Cboe Global Markets had record derivatives volumes in the third quarter, which the derivatives and securities market operator said was driven by proprietary index options and futures products.

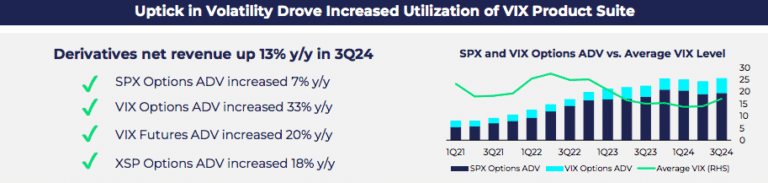

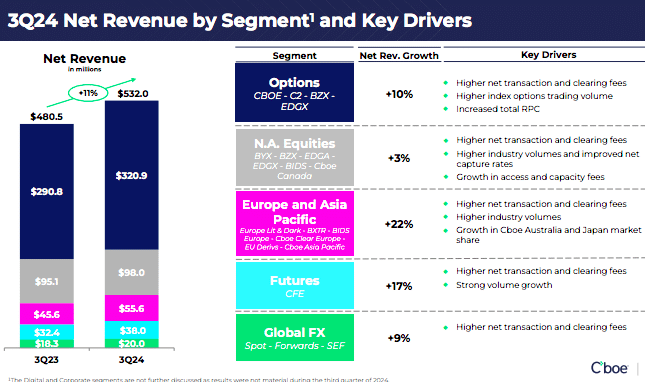

The group reported record net revenue for the quarter of $532m, up 11% year-over-year. Derivatives net revenue grew 13% year-over-year in the third quarter due to record volumes.

Fredric Tomczyk, chief executive of Cboe Global Markets, said on the third quarter results call on 1 November that the record results were driven by strong volumes in its derivatives franchise, specifically the proprietary index options and futures products. In addition, there were “solid” volumes across cash and spot markets, continued expansion of the data and access solutions business and steady expense management.

Tomczyk said: “Over the past year as CEO, I have concentrated on sharpening our strategic focus and making important and deliberate decisions on how to best allocate our capital and resources to support our growth strategy.”

As a result of the strategic review, the group has dialled back its M&A activities, lowered expense growth and stabilized margins. The capital allocation strategy has changed to increase investments in organic initiatives and reallocated resources to align with core strengths, which Tomczyk described as derivatives; data and access solutions and leading-edge technology.

Although Cboe will focus on an organic growth strategy, the group will continue to explore acquisitions that provide scale and broaden distribution inside key geographic markets. “I have always said we were going to slow down M&A, but I have never said we were never going to do M&A,” said Tomczyk

He highlighted that Cboe has just acquired a 14.8% ownership stake in proprietary trading system, Japannext.

“Japan is one of the largest and most important capital market places in the world, and is undergoing a lot of change as the regulatory landscape evolves and the market opens to more competition,” said Tomczyk. “We see tremendous opportunity for Cboe to compete.”

Options business

The strategic framework includes investing in the continued growth of the core global derivatives business as there is increasing demand for access to the US market, and for options.

“Given that options by their very nature expire, investors must repurchase new options to reposition themselves in the market, which in turn creates a quasi-recurring revenue stream that continues to increase,” Tomczyk added.

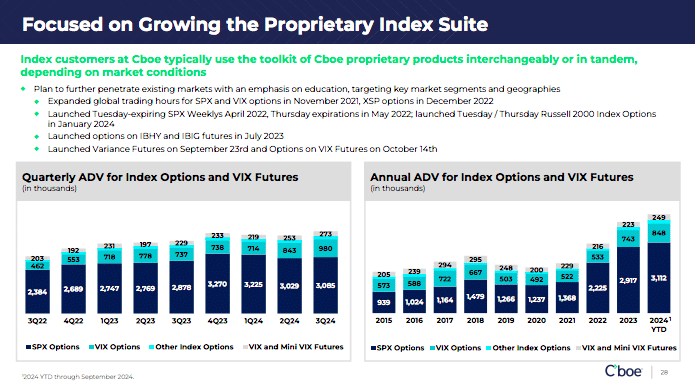

Options achieved record net revenue of $320.9m, up 10% from the third quarter of 2023. Dave Howson, global president of Cboe, said on the results call that the increase was led by strength in proprietary products.

Howson said the most notable event in the third quarter was the yen carry trade unwind on 5 August that produced one of the largest short-term volatility events since the Covid pandemic and the global financial crisis.

“Investors rushed for downside protection in the form of VIX options and ADV of 1.2 million contracts in August was the second highest on record, trailing only February 2018,” added Howson.

