Cboe Global Markets has reduced latency on its US equity exchanges by 60% by introducing dedicated cores, and expects similar results when the new architecture is rolled out to its overseas markets.

In the first half of this year dedicated cores was rolled out across Cboe’s four US equity exchanges. Dedicated cores allows members and sponsored participants to host their specific logical order entry ports on their own CPU core(s), rather than sharing a core(s), which reduces latency, enhances throughput and improves performance. Dedicated cores is an optional service and Cboe will continue to offer shared access, as some customers will always want that service.

Chris Isaacson, chief operating officer at Cboe, told Markets Media: “Customers wanted something that’s faster, more consistent, and where they have greater control to help them better define their own trading experience.”

Performance improved by 60% after the introduction of dedicated cores, according to Isaacson. Latency was reduced from 50 microseconds to 20 microseconds which he described as the biggest improvement that Cboe has delivered in its US equity markets in at least five years. The reduction excludes the latency equalisation inside the data centre, which provides for the same latency regardless of the location of a client’s server.

“The improvement in performance exceeded our expectations by more than two times, and customer demand has been greater than double our expectation as well” said Isaacson. “We are really pleased.”

A majority of volume and customers are using dedicated cores and Isaacson said customers of all types have migrated. He said some customers have provided feedback saying they have changed their routing behavior because they can now get better fills and greater consistency at Cboe.

“There will be many further improvements that we are going to make,” added Isaacson. “This was a large improvement that had an outsized impact on what customers had expected.”

Isaacson continued that Cboe has a technology platform that operates all of its exchanges around the world so it is globally consistent but locally optimized. Dedicated cores is due to be rolled out in Europe in the fourth quarter of this year, in Australia in the first quarter of 2025 and then in Japan using local data centres. He expects a similar improvement in performance as in the US.

“We build once and we deploy globally,” he added. “Dedicated cores is one of our initiatives to continue to move our leading edge technology platform forward.”

In the third quarter of this year Cboe reported that its US equities exchanges had a market share of 10.9%, compared to 12.7% in the third quarter of 2023 given higher industry off-exchange and closing auction share. Cboe’s US equities off-exchange market share was 17.7%, down from 19.9% in the third quarter of 2023.

Options

In August this year Cboe also introduced new architecture to access one of its four options markets, which have a very different market structure from equities. The new architecture and protocol includes a single gateway per matching engine and a new version of its binary order entry protocol, which Isaacson described as a “major change.”

Although improving speed was one factor, Isaacson explained that the change was more about giving customers a more consistent experience to quote and access liquidity.

“We expected to see a dramatic improvement in the consistency, as well as the efficiency, of messaging,” he added. “We want messaging to be as efficient as possible to allow for further growth in the overall ecosystem.”

As options are a quote driven market, versus an order driven market like equites, there are far more messages. On any given day Cboe processes 100 billion quotes across its four options markets according to Isaacson. Across the entire US options market, there can be between 500 billion to 1 trillion quotes in a single day.

“Options market share in October was the highest since February and messaging came down by about a third,” said Isaacson. “The change has allowed us to provide new insights into trading.”

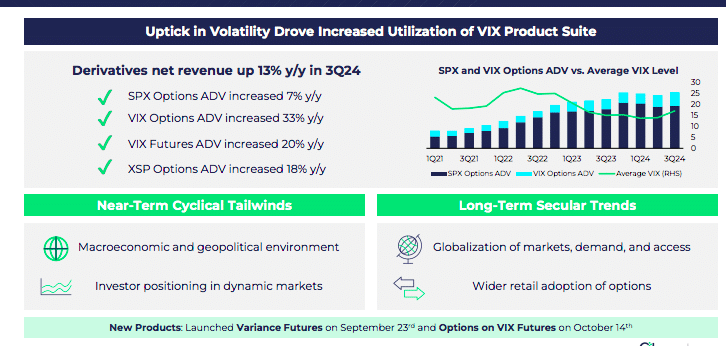

In the third quarter Cboe reported that options had record net revenue of $320.9m, up 10% from the third quarter of 2023. Cboe’s options exchanges had a total market share of 30.5%, compared to 33.6% a year ago, which it said was a result of lower multi-list market share as compared to the third quarter of 2023.

Time stamping service

In October this year Cboe launched the time stamping service for its four US equities exchanges.

Clients can subscribe for additional timestamp information in the Missed Liquidity report and the Cancels report, which Isaacson said gives them greater insight into their trading behavior and performance on the respective exchange .

“This provides better telemetry of our markets to give insight to our customers about how they can improve their trading,” he added. “We view leading edge technology as one of our strengths, and we will continue to invest because we think it helps empower and drive the business.”