The $12bn acquisition of private credit manager HPS Investment Partners follows BlackRock buying GIP, eFront and potentially Preqin as it looks to scale in private debt, which it has identified as a structural grower.

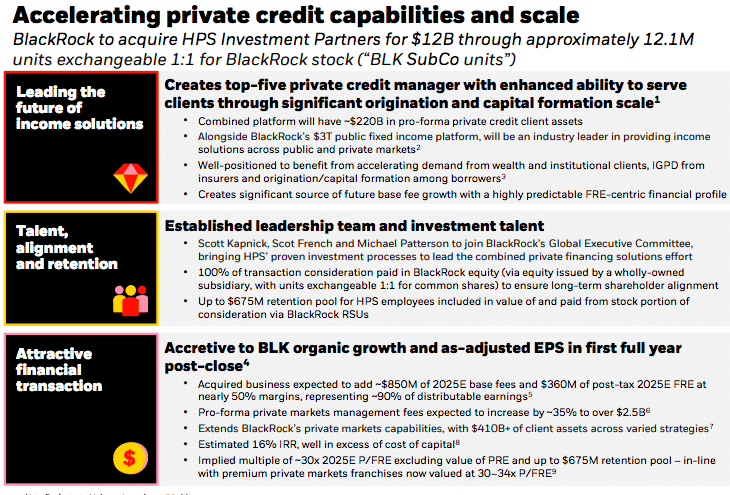

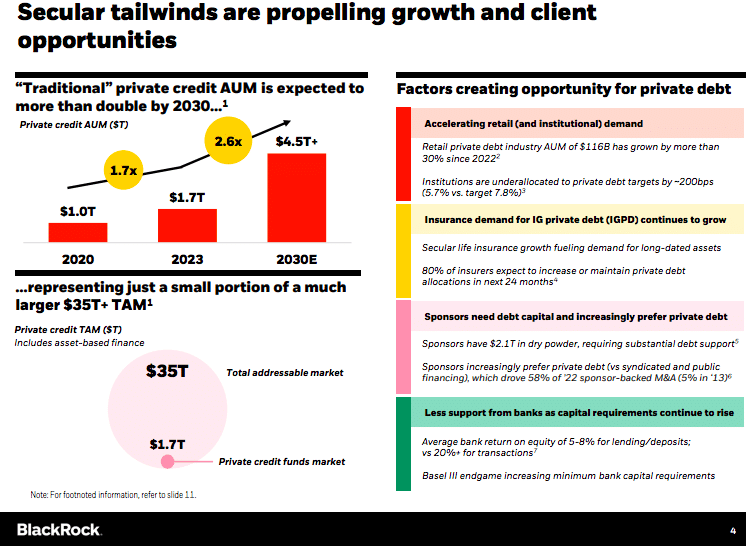

On 3 December, BlackRock said in a statement that it has agreed to a $12bn acquisition of HPS Investment Partners, which has approximately $148bn in client assets, with 100% of consideration to be paid in BlackRock equity. The combination creates an integrated private credit franchise with approximately $220bn in client assets according to BlackRock. The asset manager expects the private debt market will more than double to $4.5 trillion by 2030.

Larry Fink, chairman and chief executive of BlackRock, said on a conference call on 3 December that the asset manager only wanted to buy HPS in the private credit space. Fink argued that BlackRock stands at the intersection of public and private markets as clients increasingly want a blend of public and private investments.

Fink said: “Today, we are building portfolios that are seamlessly integrated across public and private for our clients and we have seen this barbell in public and private equity for many years. Now we see the blending of public and private credits as standard for long-term, durable fixed income portfolios.”

In the third quarter BlackRock reported that iShares had surpassed $1 trillion in fixed income ETFs, and Fink said the next stage of growth is providing private and public solutions across the firm’s $3 trillion diversified fixed income platform.

HPS was originally formed in 2007 as a unit of Highbridge Capital Management, a subsidiary of JPMorgan Asset Management. In March 2016 the principals of HPS acquired the firm from JPMorgan, which retained Highbridge and the hedge fund strategies. The firm continues to be led by its founders and long-term governing partners Scott Kapnick, Michael Patterson, Scot French, Purnima Puri, Faith Rosenfeld, Paul Knollmeyer, and Kathy Choi.

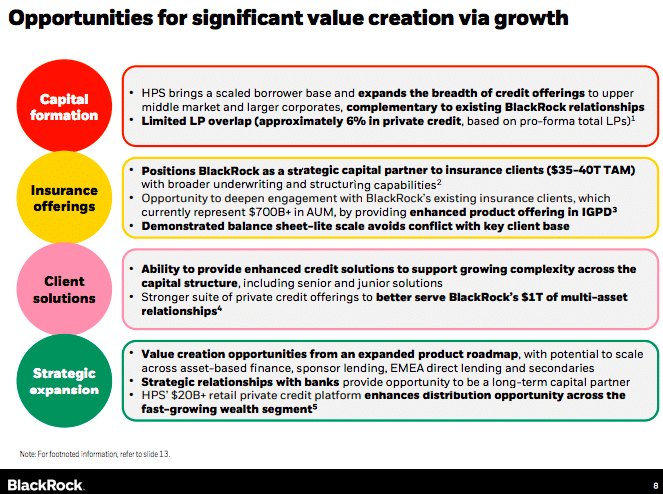

Scott Kapnick, chief executive of HPS, said on the call that the opportunities from the combination are “enormous.” For example, HPS is not present in Europe.

Kapnick said: “Together, we are going to be a huge force in both public and private markets, shaping the next decade.”

