Fredric Tomczyk moved from the Cboe board to become chief executive of Cboe Global Markets in September 2023. He succeeded Edward Tilly, who resigned from the company following the conclusion of an investigation led by the board of directors and outside independent counsel that determined he did not disclose personal relationships with colleagues, which violated Cboe’s policies.

Tomczyk said on the Cboe results call on 7 February that when he became chief executive, his priorities were to stabilize the organization after the sudden departure of the previous CEO, sharpen the strategic focus, bring a more disciplined approach to capital allocation and develop leadership for succession.

“The company now has a clear organic growth strategy, has moderated expense growth and stabilized margins, has an attractive return of capital strategy and a strong balance sheet as we enter 2025” he added.

Cboe has been through a lot of change in its executive ranks over the last 18 months, but Tomczyk believes the team is stronger and more unified.

“I have devoted considerable time to leadership development and succession and in the latter part of last year, the board engaged a search firm to more formally assist with the process,” he said. “We have reviewed internal candidates and are also considering external candidates with the search firm’s help.”

Tomczyk will continue to serve as chief executive until a successor is appointed, and will help to ensure a smooth transition before returning to being a director on the board. He explained that now is the right time for the search to give the organization more stability over a longer period of time and the board members have a list of qualities and characteristics that they are looking for.

“I would repeat we have a very strong team,” he added. “From my point of view, I completed what I set out to do when I stepped into the role in an unusual situation, and it’s now time for me to go back to the board.”

Derivatives

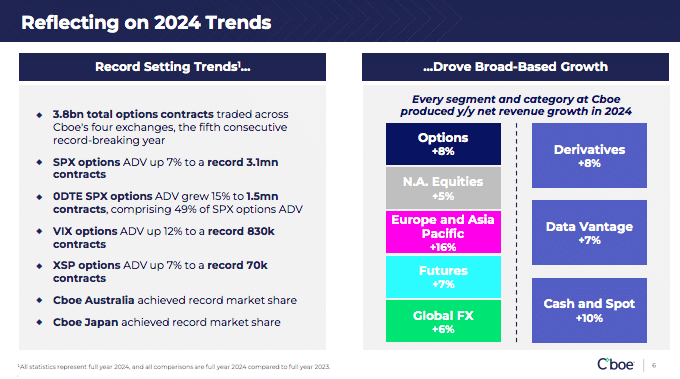

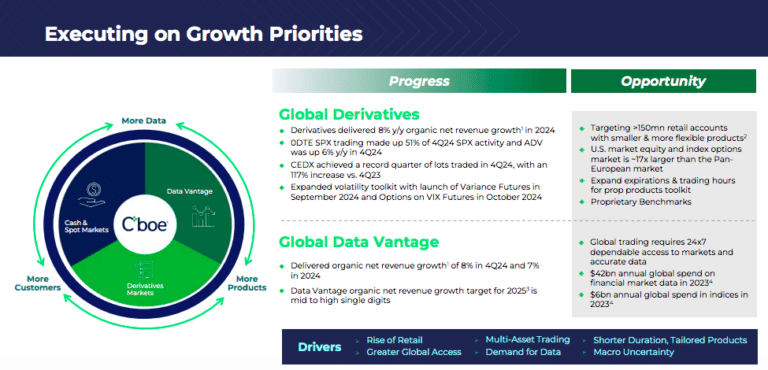

Derivatives markets net revenue was up 8% in 2024, driven by record volumes in options business. Total volume across Cboe’s four options exchanges in 2024 was 3.8 billion contracts, a fifth consecutive record-breaking year.

Average daily volume for S&P 500 (SPX) options was a record 3.1 million contracts in 2024, while average daily volume for VIX options, which allow investors to trade volatility, was a record 830,000 contracts.

Dave Howson, president of Cboe Global Markets, highlighted on the call that the growth in zero days to expiry (0DTE), or very short-term, options has led to 5these contracts making up over half of all SBX options average daily volume for the first time.

He continued that Cboe will be investing sales and educational efforts around the globe, which will translate to greater derivatives volumes being imported back to the US.

In Asia Pacific, Cboe will remain focused on expanding its presence in six priority markets of Japan, Australia, South Korea, Singapore, Taiwan and Hong Kong. During the fourth quarter of 2024, two new brokers turned on access in these priority markets, and two brokers also provide Malaysian investors with listed options.

“On the export side, we will continue to add capabilities with over 320 single-stock company options available to trade from 14 countries and record levels of open interest to finish 2024,” added Howson.

He said the right talent needs to be in place to drive success and on 5 February 2025, Cboe said it had hired Meaghan Dugan as head of U.S. options. She was previously head of options at the New York Stock Exchange, overseeing NYSE Amex Options and NYSE Arca Options markets. Prior to joining NYSE, she spent 11 years at Bank of America, including as head of product for U.S. electronic options and global future algorithms.

