Bitnomial, a regulated digital asset derivatives exchange, is looking for regulatory approval to offer perpetual futures trading in the US as EDXM Global intends to launch a venue for these contracts in Singapore.

On Bitnomial investors can trade physically settled crypto futures and options with leverage on an exchange that is regulated by the Commodity Futures Trading Commission. The firm also has a CTFC-regulated clearinghouse and brokerage subsidiaries as it was founded in 2014 to connect native digital asset hedgers with institutional traders.

In October Bitnomial said in a statement it plans to launch Botanical, which would be the first regulated perpetual futures trading platform in the US. Perpetual futures do not have an expiry date and allow traders to speculate on the underlying asset prices indefinitely. The new contracts will be listed on Bitnomial Exchange and cleared through its regulated clearinghouse, but Botanical provides a trading front end to retail customers that want a trading experience that they are used to in DeFi (decentralized finance).

Michael Dunn, president of Bitnomial Exchange, told Markets Media: “We have to go through a lot of regulatory hurdles but will be working day and night to get it over the line.”

For example, the CFTC will need to be comfortable with the pricing and clearing structure, and the new contract’s risk profile, as they would with a traditional finance contract.

Crypto research provider CCdata said in a report that following the US presidential election there is a new wave of optimism around digital asset regulation.

“The election outcome hints at a more constructive climate for regulatory conversations and the potential for comprehensive frameworks in the U.S“ added CCData. “With the Senate now leaning right – a historically tough spot for digital asset policy – there could be fresh momentum in pushing forward key policies for the sector.”

Bitnomial will use RLUSD, Ripple’s stablecoin, for the settlement of the perpetual futures through its regulated clearinghouse. Ripple, the digital asset infrastructure provider for financial institutions, led Bitnomial’s $25m funding round with new and existing investors which closed before the launch of Botanical was announced.

Brad Garlinghouse, chief executive of Ripple, said in a statement: “Bitnomial’s approach to bringing offshore trading models into the US derivatives industry presents a significant market opportunity as they establish a compliant derivatives market for digital assets, such as XRP. Alongside their planned use of RLUSD for settlement, Bitnomial is setting a new standard for the industry.”

Bitnomial is an advocate for the physically backed trading model of digital assets as opposed to cash settled products that do not directly participate in the supply and demand of the underlying digital assets.

Dunn said: “We want to launch XRP futures. We want to launch everything that can reasonably be deemed to not be a security as long as the contracts are physically delivered.”

In May this year Luxor bitcoin hashrate futures went live on Bitnomial following regulatory approval. The contracts are available to anyone with a futures commission merchant (FCM) account that connects to the Bitnomial exchange.

Matt Williams, head of derivatives at Luxor, said in a statement: “These contracts offer market participants the first fully-regulated bitcoin mining derivative, and they will usher in a new era of hashrate trading that is more transparent, secure, and liquid.”

Luxor Technology Corporation, a bitcoin mining software and services company, and Bitnomial designed the contract to give bitcoin miners an accessible tool to hedge their revenue, while also giving investors access to an exchange-traded derivative directly tied to Bitcoin mining hashrate. The hashrate futures are fungible with Luxor’s spot and forwards offerings, and fungible with Bitnomial physical bitcoin futures, enabling spreads between hashrate and bitcoin futures spreads. As a result, participants can take returns in either US dollars or bitcoin.

“We want to add electricity hedging contracts so miners can hedge price risk, hashrate risk and network competition risk and portfolio margin the suite of contracts,” said Dunn.

He believes this will be a “massive” competitive advantage if bitcoin markets scale, and also make the mining business more sustainable. Dunn would like regulators to eventually authorize the use of digital assets as collateral, which will increase coastal efficiency, and to allow 24/7 trading.

