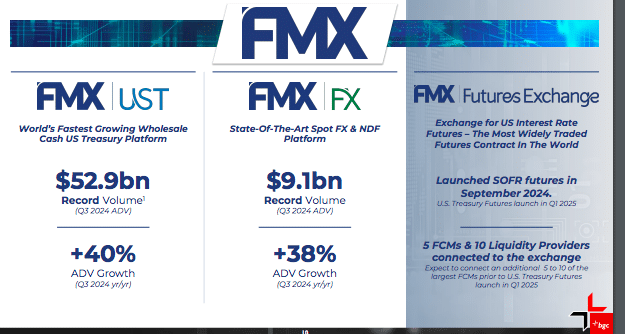

BGC Group, the brokerage and financial technology firm, expects the growth trajectory and market share of its new futures trading g venue to exceed its experience with its FMX US Treasury business.

The FMX Futures Exchange launched on 23 September 2024 with SOFR futures and five futures commission merchants (FCMs) – Goldman Sachs; JP Morgan, Marex, RBC, and Wells Fargo. Howard Lutnick, chairman and the chief executive of BGC Group, said on the third quarter results call on 31 October that the firm expects to connect an additional five to 10 of the largest FCMs for the launch of US Treasury futures in the first quarter of 2025.

Lutnick said: “We are actively onboarding clients, and we feel really good about FMX Futures. We expect the growth trajectory and market share to far exceed what we experienced with our FMX US treasury business.”

The firm expected the new exchange to open with between three and five FCMs, with more connecting over the next two quarters.

“We opened with five, which was the high end of what we expected, so I was very happy,” added Lutnick. “I’m not going to overdo it but it’s perfectly fine. They are doing business and there is open interest every day.”

He admitted there are a “whole variety of teething pains” and the firm is trying to make it smoother for FCMs to connect to the venue and its clearinghouse, the London Stock Exchange’s LCH.

“I would expect much of that to sort its way out through the end of this year,” said Lutnick. “As we go into next year, I think all these new things will be sorted out nicely and we will be in excellent shape going forward.”

Many FCMs did not start the process of connecting until after the new venue was fully approved and the opening date was announced, which is what BGC was expecting according to Lutnick.

“I have always said the first full year is to get all the players on the field, which means getting all 50 FCMs signed up,” he added. “At the end of the second year, we will have all the clients of the FCMs signed up, and we will then be ready in year three to bring full on competition with the CME.”

BGC argued that FMX Futures Exchange provides clients with much-needed innovation, superior pricing, and dramatically improved capital efficiencies through clearing with LCH, which is a derivatives clearing organization that is fully approved by the US Commodity Futures Trading Commission. LCH has $225bn of collateral securing its clearing of interest rate swaps, largely in US dollars, which LCH members can expect to cross-margin against eligible US interest rate futures traded on FMX Futures Exchange to achieve capital efficiencies.

CME Group reported record volumes for both SOFR futures and Treasuries contracts in the third quarter and chairman and chief executive Terry Duffy highlighted that this growth was achieved without lowering fees or introducing new incentive programs for these products following the launch of FMX Futires.

However, Duffy has said that US treasury futures should not be cleared at an overseas clearinghouse because the resolution authority, who gets to make the decisions over default, would lie with the Bank of England and the UK Financial Conduct Authority. He said the Bank of England has changed its bankruptcy laws for systemic institutions, and US participants no longer have protection.

CME Group CEO Terry Duffy expressed concerns about permitting trades of US sovereign debt futures under foreign jurisdiction. The practice has never before been approved in the US and is not allowed by any other major country https://t.co/ZQynntEcBj pic.twitter.com/pTOxAyAcNx

— Bloomberg TV (@BloombergTV) October 23, 2024

BCG’s FMX segment includes its cash US treasuries marketplace and a spot foreign exchange platform, alongside the new futures venue. Lutnick continued that as more FCMs come on board, they will also boost trading volumes for treasuries and FX.

He said: “FMX continues to outperform its peers, generating record volumes across our US treasury and FX platforms.”

Financials

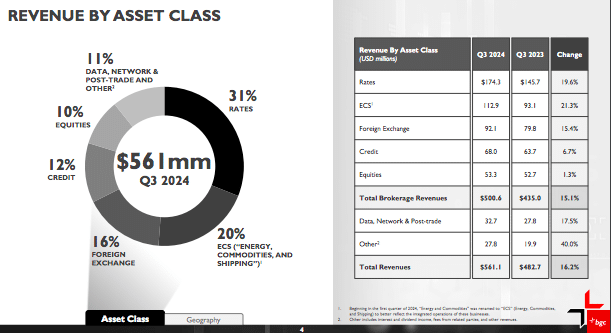

BGC Group reported record third quarter revenues of $561m, a 16% year-on-year increase which Lutnick said reflected growth across every asset class and region.

Jason Hauf, chief financial officer of BGC Group, said on the call that America’s revenues increased by 19% in the quarter, Europe, Middle East and Africa revenues rose by 16.5% and Asia Pacific revenues went up by 8.3%.

In October this year BGC Group agreed to acquire OTC Global Holdings, an independent institutional energy and commodities broker, and also closed its acquisition of Sage Energy Partners. Lutnick said: “We expect both transactions to be immediately accretive, and together add more than $450m in annual revenue. “

Sean Windeatt, chief operating officer at BGC, said on the call that the group was excited about what the OTC and Sage acquisitions will bring to its energy, commodities, and shipping (ECS) business.

“OTC, the world’s largest independent energy commodities broker, will transform our offering in oil and shipping and allow us to broker the entire barrel for the first time,” Windeatt added. “Sage seamlessly aligns with our business and further strengthens our leading environmental franchise.”