CME Group reported record volumes for both SOFR futures and Treasuries contracts in the third quarter and chairman and chief executive Terry Duffy highlighted that this growth was achieved without lowering fees or introducing new incentive programs for these products.

Duffy said on CME’s third quarter results call on 23 October that this was the best quarter in the group’s history, with records across volume, revenue, adjusted operating income, adjusted net income and adjusted earnings per share.

“This strong growth was broad based,” he added. “We achieved year-over-year growth in both volume and open interest across every asset class for the second consecutive quarter.”

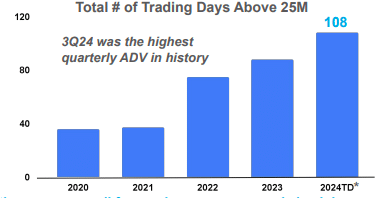

Total average daily volume in the third quarter was a record 28.3 million contracts, up 27% from the same period last year.

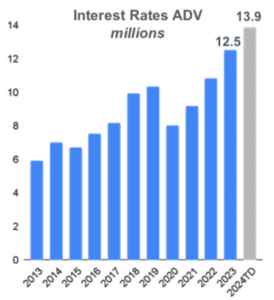

Average daily volume for financial contracts rose 28% over the same period to 23.4 million contracts, which CME said reflected a 36% jump in interest rates to a record ADV of 14.9 million contracts. This was driven by a 35% rise in SOFR futures to a record ADV of 4.1 million contracts, and 31% growth in Treasuries to a record ADV of 8.4 million contracts.

“We achieved this growth without lowering any fees or introducing any new incentive programs for these products,” said Duffy. “I think that goes to show you the value of CME’s products to its end-user.”

Ongoing levels of issuance and deficit financing should continue to provide tailwinds for interest rate trading, together with uncertainty around the US election and geopolitical events leading to a growing need for liquid and efficient markets to manage these risks according to Duffy.

There was some expectation that CME might lower fees or introduce new incentives after BGC Group said it had launched the FMX Futures Exchange for trading SOFR futures programs in September this year. FMX Futures Exchange plans to add US treasury futures in the first quarter of 2025.

Howard Lutnick, chairman and chief executive of BGC Group and chairman of FMX Holdings, said in a statement in September that the firm was excited to introduce real competition to the US SOFR futures market and provide clients with much-needed innovation, superior pricing, and dramatically improved capital efficiency.

Lutnick added: “This is the first US interest rate futures exchange to launch with a fully operational, globally connected, state-of-the-art trading system, along with enormous capital savings driven by LCH’s cross-margin capabilities.”

On 22 October ION said in a statement that it had connected to the FMX Futures Exchange so clients can trade on the new venue through ION’s execution and post-trade product suite.

Duffy agreed with an analyst who described the initial volumes on FMX Futures as “modest.” However, Duffy continued that it is too early and he did not want to draw any conclusions related to a competitor.

“We will continue to stay focused on the things that we are doing and that you have heard us highlight over the last several months and years, and again today, which is the efficiencies that we’ve been able to create for our clients in those asset classes that people are trying to compete with us in,” he added. “We feel very good about our strong performance.”

FMX Futures Exchange said it expects to provide clients with significant capital savings through its clearing partnership with LCH, the clearing arm of London Stock Exchange Group, and a derivatives clearing organization that is fully approved by the US Commodity Futures Trading Commission. LCH has $225bn of collateral securing its clearing of interest rate swaps, largely in US dollars, which FMX said LCH members can expect to cross-margin against eligible US interest rate futures traded on FMX Futures Exchange to achieve capital efficiencies.

Duffy added that CME provides close to $20bn a day for its clients in capital efficiencies. Suzanne Sprague, global head of clearing and post-trade services, said on the call that CME’s portfolio margining program offers offsets between interest rate futures and options against interest rate swaps, and delivers average daily savings of about $7bn to clearing members.

At the beginning of this year, CME and The Depository Trust & Clearing Corporation (DTCC), launched an enhanced cross-margining arrangement to provide capital efficiencies for clearing members that trade and clear both US Treasury securities and CME interest rate futures. Sprague said there are currently 12 clearing members participating in that program, who have achieved upwards of $1bn in average daily savings.

Duffy also argued that US treasury futures should not be cleared at an overseas clearinghouse because the resolution authority,who gets to make the decisions over default, would lie with the Bank of England and the UK Financial Conduct Authority. He said the Bank of England has changed its bankruptcy laws for systemic institutions, and US participants no longer have protection.

CME Group CEO Terry Duffy expressed concerns about permitting trades of US sovereign debt futures under foreign jurisdiction. The practice has never before been approved in the US and is not allowed by any other major country https://t.co/ZQynntEcBj pic.twitter.com/pTOxAyAcNx

— Bloomberg TV (@BloombergTV) October 23, 2024

Duffy highlighted that the Treasury futures market is 13% larger than the cash market so the issue is getting some traction with lawmakers.

“I know LCH is a CFTC regulated clearing entity, but that has nothing to do with our argument,” he added. “I will continue to be loud about this and make sure people understand what could be the detrimental effect of having US Treasuries, not only being cleared overseas, but at the same time having the resolution authority being overseen by a foreign regulator, and not the US government. If LCH wants to move into the United States of America and compete with us here under our laws, I’ll pull my chair back and walk out because my argument is over.”

However, if LCH did set up a US clearing house, then margin offsets would not be efficient against portfolios in London according to Duffy, as local regulators require clearinghouses to be fully capitalized in each jurisdiction for bankruptcy protection.

In addition, the US Securities and Exchange Commission has mandated an increase in cash Treasury clearing, with clearing only being performed under the SEC’s guidance and regulation in the US, according to Duffy.

Financials

Lynne Fitzpatrick, chief financial officer of CME Group, said on the call that CME set records for quarterly revenue, net income and earnings per share in the second quarter of this year, which were all surpassed in the third quarter.

The group reported record quarterly revenue of $1.6bn, up 18% year-on-year, which she said was driven by double-digit growth in average daily volume across every asset class. Net income of $977m and operating income of $1.1bn were also all-time quarterly highs.

Fitzpatrick said: “Our continued product innovation, new customer acquisition and deep liquid markets across the six major asset classes has led to a consistently higher level of demand for our product.”

She stressed that CME’s daily trading volumes surpassed 25 million contracts on the majority, 55%, of trading days in the first three quarters of 2024 versus 35% of trading days in the same period last year. In addition, each of the last six months were monthly volume records.

“This was the second consecutive quarter with growth across all asset classes in both ADV and open interest (OI) evidencing our clients’ growing need for risk management,” she added.

International average daily volume grew 29% year-on-year to a record 8.4 million contracts in the third quarter. Volume in EMEA rose 30% and Asia increased 28%.

Commodities volume was up 20% to 4.9 million contracts, including 38% year-on-year growth in metals and 21% in energy, which drove approximately one third of total clearing and transaction fee revenue.

Options increased 27% to 5.6 million contracts, including double or triple-digit growth across five of six asset classes, and record energy options average daily volume.