Volumes

Bitnomial reported that trading volume grew 53% quarter over quarter to over $79m in the first half of this year and open interest reached nearly $14m

The exchange said in a statement that the rise in second quarter volume indicated organic demand for the underlying physical assets, fueled by basis trading, spot digital asset ETF approvals, and the bitcoin halving in April.

Dunn said: “Building upon the significant clearinghouse approval granted by the CFTC at the end of last year, we anticipate exponential growth on our platform as we begin to bring new products to the market and execute our vision for fundamentally upgrading US-based digital asset derivatives trading globally.”

The exchange added that growing demand for physically backed bitcoin derivatives is demonstrated by the exchange adding over $130m in notional value in the first half of 2024, an increase of more than 1081% from the first six months of last year.

Following the US election, CME Group’s crypto futures and options suite marked its highest notional volume day on November 6 with over $16.4B transacted via 316,253 contracts, according to the exchange .

On November 12 CME reached a record in open interest of 10,782 ether contracts, a record in open interest of 38,528 bitcoin contracts, or $17.4bn, and micro bitcoin futures traded a record 184,609 contracts, or $1.6bn.

EDX Markets

In September this year EDXM Global announced the forthcoming launch of its perpetual futures venue in Singapore, which is slated for the first quarter of 2025. EDXM Global is a part of EDX, a family of digital asset technology companies.

The planned new venue follows the company’s launch of its Singapore-based settlement service in May this year and will enable secure, efficient and low-risk trading for perpetual futures contracts in bitcoin and ether.

On 13 November 2024 EDX Markets reported record volumes with members trading over $685m in a 24-hour period. In the third quarter of this year average daily volumes grew 59% and the company said it has matched over $36bn in notional volume since January 2024.

EDX also recently launched its proprietary New Matching Engine (“NME”) which it said has ultra-low latencies measured in microseconds.

Jamil Nazarali, chief executive of EDX Markets, said in a statement: “With the successful delivery and implementation of our new matching engine, EDX is well on its way to achieving the goals that we set for ourselves when we launched last year.”

Crypto survey

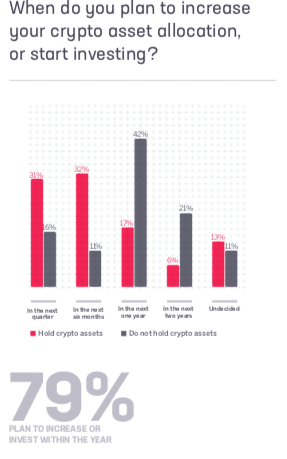

More than half of institutional and professional investors who are active in the crypto market plan to increase their allocation according to the second edition of the Future Finance Report from Sygnum, the regulated Swiss digital asset banking group,

Sygnum surveyed more than 400 market participants from 27 countries who have an average of more than 10 years of investment experience. The respondents included banks, hedge funds, multi and single-family offices, DLT foundations, funds and asset managers.

One third, 31%, of investors with existing crypto holdings also plan to increase their allocations in the fourth quarter of this year and another third, 32% plan to increase their allocation within six months.

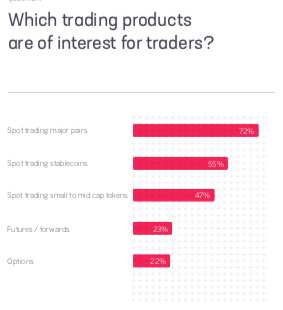

However, this year’s survey found less interest in trading futures/forwards (23%) and options (22%), which Sygnum said indicated a conservative approach to complex derivatives products.

“While they do offer sophisticated hedging and leveraging opportunities, they are also seen as very risky for most traders who do not have the resources or expertise to incorporate these products into their investment strategies,” said the report.

The survey also found that one third, 31%, of investors are interested in tokenization.

“Tokenization interest has risen since last year’s reportn, likely driven by an increasing number of leading traditional finance (TradFi) institutions launching their own tokenization platforms and products,” added Sygnum. “Supportive regulation around the tokenization of real-world assets (RWAs) may reinforce this trend.”