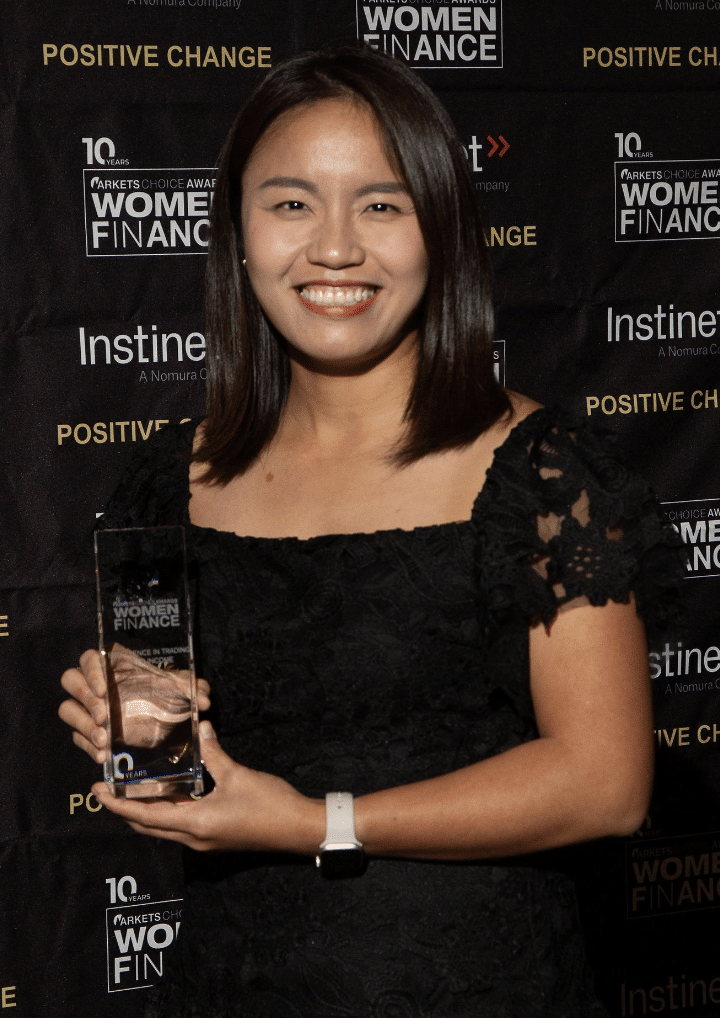

Sophie Nguyen, Head of Investment Grade Trading, AllianceBernstein, won Excellence in Trading – Fixed Income at Markets Media Group’s 2024 Women in Finance (U.S.) Awards.

What is your reaction to winning the Award?

I was very surprised and honored to hear I was nominated for the Excellence in Fixed Income Award. I have spent my entire (short) career trading bonds, so it was nice to be recognized for it :).

Please tell us about your role and your daily responsibilities.

As the Head of Investment Grade Trading at AB, I am responsible for managing our daily flows, building sell-side relationships, as well as working with PMs and analysts to recommend trade ideas across all our strategies. I also work with our technology team to build tools that improve our trading ecosystem and investment process. At AB we pride ourselves at being at the forefront of market structure and trading technology developments. A big part of my job is making sure that continues and we help develop new trading protocols in the fixed income markets. I have a wide array of responsibilities, but ultimately, my goal is to help put our Fixed Income team in the best position to generate alpha for our clients.

What have been the main drivers of your success?

I was born and raised in Vietnam. Since I left the country when I was 18, I’ve realized how lucky I am to have the opportunity to see the world and because of that, the greatest driver of my success is my desire to take advantage of the opportunities I have and work my hardest. Day in and day out, I try to challenge myself and get out of my comfort zone. I also believe that discipline is the key to success.

Another driver of my success is that I want to work to benefit not just myself, but also my broader community, which gives me a sense of purpose and motivation.

What fixed income trading trends do you see?

From my perspective as an investment grade trader, I have seen electronic trading and portfolio trading gain a significant share of trading volumes in recent years. I can still see a lot of growth ahead in this area as dealers continue to invest in technology and asset managers get more comfortable with portfolio trading and trading larger notional in comp.

Trading is a part of investment process. Technology has solved lots of frictions but many still exist. To really elevate fixed income trading and the whole fixed income market to the next level, it takes buy-in and willingness to change your investment process and be more dynamic. At AB, we have a unique setup where we work very closely with PM team and this gives us an edge in getting to that end state.

How are innovative technologies shifting behaviors within fixed income markets?

Technology has undoubtedly improved many areas within fixed income markets, similar to its impact on many other markets and industries. Technology arms market participants with better analytic tools to react to the market faster. Every aspect of the investment process has become more efficient. Fixed income markets are more fragmented than equity markets so technology has been able to help with processes around fund flow investing, security selection, portfolio construction, and optimization. From a trading standpoint, this leads to more liquidity and transparency, as well as less price slippage among other benefits.

That said, the fixed income market in some ways might be becoming complacent that these have fixed the liquidity issues. The low volatility of the past few years may have also overstated the impact of some recent advancements. Regardless of the technological progress, it’s still an over-the-counter market and traders can still add value.