In January 2025 ICE said it had acquired the American Financial Exchange (AFX), an electronic exchange for direct lending and borrowing for American banks and financial institutions, from private equity firm 7RIDGE.

AFX operates the credit-sensitive American interbank offered rate, AMERIBOR. The daily rate is based on unsecured interbank loans executed on AFX by more than 1,000 American banks and financial institutions.

Jeffrey Sprecher, chair and chief executive of ICE, said on the results call on 6 February 2025 that AFX focused on regional, mid-size and community bank customers, covering many of the same customers that ICE serves through its mortgage technology business.

“This makes AFX a natural fit at ICE and complements both our mortgage network and ICE’s growing index business,” said Sprecher. “Much like our strategy in other asset classes, we are leveraging our data, technology and expertise to bring efficiencies to the entire mortgage manufacturing workflow.”

Christopher Edmonds, president of ICE fixed income and data services, said on the call that the addition of AFX means users do not have to leave the ICE ecosystem in order to manage risk. He said: “It’s still early days but we look forward to growing that business, like we have with many other products throughout the history of the company, as it fits hand in glove with other pieces that we have.”

Sprecher said ICE’s acquisition of Interactive Data Corporation IDC in 2015 was instrumental and laid the foundation for the move into fixed income markets, which has evolved into nearly 500 institutional-grade data products.

“That move continues to deliver compounding revenue growth as fixed income markets automate and passive investing grows,” added Sprecher. “ETF assets benchmarked to our indices grew to $648bn at the end of 2024 from less than $100bn in 2017.”

Sprecher said ICE will continue to make strategic decisions to position itself for success in fixed income. In 2024 ICE announced an intention to launch a clearing service for US Treasuries and repos, using its infrastructure and expertise in centralized clearing.

Ben Jackson, president of ICE and chair of ICE Mortgage Technology, said on the call that ICE remains focused on continuing to leverage its deep expertise in gathering and cleansing unstructured data to develop actionable insights and add transparency, not only in fixed income markets, but across asset classes.

For example, in 2024 ICE integrated property and loan level mortgage data with its property-level climate risk metrics covering more than 100 million US homes. ICE also went live with its mortgage-backed securities (MBS) indicator, which uses ICE data services and mortgage technology to produce daily trading signals for more than 900,000 agency and residential MBS.

Futures and options

ICE traded more than two billion futures and options in 2024, the highest volume year in ICE’s history, including a record 1.2 billion commodity contracts and an all-time high of 753 million interest rate contracts.

Jackson said the strong performance contributed to the twelfth consecutive year of record futures revenue in 2024, which grew 20% year-on-year, including 15% in the fourth quarter.

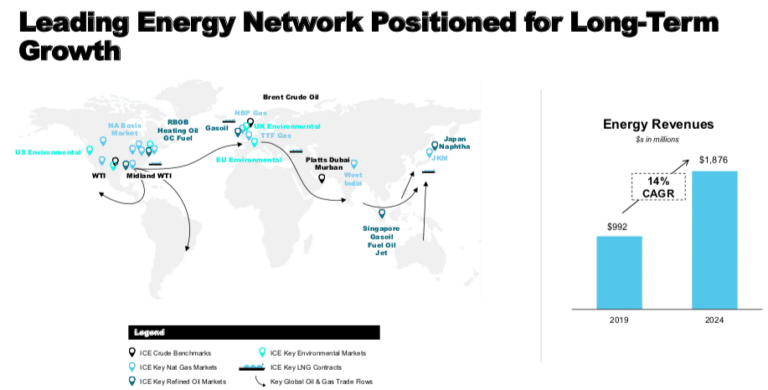

In energy markets, revenue growth has averaged 14% annually over the last five years, reaching a record $1.9bn in 2024, up 25% year-over-year. The segment was boosted by the highest volume year for total oil contracts trading.

ICE’s global oil offering sits alongside its global natural gas markets according to Jackson, where globalization is underpinned by the rise of liquefied natural gas, or LNG. He said demand for natural gas continues to grow and is likely to be sustainable due to secular growth in overall energy demand, increased power demand for more data centers and the move from coal to gas as a cleaner fossil fuel.

“Our natural gas business delivered another year of record revenues in 2024, increasing 30% versus 2023,” said Jackson. “This strong performance was led by record revenues in our TTF benchmark, which we have positioned as the Brent of natural gas.”

Sprecher believes energy demand, particularly in Asia, together with increases in US energy exports and the multi-decade energy transition all point to the growing use of market-based commodity pricing and risk management tools while continuing to stimulate trading in equity markets.

ICE launched environmental markets nearly two decades ago and Jackson said they are critical for customers to navigate the clean energy transition. Record volumes across the complex were up 39% year-over-year, led by another record-setting year in North America.

“These record volumes represent the equivalent of over $1 trillion in notional value for the fourth consecutive year, and contributed to a 40% increase in environmental revenues in 2024 versus the prior year,” said Jackson.

Financials

Sprecher said on the call that the group had reported its nineteenth consecutive year of record revenues and continued earnings per share growth.

He highlighted that when ICE went public in 2005 it was purely an energy exchange with a handful of products, and was on track to generate $156m in annual revenue.

The group’s net revenues for 2024 were $9.3bn, up 16% year-on-year. This included exchange net revenues of $5bn, up 12% year-over-year; fixed income and data services revenues of $2.3bn, an increase of 3% year-over-year; and mortgage technology revenues of $2bn.

In the exchanges segment, fourth quarter net revenues rose 9% year-over-year to $1.2bn driven by record revenues across interest rates and the global energy business. For January 2025, ICE reported record total average daily volume (ADV) up 21% year on-year with open interest up 11% over the same period. This included record ADV for energy and oil contracts.

Operating income for the group was a record $4.3bn in 2024, a 17% year-on-year increase. Full-year 2024 consolidated net revenues were $9.3bn, up 16% year-over-year.

Warren Gardiner, chief financial officer, said on the call: “Our strong and growing cash flows enabled us to reinvest in our business and pay dividends of over $1bn to stockholders while also significantly reducing leverage. As we enter 2025, we are well positioned to achieve our growth objectives and to invest in our business to strengthen our foundation for continued growth in the future.”