He was chief executive and chairman of the executive committee of Highbridge Capital Management between 2013 and 2016. Before HPS, Kapnick was a management committee member, partner, and co-head of global investment banking at Goldman Sachs between 2001 and 2006. He described HPS as a leader in asset-backed finance and said the firm could add additional power to BlackRock’s existing private market data.

“This is an all-stock acquisition,” Kapnick added. “You don’t need to know anything more than that from me about what I think about this.”

HPS had twice previously considered going public, but Kapnick argued that the partnership with BlackRock will be “extremely powerful” as a leader in the asset-backed finance space.

Fink said that in asset-based finance, banks are finding value by partnering with capital market players who can bring financing, underwriting and structuring expertise.

“This enables us to maintain customer relationships without the need to grow their increasingly costly balance sheets,’ he added. “We see this as a significant opportunity in the $30 trillion-plus market where private credit holds only a 5% share today.”

The combined platform will have broad capabilities across senior and junior credit solutions, asset-based finance, real estate, private placements, and collateralized loan obligation (CLOs). BlackRock and HPS will form a new private financing solutions business unit led by Scott Kapnick, Scot French, and Michael Patterson.

Fink agreed that HPS was highly complementary to BlackRock and said the deal will lead to the formation of a top-five private credit manager. He highlighted the insurance sector as an area of growth as HPS is a leading independent provider of private credit for insurance clients.

Martin Small, chief financial officer of BlackRock, agreed on the call that the insurance sector presented the biggest opportunity as the combination will be able to offer public fixed income, private credit, a fully outsourced solution or technology to help them understand and better manage risk.

Small continued that insurance companies have more than $700bn of assets with BlackRock, which has nearly doubled in the last five years, and every single firm wants to enhance yield by increasing its allocation to private credit.

“Even if our existing clients allocate 10% of their accounts, or $70bn, to private credit that is a great outcome,” added Small.

There are also opportunities to introduce more alternative investments to wealth management and retail clients. BlackRock said the acquisition is expected to increase private markets fee-paying assets under management by 40% and management fees by about 35%. The transaction is also expected to be modestly accretive to BlackRock’s as-adjusted earnings per share in the first full year post-close, with closure expected in mid-2025.

Private market acquisitions

BlackRock has made previous acquisitions to expand in alternatives. Small said BlackRock is building around structural growers – ETFs, Aladdin, model portfolios and private markets, especially private debt. As a result, BlackRock has made strategic moves in the last year to enhance capabilities across investments and data to meet clients’ growing allocations to private markets.

“Today’s announcement is an accelerant to our ambitions to lead the fixed income portfolio of the future,” added Small.

In June this year when BlackRock announced its £2.55bn acquisition of Preqin, an independent provider of private markets data,Fink said he believed the asset manager can lead the indexing of private markets in the same way that indexing has become the language of public markets, The Preqin deal has yet to close.

On 1 October, BlackRock completed the acquisition of Global Infrastructure Partners (GIP), an independent infrastructure manager with more than $170bn in assets, which had been announced at the beginning of this year.

Fink said on the call that the opportunities from combining with GIP have already exceeded the “high expectations” that were identified at the time of the deal. He took part in the call from Singapore and said his recent travels in Asia has shown the enormous need to finance infrastructure, which will lead to further growth of private credit.

“I see this as a unique and very timely opportunity to really transform this opportunity,” said Fink.

Small highlighted that the GIP acquisition only completed two months ago and described the integration as “excellent.” He said: “This gives us the experience to recreate that with HPS.”

For example, in September this year BlackRock, GIP, Microsoft, and MGX, an artificial intelligence and advanced technology investor, announced the Global AI Infrastructure Investment Partnership to invest $100bn investments in new and expanded data centers to meet growing demand for computing power, as well as energy infrastructure to create new sources of power for these facilities, chiefly in the United States. The partnership will seek to unlock $30bn of private equity capital from investors, asset owners, and corporates, in order to mobilize up to $100bn in total investment potential, including debt financing.

In 2019, BlackRock also purchased eFront, an end-to-end alternative investment management software and solutions provider to allow investors to seamlessly manage portfolios across public and private asset classes on a single platform by integrating with Aladdin, BlackRock’s technology platform.

Fink said: “Our Aladdin technology, including eFront, and soon Preqin, will make access to private markets simpler and more transparent.”

Tim Clarke, lead private equity analyst at data provider PitchBook, said in an email that the HPS deal caps a furious year in M&A transactions involving alternative asset managers. The value of announced deals so far this year has reached $42.6bn, double the prior record of $21.2bn in 2015.

“The HPS deal is tied for the second largest alternatives deal ever, only beaten by BlackRock’s $12.5bn acquisition of Global Infrastructure Partners announced in January,” added Clarke. “This catapults BlackRock into the fifth largest manager of private debt funds, an area which has been a hotbed of M&A this year and robust assets under management growth that has averaged 14.4% over the last 10 years and surpassed $2 trillion in size earlier this year.”

As part of the transaction Kapnick, French, and Patterson will join BlackRock’s global executive committee and Kapnick will be an observer to the BlackRock board of directors.

Perella Weinberg Partners was lead financial advisor to BlackRock. Morgan Stanley was also financial advisor, with Skadden, Arps, Slate, Meagher & Flom and Clifford Chance LLP acting as legal counsel.

J.P. Morgan Securities was lead financial advisor to HPS, with Goldman Sachs, BofA Securities, Deutsche Bank Securities, BNP Paribas, and RBC Capital Markets acting as co-financial advisors. Fried, Frank, Harris, Shriver & Jacobson was legal counsel.