High levels of acquisitions are expected in the outsourced chief investment officer (OCIO) industry according to research provider Cerulli.

A report from Cerulli, U.S. Outsourced Chief Investment Officer Function 2024, said the concentration of assets among the largest providers is expected to increase as industry-wide and idiosyncratic factors drive further consolidation. US assets managed by OCIO providers reached $2.9 trillion at the end of 2023 and Cerulli projected they will reach $4.2 trillion by the end of 2028, reflecting an average annual growth rate of 7.9%.

For example, in September this year the Shell Pension Fund Foundation (SSPF), which had €27bn in assets at the end of last year and more than 30,000 participants, said in a statement it has decided to appoint BlackRock as its fiduciary manager for asset management.

“SSPF’s assets will be managed by an experienced BlackRock team, leveraging the scale and global expertise of the world’s largest asset management company,” said the statement. “Moreover, BlackRock adds relevant experience with the design of the portfolio for the new pension scheme with several other clients.”

In May this year Goldman Sachs Asset Management said in a statement it had been appointed by the UPS pension plan fiduciaries to provide investment management services for UPS’s US and Canadian defined benefit pension plan assets. UPS’s North American pension plans had a combined $43.4 bn in assets as of March 31, 2024.

Marc Nachmann, global head of asset & wealth management at Goldman Sachs, said in a statement: “Outsourced CIO solutions can deliver investment excellence, economies of scale and enhanced risk management while allowing corporate and pension plans of all sizes to focus on their core business.”

Large-scale OCIO providers, above the 90th percentile in assets under management, account for 61% of global OCIO assets, up from 49% in 2017 according to Cerulli.

Chris Swansey, associate director at Cerulli, said in a statement that an OCIO provider needs sophisticated investment capabilities, expertise working with large client portfolios, and a well-established investment team in order to gain scale among institutional investors. “Acquiring a well-established institutional OCIO provider may help RIAs expand into the channel and gain access to better alternative asset capabilities for their private wealth clients,” he added.

In addition, the rising costs of technology, compensation, and regulatory/compliance requirements have put pressure on many OCIO providers. As a result smaller providers have also shown an interest in selling all or a portion of their businesses.

“Acquisitions from outside entities such as RIAs and private equity firms could lend resources to these providers that enable them to build new market advantages,” said Swansey. “As large providers gain scale and smaller providers entrench themselves within niche markets, middle-market providers will need to differentiate their value.”

Endowments and foundations

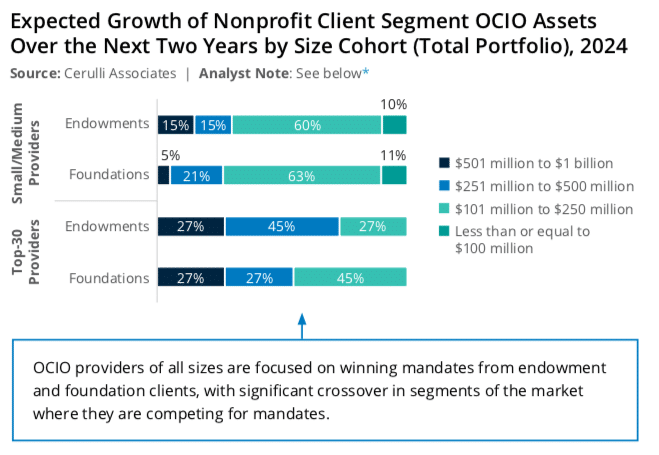

Cerulli continued that endowment and foundation clients are one of the only client channels where both large and small OCIO providers can compete for assets.

The majority, 60%, of endowments with between $100m and $250m in AUM already use an OCIO provider and there has been an increase in the number of large institutions with more than $1bn in assets adopting the OCIO model.

Endowment assets managed by OCIO providers are expected to grow 11.3% annually over the next five years, according to Cerulli.