He also highlighted the launch of variance futures on 23 September, which Howson described as the latest tool in Cboe’s volatility toolkit to provide an exchange-listed alternative to over-the-counter variant swaps.Variance futures offer a streamlined approach to trading the spread between implied and realized volatility of the U.S. equity market as measured by the S&P 500 index, enabling market participants to take advantage of discrepancies between market expectations and actual outcomes.

In addition, Howson noted the launch of options on VIX futures on 14 October. Cboe offered securities-based VIX index options but the new contracts are physically settled. With futures as the underlying asset, the new options are CFTC-regulated, enabling access for market participants that are restricted from accessing U.S. securities-based options to use the product to express their views on equity market volatility.

Options on VIX futures also allows Cboe to offer more tenors, in particular, those with a shorter duration that meet customer demand. Howson said: “These two additive products need time to seed, but the early signs are really good, though. We have got prices on the screen, customers engaging and testing the plumbing, and a good pipeline coming through.”

He continued there is also a meaningful opportunity to bring options to a greater portion of the US customer base, especially using exchange-traded products to access a variety of options strategies in a traditional ETF wrapper.

“US listed options-based ETFs have grown to an estimated $120bn in AUM, with assets increasing over 600% over the past three years,” added Howson.

Retail market

Cboe also remains optimistic on the growing retail participation in the options market. In October this year Cboe and Robinhood Markets announced they will launch Cboe’s index options on the retail broker’s platform, which is slated for this quarter.

“We believe retail adoption of index options is just beginning, and Cboe is well positioned to cater to this growing demand,” added Tomczyk.

The strategy for supporting continued retail growth includes education, broadening access by working with retail brokers and listing products that provide opportunities for customers to trade a contract that is the right size for them and on a time frame that suits their needs, particularly shorter-dated contracts. Cboe estimated that less than 10% of customers at large retail broker-dealers are currently enabled to trade options.

International growth

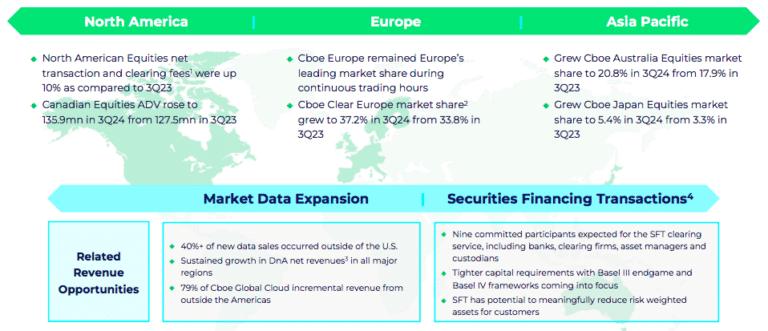

During the third quarter, approximately 40% of new sales in the data and access business were international.

“We remain particularly excited about the outlook for our Canadian business as we remain on track with the migration of our Canadian market to Cboe technology in early 2025, subject to regulatory approval,” said Howson.

In Australia Cboe grew market share to 20.8%, up 2.9% from the third quarter of 2023. In Japan market share hit 5.4% in the third quarter, a 2.1% improvement from the same period in 2023.

“The Asia Pacific region remains a key focus for Cboe as we move forward, providing a number of opportunities across our ecosystem to fuel growth,” said Howson.”We anticipate continued strategic investment in the region in increased brand awareness and improved sales efforts for the import of derivatives activity into the US.”

Technology

In February this year Cboe introduced dedicated cores for its EDGA equities exchange. Dedicated cores allows members and sponsored participants to host their specific logical order entry ports on their own CPU core(s), rather than sharing a core(s), which reduces latency, enhances throughput, and improves performance.

“The uptake from dedicated cores continues to exceed our expectations as we roll the functionality out across additional markets,” Howson.

Dedicated cores is due to launch in the UK and Europe in this quarter and the first quarter of next year, then Australia, and eventually Japan and Canada.

Chris Isaacson, chief operating officer, said on the call that the Canadian migration in March will be the last onto Cboe’s technology platform.

“We have spent a fair amount of time and a lot of resources this year making that happen,” he said. “We think that will free up a substantial amount of resources to focus on high growth areas like derivatives and data and access.”

Isaacson added that Cboe is investing heavily in its data analytics platform and on artificial intelligence to drive productivity within the organization, but also to explore and enhance revenue opportunities for customers.

Jill Griebenow, chief financial officer, said on the results call that Cboe is raising the organic total net revenue growth range for 2024 to between 7% and 9%, up from the prior guidance of 6% to 8%, given the year-to-date trends and expectations for the fourth quarter.