Dugan said in a statement: “I have long admired Cboe for not only its remarkable success in U.S. options, but also its ongoing expansion into a truly global derivatives powerhouse.”

Other recent appointments include Steven Jorgensen as head of derivatives sales for Europe and the Middle East and Jason Beck as senior director of derivatives sales, head of Florida and U.S. sell side. Cboe also grew its Asia Pacific derivatives sales team by appointing Hiroshi Okitsu (Tokyo), James Paik (Hong Kong) and Lydia Stringer (Hong Kong) as sales directors, and Vincent Wang (Singapore) as sales manager. In addition, Cboe recently expanded its derivatives market intelligence team under Mandy Xu, appointing Henry Schwartz as vice president and Ed Tom as senior director, Market Intelligence, with plans to add one more hire in the Asia Pacific region.

“We expect 2025 to be a transformational year as we leverage a strong bench of talent to provide customers with improved access, enhanced education and continued innovation around our volatility toolkit,” added Howson.

Tomczyk believes the strong performance of the US stock market will continue to attract domestic and international investors, and Cboe has a significant and growing opportunity to facilitate risk management and import foreign investment back into the US. He said: “That will be a top focus for us in 2025.”

In January 2025 S&P 500 Index (SPX) options traded an average daily volume of 3.46 million contracts, its second best month on record.

SPX options set individual trading records related to short-dated options and global trading hours activity, including:

•On January 31, 2.42 million zero days to expiry (0DTE) SPX contracts traded, the most 0DTE contracts traded in a single day.

•On January 27, 253 thousand SPX contracts traded during Cboe’s global trading hours (7:15 PM to 8:25 AM CT), a new record for the trading session.

Retail

Cboe index options are now available to all customers at Robinhood, the US brokerage for retail investors, and Tomczyk believes that retail adoption of index options “still has room to run.”

Howson said the Robinhood launch in the fourth quarter of last year exceeded expectations as it has been quicker than expected, and uptake has been greater than expected.Robinhood has nearly 25 million funded accounts, and only 4% penetration for options according to Howson.

He said: “That’s a really solid runway for us to continue to access throughout 2025.”

Technology

Over the last year Cboe has reallocated capital resources to investment in its technology platform. Last month the group unveiled a new brand identity for its technology platform, Cboe Titanium.

“Cboe Titanium enables innovation across our markets, products, data and insights on a unified and scalable global technology platform,” Tomczyk added. “In every new market we have entered, our market share has improved following a migration to Cboe technology.”

The group anticipates completing the final migration of its Canadian market to Cboe technology on 3 March 2025. Tomczyk said the group has changed its capital allocation to focus less on M&A and more on organic growth opportunities.

“Following the completion of the two technology migrations this year, this will be the first time in 10 years that our technology resources will be fully focused on the business as opposed to focusing on migrations,” he added. “Redeploying our technology resources enables us to leverage one of our greatest strengths.”

Howson said the uptick from the launch of dedicated cores in 2024 had exceeded expectations. Dedicated cores allows members and sponsored participants to host their specific logical order entry ports on their own CPU core(s), rather than sharing a core(s), which reduces latency, enhances throughput and improves performance. Chris Isaacson, chief operating officer at Cboe, told Markets Media in November 2024 that the introduction reduced latency on Cboe’s US equity exchanges by 60%.

Dedicated cores is being rolled out across Europe and Australia in the first quarter of this year, which Howson said highlights Cboe’s ability to take a product working well in one region and replicate that success across its global network.

“With our technology team shifting from migration work to revenue generating activities, we look forward to further product development that leverages our scale infrastructure,” Howson added.

Financials

Cboe reported record net revenue of $2.1bn for full year 2024, up 8% from 2023.

Tomczyk said: “I’m incredibly pleased with the strong 8% net revenue growth in 2024 coming against a modest 6% increase in adjusted expenses, stabilizing our margins and driving a 10% improvement in adjusted diluted earnings per share for the year.”

He added that while the robust options volumes were a “standout” for 2024, the results were notable in that each category – derivatives markets, Data Vantage, and cash and spot markets – contributed to the fourth quarter and full year growth.

Data Vantage net revenue grew 7% in 2024, and cash and spot Markets net revenue increased 10% for the full year.

Cboe anticipates organic total net revenue growth will be in the mid-single digit range in 2025 and Data Vantage organic net revenue growth will be in the mid- to high-single digit range this year.

“We believe that we are well positioned for the secular trends that we expect to continue shaping the markets globally, the rising popularity and adoption of options trading, the continued rise of the retail investor, the globalization of markets and the rapidly evolving area of technology and data management, including newer technologies like artificial intelligence,” added Tomczyk.