D2X has launched the first MiFID-regulated crypto futures and options exchange which operates seven days a week, while GFO-X, the UK’s first regulated and centrally cleared trading venue for digital asset derivatives, has announced strategic partners before going live in the first quarter of next year.

Netherlands-based D2X was founded in 2021 and in March this year the firm said in a statement that it had become the first entity in the European Union to obtain a multilateral trading facility (MTF) license for crypto derivatives under the MIFID regulation. The Dutch Authority for Financial Markets has approved D2X to operate a regulated trading venue for cash-settled crypto futures and options.

Laetitia Grimaud, co-founder and head of growth at D2X, said the firm spent a fair amount of time deciding on where to apply for regulatory approval. D2X chose the Netherlands, where the company is located, because the Dutch regulator knows a lot about derivatives and market infrastructure.

“We were the first to put crypto components in our application and we had to explain to the regulator how our products fall within the remit of MiFID, as they could have disagreed,” she said.

The regulator also looked very carefully at D2X’s risk model because the venue was built in-house using proprietary technology and is open seven days a week. Grimaud said the firm has designed an innovative liquidation algorithm.

“I think the regulator appreciated that Ernest van Der Hout, our chief risk officer, is very seasoned and experienced,” she added.

Der Hout previously spent nearly 12 years at LCH.Clearnet, part of the London Stock Exchange Group, including a role as group head operational and enterprise risk, and was also formerly head of financial surveillance at Euronext.

Grimaud argued that a differentiator for D2X, when compared to regulated incumbents, is that the venue is open seven days a week, like crypto markets. She said that a differentiator, when compared to crypto-native exchanges, is that D2X is regulated, robust and has strong market surveillance.

Theodore Rozencwajg, co-founder at D2X, said in a statement: “Institutional demand for regulated exchanges has never been higher and we are witnessing a truly unique moment for crypto. Market participants should not have to choose between regulatory compliance or seven days a week trading, and D2X solves this.”

In March this year D2X also closed its $10m Series A funding round led by Steve Cohen’s Point72 Ventures.

Adam Carson, partner at Point72 Ventures, said in a statement: “D2X’s dedication to providing a regulated trading venue for institutions, coupled with their innovative approach, has the potential to make transformative changes in the industry. “

Grimaud continued that D2 does not have a clearing house, so it is able to be more agile when listing products. Instead, D2X offers cash collateral management services in partnership with a Tier-1 EU credit institution, which features off-exchange collateral and mitigates counterparty risk.

Crypto-native exchanges also offer perpetual futures, but D2X has launched with cash-settled boitcoin-euro and ether-euro calendar futures. On the first day of trading participants on D2X included Flow Traders, Basis Capital Markets and Algorithmic Trading Group according to the firm. D2X will offer perpetual futures at some point but the product is not on the immediate roadmap, according to Grimaud.

“Today there is a very big gap in having a robust and regulated exchange that can offer crypto options,” she added. “Options volumes will continue to boom next year.”

US dollar-denominated calendar futures and options are scheduled for early 2025.

Grimaud said: “Our model is a hybrid between what you will find on CME Group and what you will find on crypto-native exchanges, with an array of safeguards that have been put in place.”

GFO-X

In the UK, GFO-X said in a statement that ABN Amro Clearing, IMC, Standard Chartered Bank and Virtu Financial have become strategic partners. The UK’s first regulated and centrally cleared trading venue dedicated to digital asset derivatives is due to launch in the first quarter of 2025.

Arnab Sen, chief executive and co-founder of GFO-X, said in a statement: “It demonstrates the need for a highly regulated venue to bring additional depth, breadth, and diversification to the current limited choices in centrally cleared digital asset index derivatives. We believe the digital asset derivatives market will grow exponentially over the coming years.”

GFO-X has partnered with LCH, the clearing arm of London Stock Exchange Group, and will use LCH DigitalAssetClear’s clearing services

Andy Ross, global head, prime & financing, financing & securities service at Standard Chartered, said in a statement: “We’re delighted to support the launch of GFO-X derivatives and to join LCH SA as a general clearing member to enable our clients to trade and clear.”

Crypto derivatives volumes

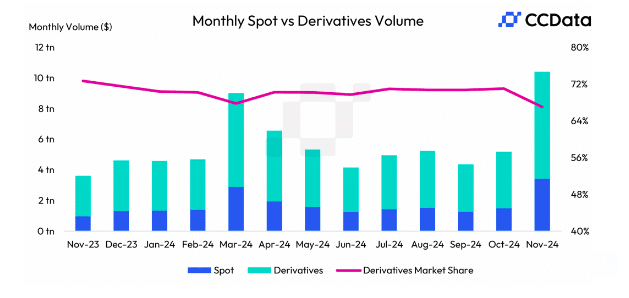

In November this year, crypto derivatives volumes on centralized exchanges climbed 89.4% to $6.99tn, surpassing the previous all-time high set in March this year, according to CCData. The data provider said this was fueled by heightened confidence in the asset class following the US presidential elections with regulation expected to become more friendly under the new administration.

Total crypto derivatives trading volume on CME Group rose 83.7% to $245bn in November, an all-time high in monthly trading volume for the exchange, according to CCData.

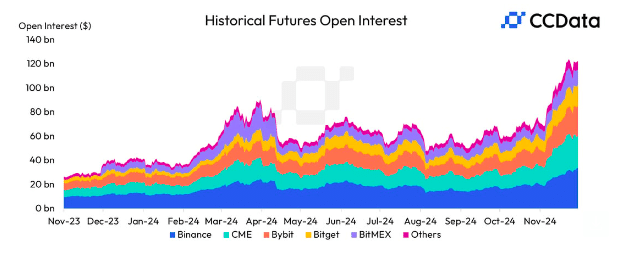

Open interest on centralized derivatives exchanges increased 67.1% to $129bn, according to CCData, as traders capitalized on the positive price action of digital assets including Bitcoin which recorded an all-time high. CCData said in a report: “This milestone also marked an all-time high for open interest across all instruments on centralized exchanges.”

Yuval Rooz, chief executive and co-founder of technology company Digital Asset, said in an email that he expects 2025 to be a defining turning point for both traditional finance and crypto.

“We’ll see exchanges and custodians on the crypto side address the privacy shortcomings of public permissionless networks to unlock the full potential of tokenized real-world assets – to increase the maturity and institutional liquidity in crypto trading markets,” he added.

Rooz predicted that spot and derivatives trading and on-chain repo will double in volume. He gave the example of fintech Broadridge facilitating between $100bn and $150bn of daily repo transactions and said this could reach $500bn per day by the end of 2025.

“I believe that assets like crypto derivatives will be trading double as a result of being able to move new and diverse forms of collateral with privacy – both in and out of exchanges and with new bilateral margin capabilities too,” said Rooz.