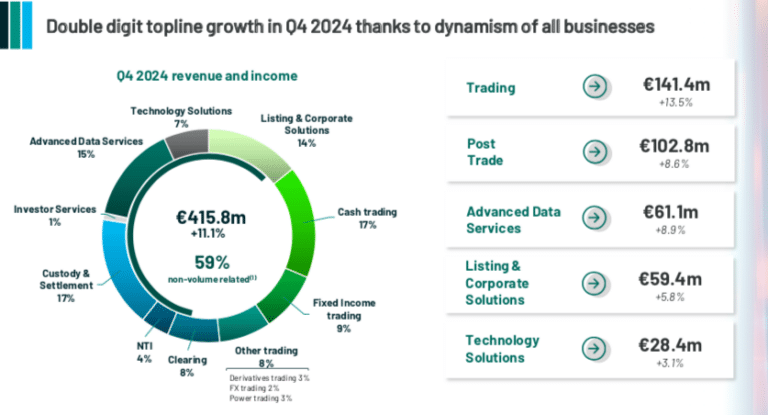

Euronext reported double-digit top line growth in the fourth quarter and for full-year 2024, which Boujnah said is the result of the diversification of the group’s business model and the successful expansion of its clearing house across Europe. Full year 2024 revenue and income increased 10.3% to €1.6bn.

Boujnah highlighted that for the first time, the group exceeded the “significant” threshold of €1bn in adjusted EBITDA, which he said is a testament to operational excellence and cost discipline.

In addition, Boujnah highlighted that non-volume related was the majority, 58%, of total group revenue in full-year 2024 and posted a “very strong” overall performance. In 2024 Euronext strengthened the non-volume business with acquisitions including Global Rate Set Systems (GRSS), a provider of services to benchmark administrators; Substantive Research, which provides data on investment research and Acupay Group, which provides financial reporting, corporate actions, cross-border tax relief and securities processing.

He continued that Euronext achieved key milestones that allowed the group to expand its presence across the entire capital markets value chain, following the completion of the integration of the Borsa Italiana Group. Boujnah said 2025 will be an “investment year.”

“We are building the foundations and investing to achieve the 2027 targets,” he added. “Euronext has promising growth opportunities ahead, which will further reinforce our position as the leading capital market infrastructure in Europe.”

Euronext has already made progress on its “Innovate for Growth 2027” strategy, according to Boujnah.

One priority in the strategy is to expand in power. On 28 January 2025 Euronext announced the signing of a binding agreement with Nasdaq to acquire Nasdaq’s Nordic power futures business which will be fully financed with existing cash, subject to regulatory approvals. Euronext said this will significantly contribute to the growth of its fixed income, currencies and commodities (FICC) trading and clearing business.

“This is a major accelerator for the Nordic and Baltic power futures market we have been developing, which is expected to go live in June 2025,” added Boujnah. “Clients will be able to test our offering as soon as March 2025.”

Trading of power futures will be operated from Euronext Amsterdam and will be cleared through Euronext Clearing. Existing open positions in Nasdaq’s Nordic power derivatives, currently held in Nasdaq Clearing will be transferred to Euronext Clearing, with approval of the members. Nasdaq Clearing, Nasdaq Oslo and their respective infrastructure are not included in the sale.

On 11 February 2025, Euronext also announced a new collaboration with Euroclear which it said is a first major step in expanding its Italian repo clearing franchise to a range of European government bonds. Euronext’s new repo clearing offering is due to roll out in June 2025, enabling the onboarding of clients including international banks, with an updated risk framework. Clients will be able to use Euroclear as a triparty agent for repo clearing.

Attia said the partnership with Euroclear Bank is non-exclusive, and a market standard for CCPs who want to grow into clearing over-the-counter derivatives, repo or interest rate swaps. He

“We allow our clearing members to optimize the way they deposit margins into the CCP, and it will be also supported by an extension of collateral accepted in the CCP,” he said. “In the future Euronext will be able to accept non-Euro collateral.”